Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

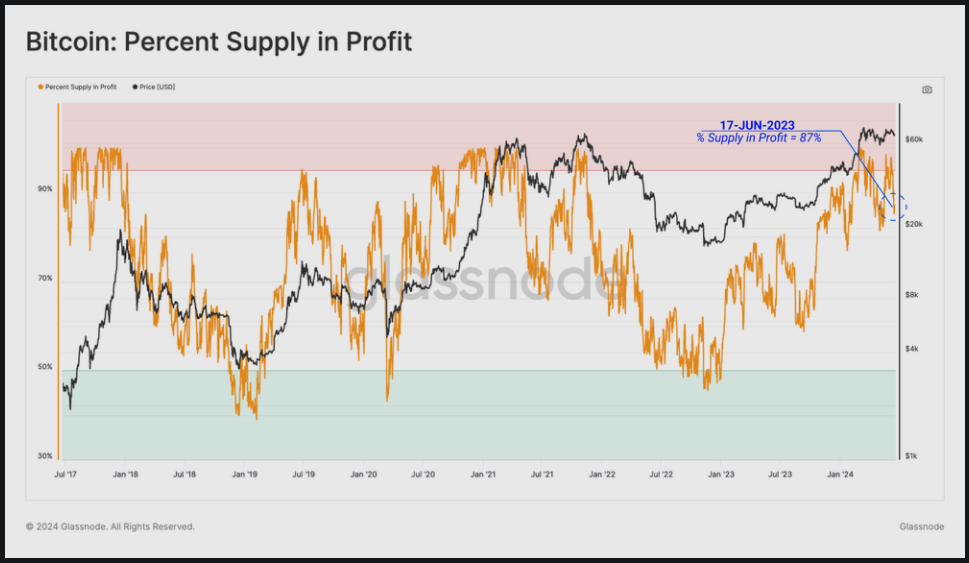

For investors, the situation of the Bitcoin market now presents a mix of hope and caution. With their investments more than their initial purchase cost, over 87% of Bitcoin owners are in profit.

Glassnode data shows that these investors are typically realising unrealised gains of 120%, a noteworthy amount that mirrors the major surge driving Bitcoin to its all-time high in March. Still, the market shows both positive long-term trends and some short-term uncertainty that demand careful study notwithstanding these advances.

Profitability And Market Metrics

Among investors in Bitcoin, there is clear profitability. Key indicator of market mood, the MVRV (Market Value to Realised Value) index stays much above its annual average. This indicator of average unrealised profit throughout the market gauges the ratio of Bitcoin’s market value to its realised value.

A high MVRV ratio suggests that most investors are sitting on significant unrealised gains, so presenting a good image of the state of the market. The resilience of long-term investors who bought the dip and are now seeing their foresight rewarded contrasts with the recent market volatility.

Reduced Trading Activity And Demand

Though the market is generally profitable, trading activity of Bitcoin is clearly declining. Once defining the market, the active speculative trading has greatly reduced.

Previously profite on price swings, day traders have pulled back, lowering trading volumes and driving down demand. Lack of speculative trading has caused Bitcoin prices to stagnate, now limited to a clearly defined range. The present situation of the market might be compared to a calm phase following a storm, in which activity is limited and prices move only gradually without notable change.

Investor Caution And Market Sentiment

The lower trading activity indicates investors’ more general cautious attitude. Based on the present phase of consolidation, many investors seem to be waiting and seeing the state of the market before making any firm decisions.

On-chain statistics showing a notable decline in Bitcoin movement into exchanges supports this wary attitude even further. Usually, as holders try to sell their positions, a spike in Bitcoin flows to exchanges foreshadows sales activity. The present drop in these transfers suggests that rather of selling, both short-term and long-term holders would rather keep onto their assets.

Once avidly trading Bitcoin for fast gains, short-term holders are now moving far less coins than at the high witnessed in March. This behaviour points to a change towards a more conservative approach, maybe in line with expected future price swings. Conversely, long-term investors seem happy to keep their positions and show faith in Bitcoin’s long-term possibilities despite the temporary market stagnation.

Featured image from Adobe Stock, chart from TradingView