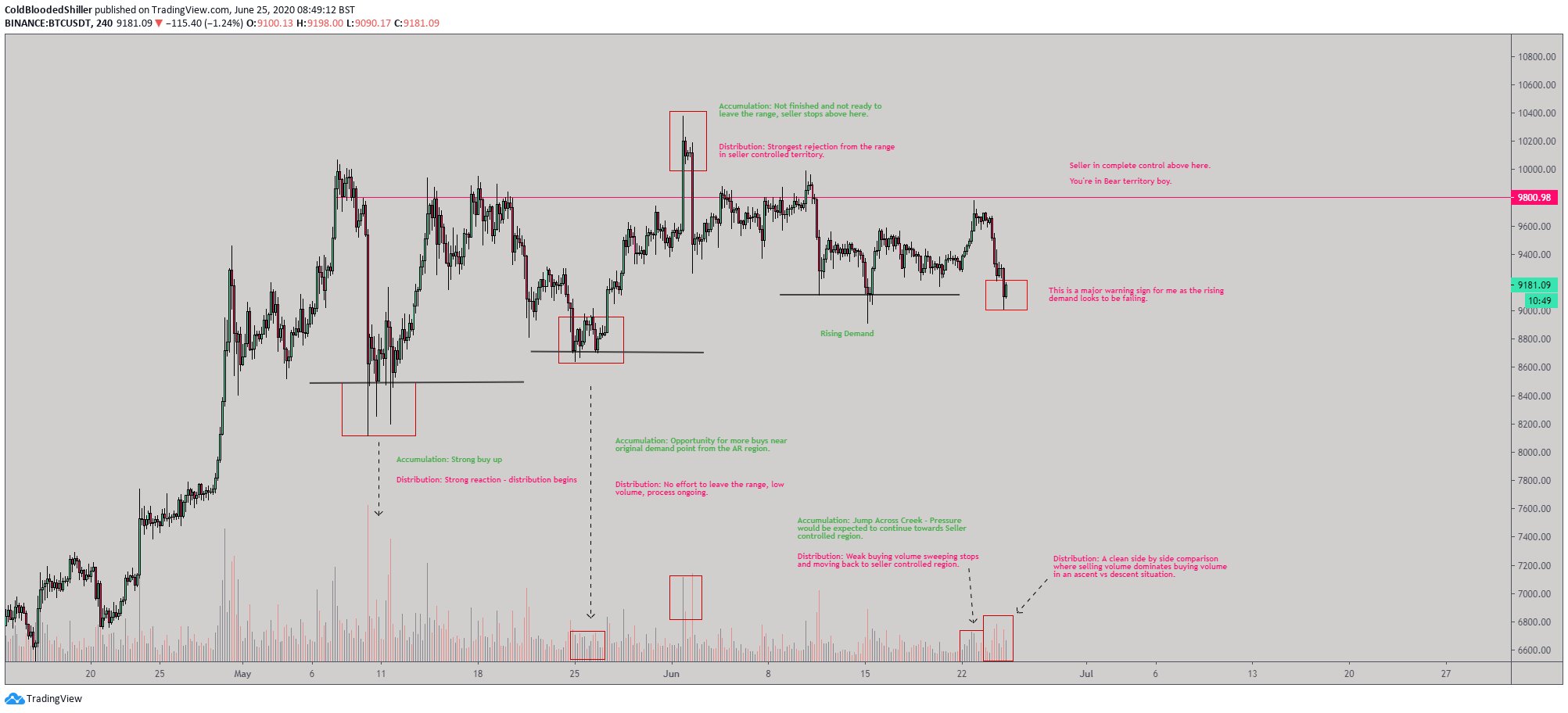

Bitcoin’s consolidation over recent weeks has convinced some traders that there is a move to the downside in the works. As reported by NewsBTC recently, one analyst commented that the recent price action is signaling a potential “distribution” pattern:

“A couple more clues developing that lend themselves to HTF distribution. 1. Rising Demand on the verge of failing. 2. Side by side, ascent vs descent with selling the dominant pressure from volume.”

Bitcoin distribution analysis shared by trader “Cold Blooded Shiller” (@Coldbloodshill on Twitter). Chart from TradingView.com

One fractal analysis, though, predicts that Bitcoin’s ongoing consolidation will resolve to the upside in an explosive fashion. The catch: the breakout will come at the end of 2020 — over five months away.

Bitcoin Could Break Explosively to the Upside… Eventually

On March 12th and 13th, the Bitcoin market broke down. As many investors likely remember, in the span of approximately 24 hours, the cryptocurrency market fell by around 50%. Bitcoin then plunged from the $7,000s to $3,700.

Few expected the market to recover at the time. There were some, however, trying their best to stay optimistic.

The CIO of Altana Digital Currency Fund, Alistair Milne, shared the chart below in the day after the crash, attaching the comment:

“So, if you take the fractal after the Aug 2015 meltdown due to exchange dysfunction (and major trendline break) … and place it on the end of Friday’s meltdown, you get this …”

Chart of a potential BTC fractal shared by the CIO of Altana Digital Currency Fund, Alistair Milne. Chart from TradingView.com, current as of March 14th.

The chart, which showed Bitcoin could follow the path it took after 2015’s crash, implied that BTC would recover to $10,000 by June. And that it did, with Bitcoin spiking above $10,000 at the start of June.

This same fractal now predicts that after two more months of consolidation, Bitcoin will hit $18,000 by the end of 2020. As Milne explained in a recent update about the fractal:

“Would you accept another ~2 months of no volatility if it meant we go directly to $18k within 4 weeks of a breakout?”

Milne isn’t the first individual to have suggested that Bitcoin’s ongoing consolidation will resolve higher.

Mike McGlone — the senior commodity analyst at Bloomberg Intelligence — recently wrote the following on Twitter:

“Volatility should continue declining as Bitcoin extends its transition to the crypto equivalent of gold from a highly speculative asset, yet we expect recent compression to be resolved via higher prices.”

#Bitcoin Blahs? Benchmark #Crypto Looked Similar Before Past Gains —

Volatility should continue declining as Bitcoin extends its transition to the crypto equivalent of gold from a highly speculative asset, yet we expect recent compression to be resolved via higher prices. pic.twitter.com/XbIMv5AYAf— Mike McGlone (@mikemcglone11) July 2, 2020

So, if you take the fractal after the Aug 2015 meltdown due to exchange dysfunction (and major trendline break) … and place it on the end of Friday’s meltdown, you get this … The sentiment McGlone shared is in line with the sentiment he shared in previous analyses.

In editions of Bloomberg’s “Crypto Outlook” released over recent months, the Wall Street analyst has outlined a perfect storm of reasons indicating that Bitcoin will move higher. Some of those reasons are as follows:

- The BTC block reward halving that came in May

- The increasing investment in the Bitcoin market by users of the CME and clients of Grayscale

- Bitcoin’s growing correlation with the gold market

- And more.

Frothy Stock Market Could Change BTC’s Fate

Although the fractal is seemingly relevant, a frothy move in the stock market could change Bitcoin’s fate.

As is now common knowledge, movements in the S&P 500 have been mirrored by Bitcoin over recent months. This correlation has been noticed by JP Morgan, whose analysts noted in June that since the March crash, cryptocurrencies have traded almost like equities.

Should the S&P 500 surge or crash in the weeks ahead, Bitcoin will break the fractal, potentially rejecting the sentiment BTC will hit $18,000 by the end of 2020.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com This Bear Market Fractal Bitcoin Could Shoot Towards $20k in 2020