Although volatility in the bitcoin market has rocked it over the past year, Bitcoin is currently making an amazing recovery and surpassing $67,000 for the first time since late 2023.

The Bitcoin community has been energised by this unanticipated surge, which has also inspired general confidence and fresh hope among investors.

Confidence In Bitcoin High

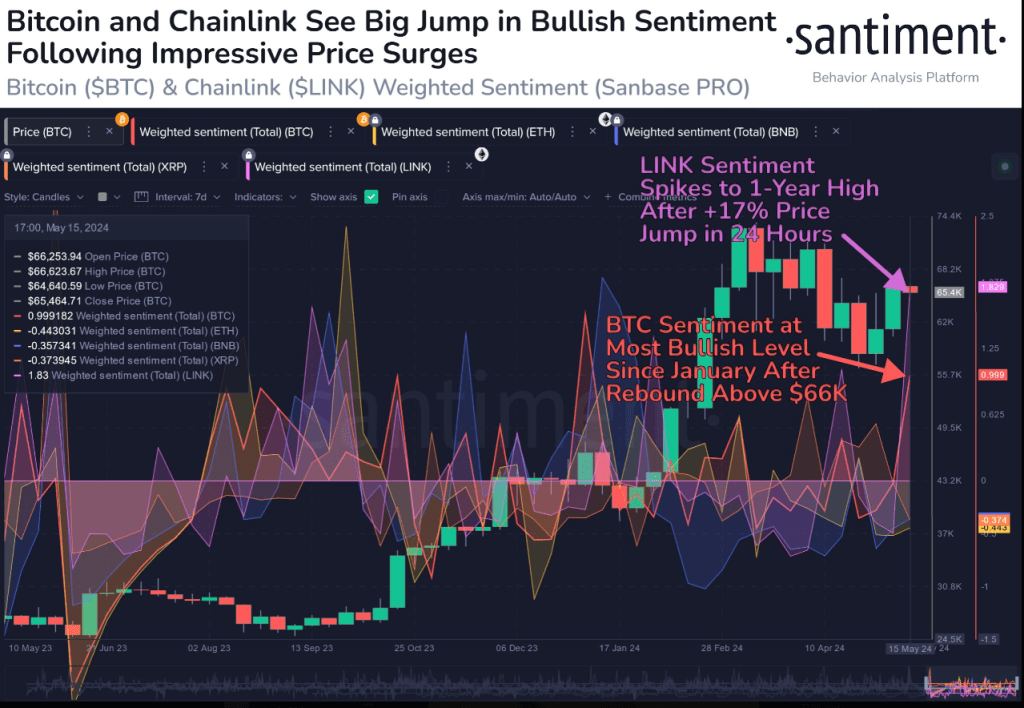

Based on Santiment’s “Weighted Sentiment” indicator, the general attitude of the Bitcoin community is now most positive since the SEC’s historic approval of Bitcoin spot ETFs in late 2023.

That pivotal regulatory move had significantly bolstered confidence in the cryptocurrency’s legitimacy and legitimized it as an investable asset class.

🥳 The crowd’s sentiment has shifted toward #Bitcoin after the surprise bounce above $66K Wednesday (and now above $67.2K). Additionally, #Chainlink is seeing its most #bullish sentiment in over a year. #FOMO staying low will help these rises continue. https://t.co/TcEPBdS9Oh pic.twitter.com/czvE1mOgId

— Santiment (@santimentfeed) May 17, 2024

Passionate debates abound on social media as Bitcoin aficionados share their enthusiasm about the future of the bitcoin. Many are making comparisons to the previous significant bull run of 2021, when Bitcoin hit its all-time high of almost $68, 000.

Cautionary Notes Amidst The Enthusiasm

Although the Bitcoin community celebrates this most recent success, seasoned analysts are advising investors to exercise caution and stay away from the dangers of snap decisions. Markets for cryptocurrencies are famously erratic, and Bitcoin’s price history is full with sharp swings.

Along with a general increase in conventional markets, Bitcoin’s recent comeback begs issues regarding the degree to which the performance of the coin is entwined with the larger financial ecosystem. For instance, a possible stock market fall could slow down Bitcoin’s progress as investors move their money in line.

Managing FOMO, Maintaining A Long-Term Perspective

The risk of FOMO, the fear of missing out, rises along with the price of Bitcoin. Fearing they would lose out on major rewards, this psychological phenomena can cause investors to act impulsively.

Although the comeback of Bitcoin has energised the bitcoin community, seasoned investors are aware that the road ahead could not be clear-cut. Sometimes extreme bullish attitude serves as a contrarian indicator, implying that the market might be about to peak.

Data from Coangecko shows that Bitcoin was trading at $67,096 at the time of writing, down a meagre 0.2% in the last 24 hours, but managed to sustain a 10.0% increase in the last seven days.

Featured image from iStock, chart from TradingView