Ethena Labs has revealed its latest strategic move: the inclusion of Bitcoin (BTC) as collateral for its synthetic dollar-pegged product, USDe. This decision, aimed at significantly scaling the product’s supply from its current $2 billion, capitalizes on the burgeoning BTC derivative markets for enhanced scalability and liquidity in delta hedging practices.

Ethena Labs’ ambitious goal is to leverage the considerable growth of BTC open interest, which has seen a substantial rise from $10 billion to $25 billion in just one year, far outpacing Ethereum’s (ETH) growth rates. Ethena’s statement highlighted the strategic benefits of integrating BTC, emphasizing the superior liquidity and duration profile of Bitcoin compared to liquid staking tokens and the potential for USDe to achieve greater scalability as a result

“With $25bn of BTC open interest readily available for Ethena to delta hedge, the capacity for USDe to scale has increased >2.5x,” the announcement noted, illustrating the robust backing that BTC provides.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

This is a crucial unlock which will enable USDe to scale significantly from the current $2bn supply pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

CryptoQuant CEO Issues Bitcoin Crash Warning

This move has not been met without skepticism. Ki Young Ju, CEO of the analytics firm CryptoQuant, took to X to voice his concerns, drawing parallels to the infamous LUNA collapse and questioning the risk management strategies employed by Ethena Labs.

“This isn’t good news for Bitcoin holders—it sounds like a potential contagion risk, like LUNA. How do they maintain a delta-neutral strategy for BTC in bear markets?” Ju queried, implying that the success of such strategies is largely contingent on market conditions that favor bull runs.

He further elaborated on the complexities of shorting BTC in bear markets, suggesting that the market size for such operations could be smaller than the total value locked (TVL), potentially leading to significant market disruptions. The CryptoQuant CEO stated:

How do they maintain a delta-neutral strategy for BTC in bear markets? In bull markets, they hold spot BTC and short BTC. If there’s a method to short BTC by holding some DeFi-wrapped BTC, the market size would be smaller than its TVL. This is a CeFi stablecoin run by a hedge fund, effective only in bull markets. Correct me if I’m wrong.

Ju added that he’S concerned about a repeat of a LUNA-like doom scenario: “selling BTC to stabilize USDe’s peg if their algorithm fails during bear markets.”

Adding to the discourse, OMAKASE, a former advisor for Sushiswap, referenced historical challenges faced by delta-neutral strategies, highlighting their propensity to turn illiquid and the difficulty in unwinding such positions without causing market slippage.

“Delta neutral strategies are usually never delta neutral. Post dot-com boom in Singapore, it took years for banks to unwind delta neutral books that had suddenly turned illiquid. Size begets slippage,” OMAKASE remarked, underscoring the inherent risks of such financial maneuvers.

The industry’s reaction to Ethena Labs’ announcement has been mixed, with some lauding the potential for increased scalability and others cautioning against the risks of replicating past financial crises. A few days ago, Fantom founder Andre Cronje also questioned the stability of USDe.

Amidst these concerns, Ethena Labs stands by its decision, pointing to the advantageous market conditions and the growing BTC derivative markets as key factors supporting their strategy. “While BTC does not possess a native staking yield like staked ETH, staking yields of 3-4% are less significant in a bull market when funding rates are >30%,” the company stated, indicating a strategic optimization for the current market environment. This move, according to Ethena, is not just about scaling but also about offering a safer and more robust product to its users.

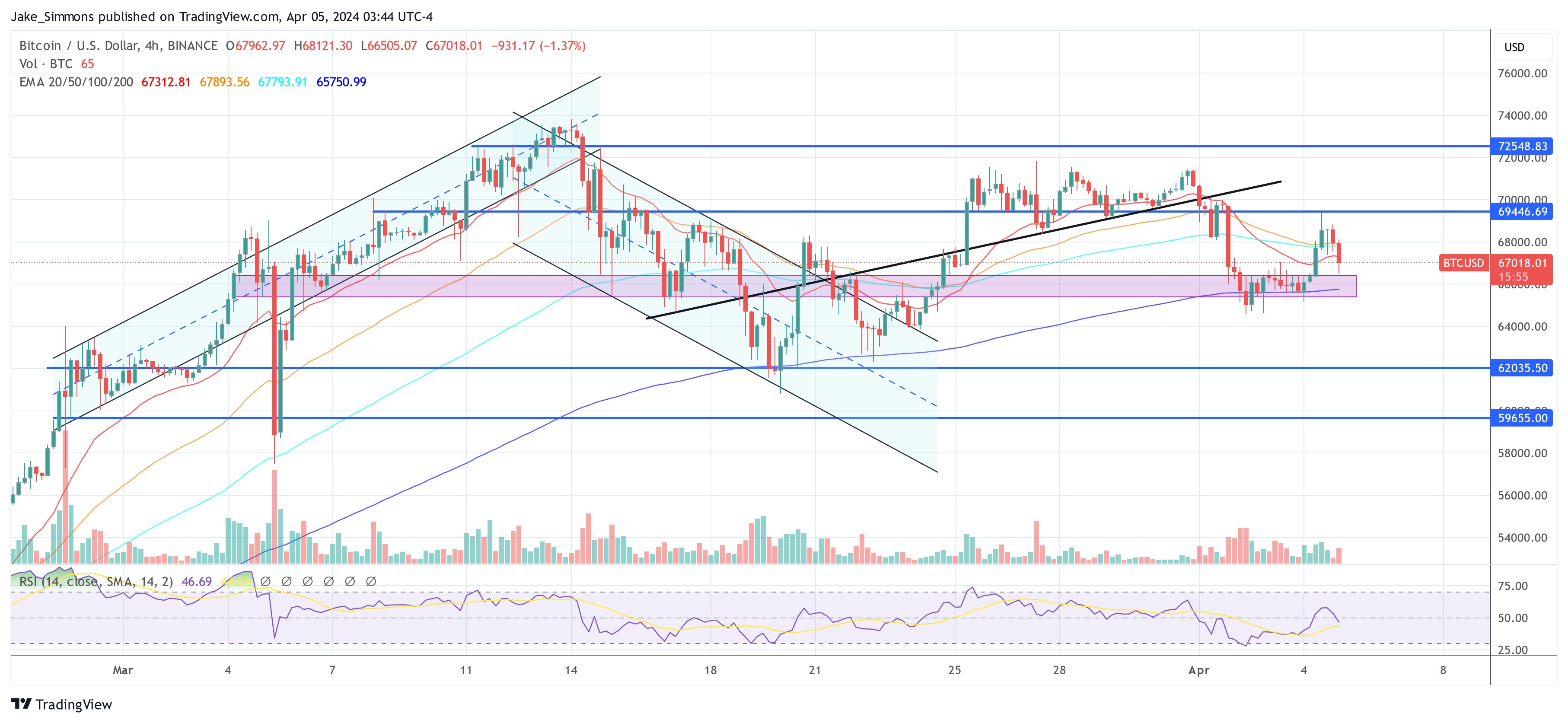

At press time, BTC traded at $67,018.