Bitcoin has formed a range at its current trading level, avoiding a drop to the $22,000 area by bouncing off its support at $23,500. Bitcoin is at a crossroads as the bulls and bears are battling to decide which side will come ahead.

As of this writing, the largest cryptocurrency on the market trades at $23,900, skimming the $24,000 border.

As reported by NewsBTC on February 22nd, Bitcoin has withstood selling pressure from retail investors while the whales continue to push the price above the next resistance level. Can the market price action of BTC find an argument to resolve the dispute?

Related Reading: Polkadot Can Resume Bullish Momentum Only If It Flips This Level Into Support

What Will Be The Next Move For Bitcoin?

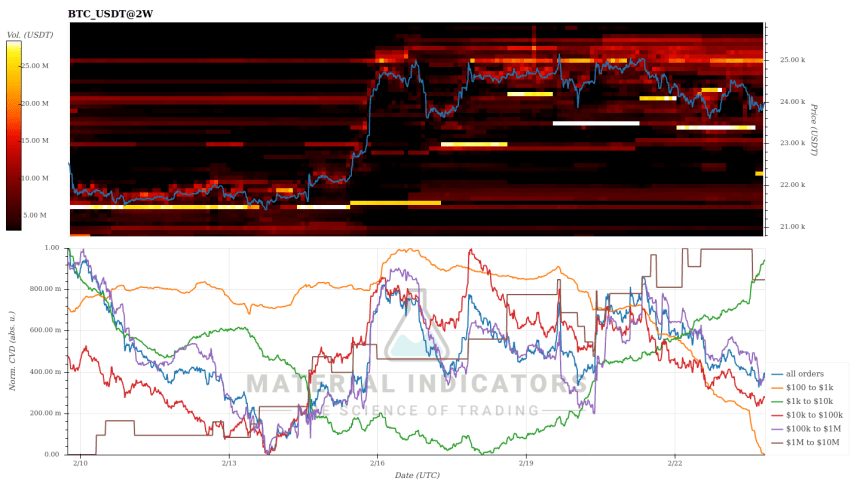

As of press time, Bitcoin’s support and resistance levels appear to have been cleared, leaving the doors open for its next move to consolidate a new bullish trend or continue its bearish price action and further freeze buyers. As can be seen in the chart below, the resistance at the $23,500 level has been cleared by sellers.

The bid wall has moved to the $22,400 area, and the next resistance level shown on the chart below appears to be forming at the $25,000 level.

With ongoing concerns about a more hawkish Federal Reserve (Fed) policy and heavy selling pressure among investors, the bears seem to have the upper hand in Bitcoin’s short-term price action.

Do Bulls Have A Chance Of Recovering?

As the markets alternate between bullish and bearish sentiment, Bitcoin reacted slightly positively to the U.S. Gross Domestic Product (GDP) report, spiking close to the $24,000 level.

Economist and founder of the trading platform Eight, Michael Van de Poppe, commented on Bitcoin’s price action, stating that an economic recession can be avoided with a lower-than-expected GDP report. The latter is a sign of a continuation of BTC’s uptrend and the largest cryptocurrencies in the ecosystem. Van de Poppe said:

We dropped towards the lower part of the area and previous resistance around $23.3K. Significant bounce from that area for Bitcoin, probably some more consolidation, and from there, continuation towards $30K.

If Bitcoin’s support holds, the price action can chase the liquidity of short positions to fuel and continue its uptrend. With Bitcoin’s resistance level failing to break four times in the last week, still at the $25,400 level, buyers could have another chance to return to those levels and aim for new yearly highs at the $27,000 land.

Bitcoin is trading at $23,950, up slightly in the last 24 hours. BTC has reduced its gains in broader time frames, falling 1.4% over the past seven days. BTC has trimmed its gains considerably in the fourteen-day timeframe, holding just 4.4%.

After an intense bullish price action in mid-February, Bitcoin has come close to the neutral zone in the thirty-day time frame, showing gains of 4.3% after rising almost 35% at the beginning of 2023.

Featured image from Unsplash, chart from TradingView.