Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Hedera Network services are experiencing a critical moment with an ongoing exploit that compromises the network’s tokens after discovering irregularities affecting various Hedera dApps, Liquidity Pool (LP) tokens, wrapped tokens, and their users. The Hedera Foundation (HBAR) tweeted:

We’ve noticed network irregularities that are impacting various Hedera dApps and their users.The Foundation is in communication with impacted partners. We’re monitoring and working to help resolve the issue. Please standby for more information.

How The Exploit Impacted The Hedera Network?

Hedera is a fully open-source and publicly distributed ledger that uses fast and secures hash graph consensus. Hedera’s services include smart contracts based on Solidity, an object-oriented programming language developed by the Ethereum Network team specifically for constructing and designing smart contracts on blockchain platforms.

According to the Decentralized Finance (DeFi) researcher, who goes by the pseudonym DeFiIgnas, the ongoing exploit has targeted the decompilation process in the Hedera network. In addition, bridged tokens have been frozen by Hashport, the enterprise-grade public utility that facilitates the movement of digital assets between distributed networks.

To ensure the safety and security of users, the Hashport bridge has been temporarily paused so that users won’t be able to access multi-chain transactions. As of this writing, the exploit continues to affect the Hedera network.

In addition, the Hedera Foundation reported that it has been in contact with and continues to communicate with affected partners as it monitors and works to resolve the network security breach.

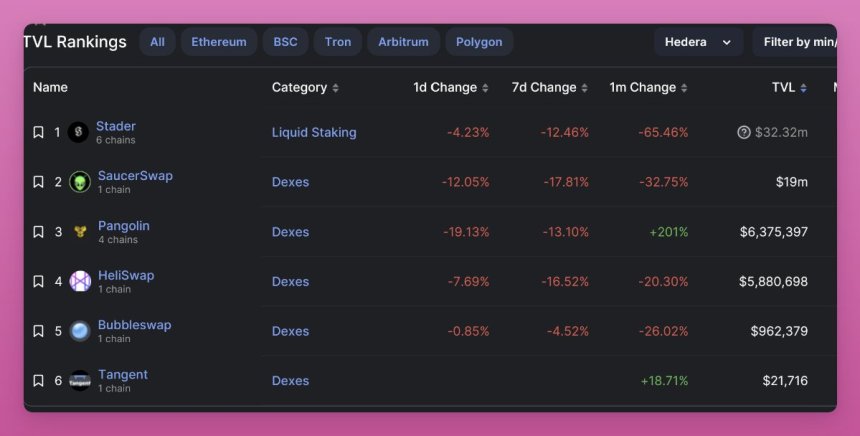

dApps Total Value Locked Dropping Fast

The decentralized digital asset exchange (DEX) Pangolin has reported that users are experiencing problems withdrawing their funds from hashpart-related pools, as the various tokens on the network are “paused,” as are all smart contracts, due to the “outage” that the Hedera network is experiencing.

As seen in the chart above, the total value locked (TVL), which measures the value of deposits and stakes in the dApps and the blockchain, is falling rapidly for Hedera dApps. The TVL includes all coins deposited in the features provided by the DeFi protocols, including stakes, loans, and liquidity pools.

Stader labs, which supports six separate networks that allow users to deposit tokens into liquid staking protocols, is the most affected by the current exploit, suffering a 65.46% drop with a TVL of $32 million.

The exploit has significantly impacted the Hedera hashgraph token, highlighting the downtrend the hashgraph has been experiencing since February, from a high of $0.0914 to the $0.0589 level.

Investigations by the network’s core team are underway to identify the security breach of the smart contract network and the cause and further impact on the tokens. The Hedera Foundation concluded:

The Hedera core team is actively investigating the smart contract irregularity that has been discovered. They are working directly with teams across the DeFi ecosystem to determine the cause and potential impact. Updates will be provided as they become available.

Featured image from Unsplash, chart from TradigView.com