Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

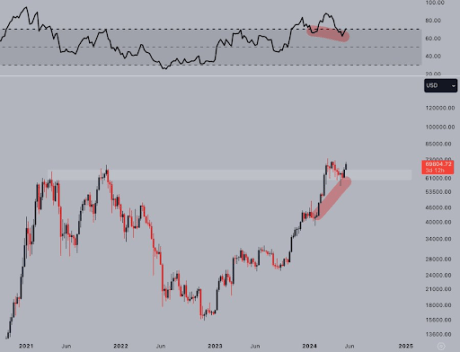

Bitcoin has dropped from its weekly high of $71,980, recorded on May 21, to as low as $67,000, raising concerns amongst crypto investors. However, crypto analyst Jelle has suggested that there is no need to be worried about the flagship crypto’s price action.

Why Investors Shouldn’t Be Worried About The Bitcoin Price

Jelle noted in an X (formerly Twitter) post that Bitcoin is still following a “similar path” to the 2017 bull run. He claimed that once the crypto token breaks again above the 2021 all-time high ($69,000), it will make a parabolic move to the upside. Jelle predicts that Bitcoin could reach $100,000 when that happens.

In an earlier X post, Jelle provided insights into why Bitcoin could easily make such a move. He revealed that all key resistance levels have been broken. He also noted that a weekly hidden bullish divergence had formed on Bitcoin’s chart, just on top of the previous cycle highs.

Meanwhile, crypto trader and analyst Mags also echoed Jelle’s bullish sentiment. In an X post, he mentioned that this recent price correction was the “fakeout before the next leg up.” Mags noted how Bitcoin has maintained a similar pattern since its price bottomed at $15,000, with the flagship crypto consolidating inside a range for “a few weeks or months.”

Mags claims that Bitcoin then breaks below the range where it traps all bears before making a “quick reclaim and another leg up.” The analyst added that there is going to be a “massive leg up soon” if Bitcoin manages to repeat this pattern.

Crypto analyst BitQuant also assured there was no need to panic about Bitcoin’s recent dip. In an X post, he claimed that the price dip was a “good confirmation” that Bitcoin is preparing for a “big leg up.” The crypto analyst predicts that the flagship crypto will rise to as high as $95,000 when this parabolic move happens.

BTC’s Outlook Is Bullish Either Way

Crypto analyst Rekt Capital suggested that Bitcoin’s outlook is bullish regardless of what happens. He outlined two possible moves the flagship crypto could make from here. First, he stated that a weekly candle close above $71,500 would likely kickstart the breakout from the Re-Accumulation Range.

On the other hand, he noted that history suggests that Bitcoin will consolidate inside this Re-Accumulation Range for some weeks more. Based on his analysis, Bitcoin is still bound to make significant moves to the upside, and all that matters is the timing. The analyst noted that a breakout now could mean Bitcoin would have an accelerated cycle.

However, if Bitcoin continues to consolidate for some more weeks, that will help it resynchronize with past halving cycles, resulting in a longer bull run.