- Bitcoin (BTC) prices up but in tight ranges

- The US SEC delays their decision on Bitwise Bitcoin ETF

After their decision on Bitwise Bitcoin ETF, all eyes are on the US SEC and whether they will finally approve any of the many applications. Even so, buyers are in charge with prices soaring 70 percent after breaching $4,500 resistance, now support.

Bitcoin Price Analysis

Fundamentals

Over and above Satoshi’s objective of creating a global payment platform, Bitcoin is disruptive. The technology underpinning its success is likely to cause a paradigm shift accommodating fluid projects. Thus far, there is resistance—but for good reasons.

Bitcoin and all blockchain applications are global and mostly unregulated. That is why there is reluctance from institutional grade investors to sink funds into a sphere where asset price manipulation is so rampant that Jay Clayton of the SEC said the agency wouldn’t approve any crypto derivatives until there is proper monitoring in place.

As agencies and start-ups, lay down rails in compliance, Bitcoin benefits are seeping through barriers. While all eyes are on the SEC and whether they will give the green lights, other jurisdictions are reaping benefits from correctly classifying and assuring investors through capital tax gains. Malta is the lead, and Japan is setting the foundation while there are rumors that Russia is amassing Bitcoin and Gold as a cushion in case there is another sanction.

Meanwhile, Bakkt, Fidelity and traditional brokers are offering avenues for investment, meaning the future is all but bright for early entrants.

Candlestick Arrangement

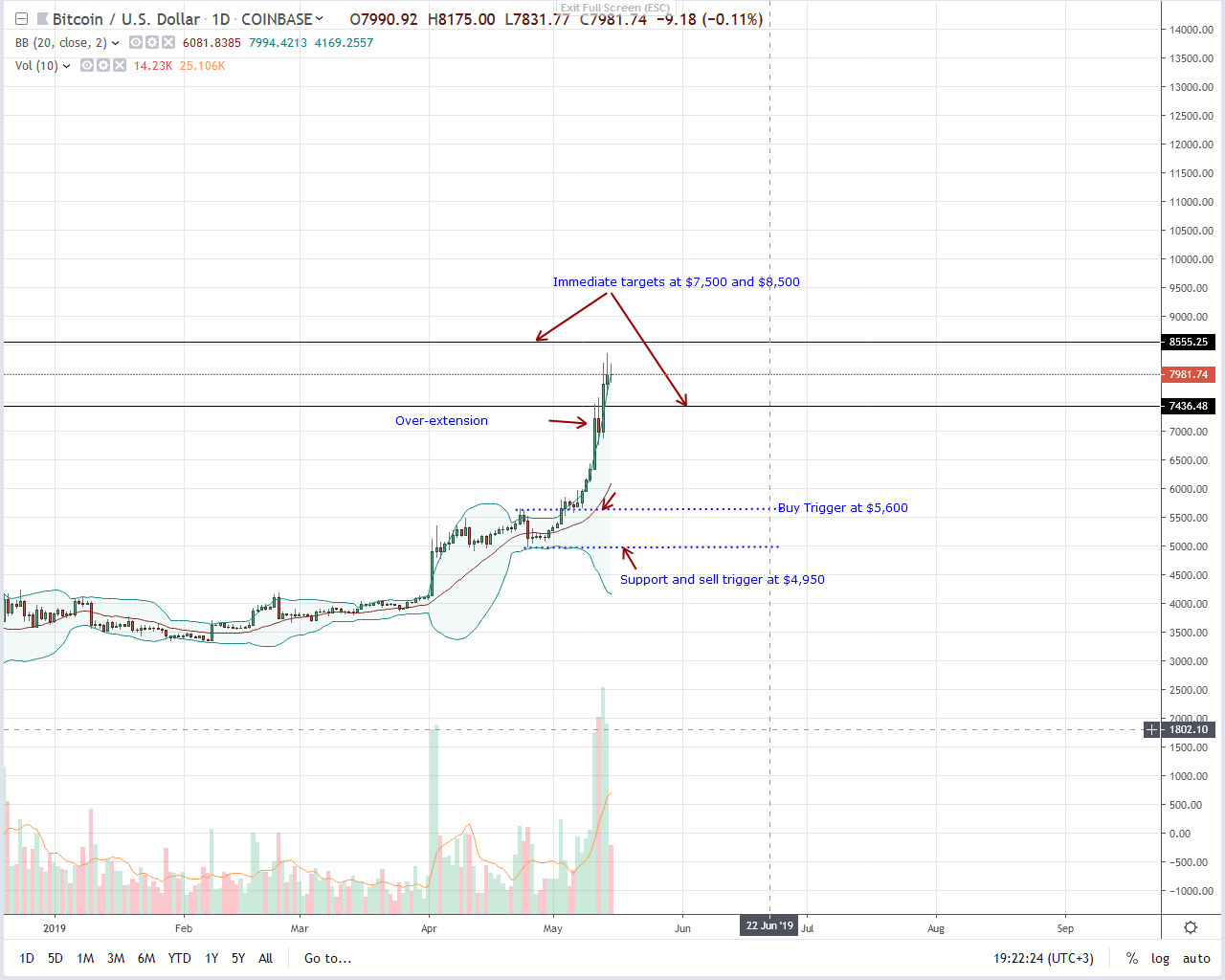

Price wise and Bitcoin (BTC) buyers are slowing down. After six weeks of stellar performance that saw BTC prices soar 70 percent—or more once bulls tore $4,500, the foundation is firm. Presently, BTC prices are under sell pressure. With yesterday’s long upper wick hinting of liquidation in lower time frames, today’s trade range is inside May-14 highs despite a near perpendicular expansion.

All the same, there is a high likelihood that buyers will forge forward. However, if there is a retracement from spot levels in a correction of May-14 over-valuation—a whole bull bar is above the upper BB, then prices would likely slide to $7,500 in a retest phase.

Nonetheless, from candlestick arrangement, buyers are firm and risk off traders should ramp up on dips, albeit with stops at around $7,600.

Technical Indicator

In light of this slow down and expectation of a retracement, our anchor bar is May-11’s. The candlestick is wide-ranging and with above average volumes—47k. For trend continuation, any breach of $8,500 or drop below $7,500 must be with high participation. These volumes must exceed averages of 24k and 47k confirming or nullifying our trade position.

Chart courtesy of Trading View