Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

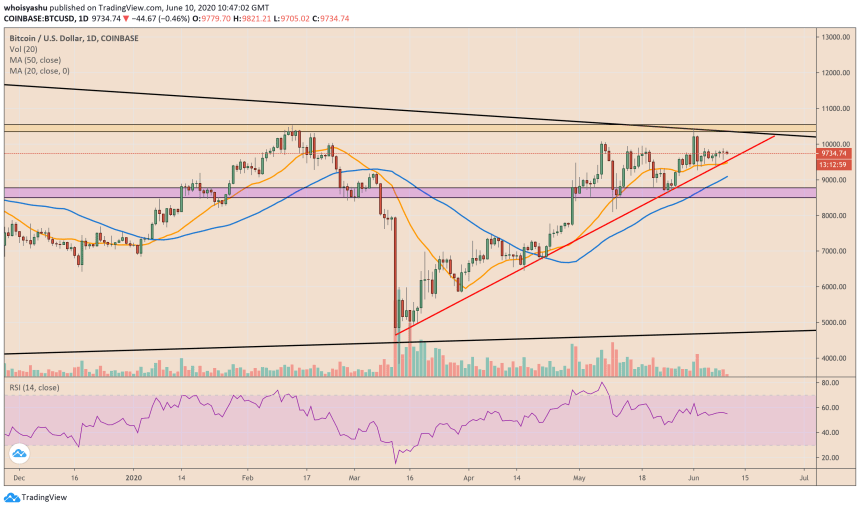

- Bitcoin is looking to repeat a bearish pattern in June 2020, which has led its spot price to be lower by 60 percent.

- The cryptocurrency’s daily chart could form a “Death Cross” if it continues to struggle below $10,000.

- Meanwhile, bitcoin’s momentum indicator suggests a bearish divergence.

In June 2020, bitcoin could form a so-called “Death Cross.”

The alarming technical indicator flashes when an asset’s long-term moving average crosses below its short-term moving average. Traders perceive it as a signal of potential market sell-offs that may begin a new bear cycle.

So it seems, bitcoin is going to paint a Death Cross when its 50-day moving average (50-DMA) slips below its 20-day moving average (20-DMA). If the bearish crossover appears as indicated, it will be bitcoin’s second Death Cross since March 2020.

The last appearance of the pattern left Bitcoin in an extreme bearish bias, as trading advisory firm TradingShot noted. The cryptocurrency fell by more than 60 percent after the 50-20 MA crossover.

“Of course, [bitcoin’s downside move] was very much fueled by the stock market crash (related to the COVID outbreak),” said the TradingShot analysts.

“So the effects of this MA20/50 Bearish Cross may have not been so devastating on any other occasion, but I have to highlight it regardless. Unfortunately, BTC is close to forming this Cross in the next week if it doesn’t sustain the Higher Lows sequence.”

The $10,000 Resistance

Bitcoin’s Death Cross also looms when it has repeatedly failed to sustain its bullish bias above $10,000.

The technical resistance level defied traders’ breakout attempts on twelve occasions since February 2020. Failure to clear the obstacle could further lead bitcoin to invalidate its slope of price appreciation since March 2020, as shown in the chart below.

A break below the red trendline could have bitcoin initiate a broader pullback. At the same time, a successful break above $10,000 could invalidate the bearish projections altogether, including the Death Cross.

Supportive Bitcoin RSI

TradingShot spotted irregularities in the March 2020 fractal compared to Bitcoin’s ongoing trend. The firm noted differences in the Relative Strength Index (RSI) of both the price patterns, noting that the current one supports a bullish narrative.

RSI represents the magnitude of an asset’s recent price changes to evaluate whether it is overbought or oversold.

Bitcoin’s old RSI was trending downwards alongside the price, confirming a bearish bias. On the other hand, the current RSI shows a bearish divergence, which means the RSI is moving sideways alongside the price.

“If [the current RSI] breaks above its June 01 High, we have a confirmed divergence, and most likely, we avoid the bearish scenario of a bigger drop in early March,” noted TradingShot.