Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The sector of crypto mining is poised to start a new era. By halfing block rewards, the much awaited halving event in April 2024 stunned the ecology. Since the halving, daily income has dropped by more than 70%; so, miners have had to hustle to create innovative ideas to save their bottom line.

AI comes in here here. Driven by the likes of OpenAI’s ChatGPT, artificial intelligence (AI) computing is undergoing a demand explosion. This is why miners are finding increasing attraction in artificial intelligence since it has the potential to provide more earnings than Bitcoin mining.

AI: A Beacon Of Hope In A Volatile Sea

Leading this wave are bit digital and related businesses, whose income comes from artificial intelligence more than thirty percent. Among the other sector heavyweights exploring artificial intelligence are Hut 8 and Hive.

Adam Sullivan, CEO of Core Scientific, said:

“The shift to AI allows us to create a diversified business model with more predictable cash flows.”

This diversification is crucial in the face of the volatile nature of Bitcoin prices. By incorporating AI, miners are aiming to reduce their dependence on a single, often unpredictable, income stream.

Mass Exodus Or Miner Metamorphosis?

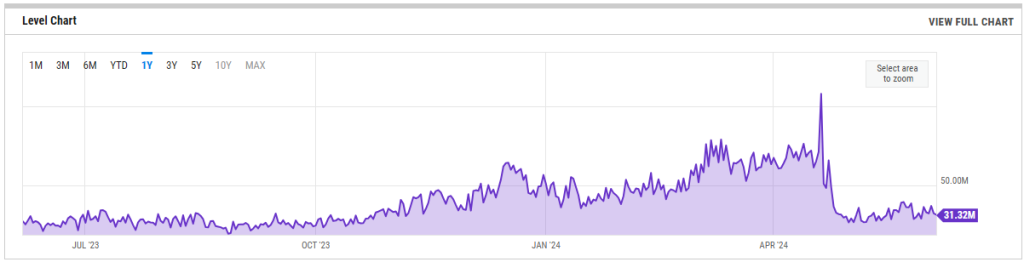

The halving affects more than only lowering income. Data suggests a possible upheaval in the mining sector. Based on a recent study, hashrate—a gauge of total mining capability—has declined noticeably on the Bitcoin network. Particularly those who are utilising less effective rigs and are struggling to survive the incentive drop, miners may be fleeing in great numbers.

The most current surge in the Hash Ribbons statistic gives greater weight to this idea. Spikes reflect the variation in the short-term and long-term moving averages of hashrate; they show low mining activity or miner capitulation.

This could be a “tempting Bitcoin buy signal,” according to crypto hedge firm Capriole Investments, suggesting that declining mining pressure could be driving market response.

The strong desire miners have to sell their Bitcoin is known as mining pressure. Usually paying for hardware and electricity, miners pay for maintaining network integrity while selling the Bitcoin they have acquired to meet overhead expenses. Usually, less demand means less quick sale of Bitcoin by miners.

A Silver Lining For Long-Term Bulls?

Simultaneously, many contend that institutional investors are re-engaging with Bitcoin and become more “risk-on”. This could suggest that people’s future expectations of the bitcoin are growing more hopeful.

Featured image from The Motley Fool, chart from TradingView