A few hours after Bitcoin scaled the $30,000 mark, the global crypto market has been rocked by substantial liquidations. The past 24 hours alone have seen a drastic exodus of more than $260 million from the crypto market. This significant upheaval underlines the high-stakes, volatile nature of digital currency trading.

Notably, traders currently at a loss despite the uptrend in the market are those that took short positions with the hope of the crypto market continuing a downward trend.

Sweeping Liquidation Wave Hits Crypto Traders

Data from Coinglass reveals that an estimated 65,392 traders and counting had their positions liquidated in the past 24 hours, amounting to cumulative losses above $269 million. This event underscores the risk in crypto trading, particularly during significant market shifts, such as Bitcoin’s recent surge beyond the $30,000 threshold.

Binance, a prominent player in the crypto exchange arena, accounted for the most significant slice of these liquidations, totaling $84.79 million. Other exchanges, including OKX with $69.53 million, Bybit with $37.9 million, and Huobi with $32.35 million, also recorded large liquidations.

While smaller exchanges also saw liquidations, their impact on the overall market was less severe. Notably, The liquidation wave impacted traders mainly holding short positions, reflecting the majority’s anticipation of a price decrease.

These traders bore the brunt of the liquidations, accounting for approximately 80.9% ($218.21 million). Simultaneously, traders holding long positions were not immune to the market’s volatility, with liquidations amounting to nearly 20% of the total ($51.50 million).

This underscores that fluctuations in the crypto market can be equally detrimental to both ends of the trading spectrum. A stark illustration of this explosive situation came from Bitmex, where a single trader recorded a massive loss of $9.30 million in an XBTUSD swap, the largest single liquidation in this episode.

Bitcoin Latest Price Action

Over the past 24 hours, Bitcoin has made significant moves. The asset has briefly tapped a notable high of above $30,000 a few minutes ago from writing. This surge comes after the asset’s previous blood bath amid the intensified regulatory scrutiny on the largest crypto exchanges that saw its price trade below $25,000.

Bitcoin currently trades at $29,991 after briefly climbing above $30,000. Over the past 7 days, Bitcoin’s total market capitalization saw a boost of 15.7%, amounting to an additional $80 billion. The market capitalization of Bitcoin presently hovers at $583.6 billion, an increase from last Wednesday’s $503 billion.

Bitcoin’s daily trading volume has also surged from a low of around $7 billion last week to as high as above $30 billion in the past 24 hours. This update suggests an increased trading activity of Bitcoin within a span of 7 days.

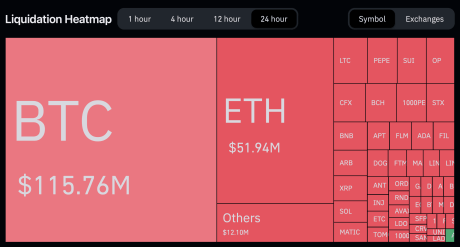

Furthermore, Bitcoin liquidations formed a significant chunk of this turbulence, accounting for $115.76 million. Following Bitcoin, Ethereum (ETH) traders witnessed liquidations of $51.94 million, reaffirming the ripple effect across different cryptocurrencies.

Featured image from iStock, Chart from TradingView