After spending three years of the crypto bear market as the butt of all jokes, being compared to sheep manure, and much more, XRP has shocked the entire industry with a 225% single-month explosion. But the powerful breakout could only be just beginning, according to a variety of technical indicators that measure the strength of the movement.

Here are five factors behind the breakout and why the move is more than likely sustainable.

XRP Taps Nearly $1 On Coinbase, Breakout Is Only Just Beginning

During the early morning hours, the third-ranked cryptocurrency pushed to a peak price of over 90 cents per token at the high on Coinbase.

The cryptocurrency began the month trading at the low end of 20 cents, more than tripling in value from low to current levels.

Related Reading | Bitcoin And Dollar Dominance: Five Factors Behind The Current Altcoin Season

The disbelief rally began following Ripple revealing it was buying back XRP, and news circulating about the upcoming Spark token airdrop.

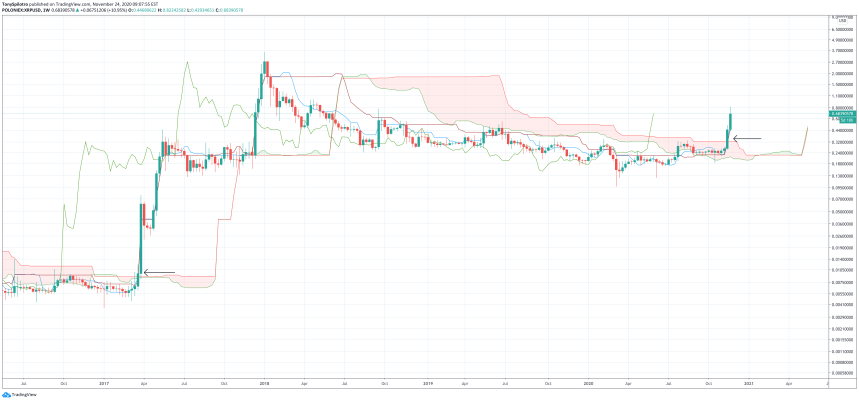

And while XRP has moved so much so quickly, technicals suggest that the rally has legs and is only just starting. The chart below shows exactly where the altcoin called Ripple could be in terms of its market cycle.

The RSI is in bull market zone with room to grow, and the MACD has flipped bullish | Source: BTCUSD on TradingView.com

The Relative Strength Index on weekly timeframes has broken into bull market territory, in which it has only reached three times prior.

The first time there was such a bullish impulse, the rally kept going until nearly 900% ROI was reached. Weekly RSI reached as high as a reading of 95, pointing to extremely overbought conditions.

The Ripple rocket is only at 88 currently, suggesting that there is plenty of room to grow during bullish impulse one of three. The chart above also shows the MACD only just now breaking up. The lagging momentum indicator adds credence to the theory that an extended rally is here.

The Ripple Effect: Why The Bullish Impulse Is Only Getting Started

With the RSI in bull market territory and room to run, and the MACD only just now flipping bullish, that still leaves two more significantly bullish factors to examine in Ripple.

The Bollinger Bands also back up the idea of a massive bull breakout | Source: BTCUSD on TradingView.com

On weekly XRP charts against the dollar, the altcoin has also reached the top of the Bollinger Bands after making it through the middle-line. This also occurred during the last bull breakout, which ultimately led to a 34,000% increase less than one year later.

Related Reading | Here’s Why Crypto Analysts Are Divided Over The Future Of Altcoins

The Bollinger Bands also mimic the signal provided by the Ichimoku cloud. Once XRP made it through the cloud the last time around, it was off to the races for Ripple bulls.

The Ichimoku indicator also supports an extended bull trend | Source: BTCUSD on TradingView.com

Now that XRP is back above the cloud on weekly timeframes, the sky is no longer the limit, and the altcoin known as Ripple could soon head out of orbit completely.

Featured image from Deposit Photos, Charts from TradingView.com