Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is making waves on Wall Street, with BlackRock and Fidelity, two of the popular spot Bitcoin exchange-traded funds (ETF) issuers shattering records. Looking at recent trends, spot Bitcoin ETFs are surging in popularity, indicating that institutional investors, or “whales,” are diving headfirst.

Fidelity And BlackRock Spot Bitcoin ETFs Break Wall Street Record

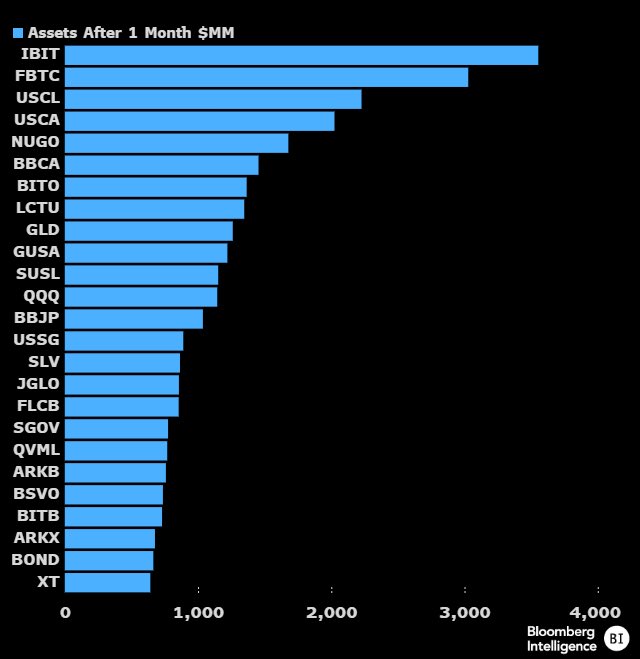

Mark Wlosinski, a crypto commentator, took to X on February 12, highlighting the meteoric rise of BlackRock (IBIT) and Fidelity (FBTC) Bitcoin spot ETFs. Both have amassed a staggering $3 billion in assets under management (AUM) within 30 days. This feat is historic, marking the first time an ETF of any product has achieved such rapid growth in such a short period.

This unprecedented demand for spot Bitcoin ETFs comes amidst a broader trend of institutional adoption. Wlosinski notes that over 5,500 ETFs have been launched throughout history. However, none have yet witnessed the level of enthusiasm currently surrounding spot Bitcoin ETFs.

The pace at which BTC AUM of spot ETF issuers continues to grow suggests a significant shift in investor sentiment. Specifically, Wall Street is increasingly recognizing BTC’s potential as a viable asset class.

For years, leading Wall Street executives, including Jamie Dimon, the head of JP Morgan, dismissed the coin, saying it was speculative and a scam. However, with the United States Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs after more than ten years of rejecting the product, there appears to be a seismic shift in the investment landscape.

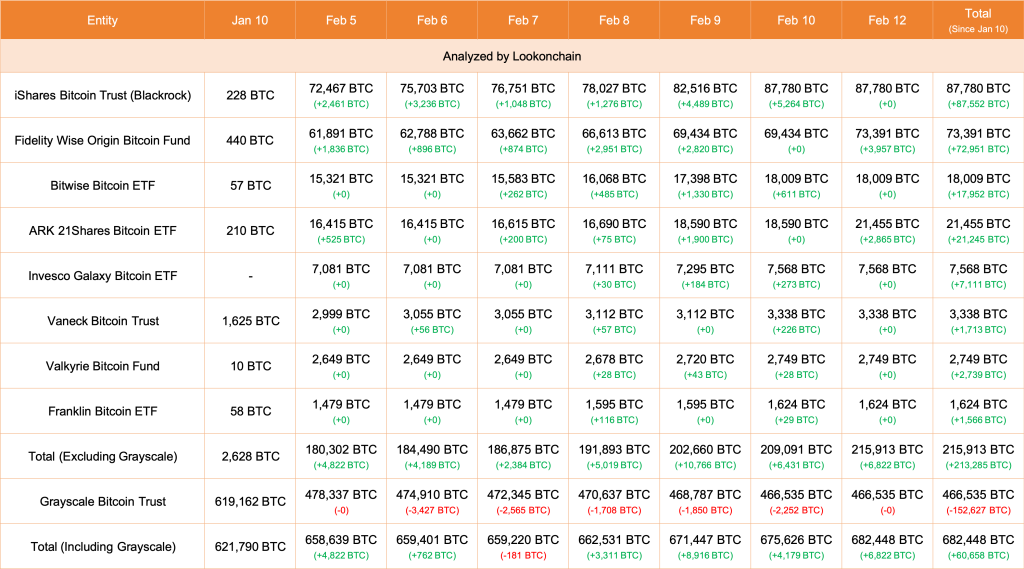

As of February 12, Lookonchain data shows that Fidelity and Ark21 Shares bought an additional 6,822 BTC worth over $339 million. BlackRock’s IBIT remains the largest spot BTC ETF by AUM, controlling over 87,780 BTC. However, spot ETF issuers continue to accumulate, pushing their total haul to 682,448 BTC.

BTC Retests $50,000, Path To November 2021 Highs?

Since spot Bitcoin ETFs track the spot price, the more spot ETF issuers buy, the higher the demand for the coin becomes. Accordingly, rising demand has significantly impacted prices, as the daily chart shows. So far, Bitcoin is trading close to the psychological $50,000 mark, the highest level since 2024.

Technically, the uptrend remains, and buyers are firmly in control. If buyers double down, buy more, and take more coins out of the reach of spot ETF issuers, Bitcoin will likely float to $70,000 or better in the sessions ahead.

Related Reading: SOL Price Surges To $115 – Why Solana Could Rally Another 10%