Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Associating with the term “DeFi” worked in favor of many blockchain assets this year. UNI was one of them.

The governance token, which landed in the hands of people who contributed to the progress and running of UniSwap, a decentralized crypto exchange, was a hit right after its launch. It topped charts after rising more than 5550 percent within hours of trading, surging from $0.15 to $8.62.

Of course, UNI remained an airdrop token – helicopter money that prompted beneficiaries to dump it the moment they received it. That caused UNI/USD to plunge harder from its year-to-date high. As of October 7, almost three weeks after its launch, the pair was trading for $2.47, down 71.25 percent.

UNI/USD price trends since launch. Source: TradingView.com

The slipover occurred amid a market-wide DeFi meltdown. Almost every asset, that represented yield farming projects, decentralized exchanges, and distributed lending/borrowing, fell hard. It showed that their upside bias was exhausting, leading to serious profit-taking among traders.

But despite the DeFi crash, UNI is still promising to recoup its entire losses. So says a TradingView-based analyst that has spotted the UniSwap token inside an indicator known as…

…The Cypher Pattern

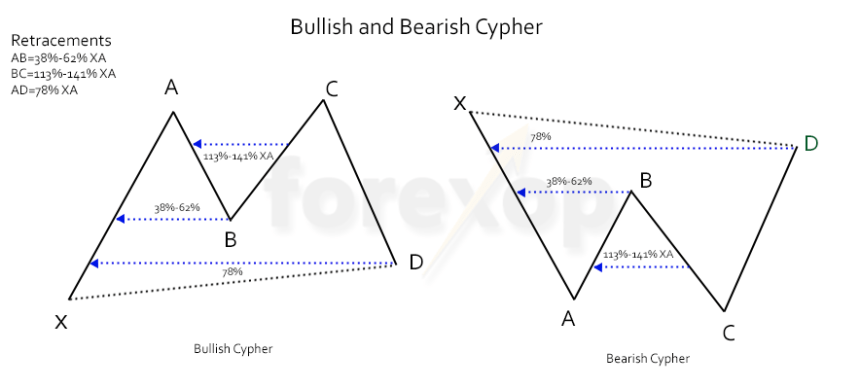

According to ForexOP.com, the Cypher in forex trading represents a five-point harmonic chart pattern: XABCD.

“In any Cypher, points X, C and D are the critical points,” the portal noted. “For a bullish Cypher, X should be the pattern low and C the pattern high. A bearish Cypher makes its high at X, and its low at C.”

Based on the definition, UNI is currently printing a bearish Cypher Pattern. It also gets confirmed by retracements between AC (38%-62%), BC (113%-141%), and AD (78%) against the XA. For instance, the chart below illustrates the segments:

Example of Cypher Patterns. Source: ForexOp.com

And now, placing the Bearish Cypher pattern on the current UNI/USD chart makes it look like the following.

UNI/USD and its Cypher Pattern outlook. Source: TradingView.com

“So far all fib levels line up accurately,” the analyst behind the chart above said. “If this is the case and price breaks above $5 resistance, we’ll be seeing $7 soon.”

UNI Fundamentals Agree

UNI is a new token but what it represents is a three-year-old credible DeFi project, UniSwap. The exchange now facilitates hundreds of millions of dollars in volume every day. Its output is higher than the ones posted by the top centralized exchanges Binance and Coinbase.

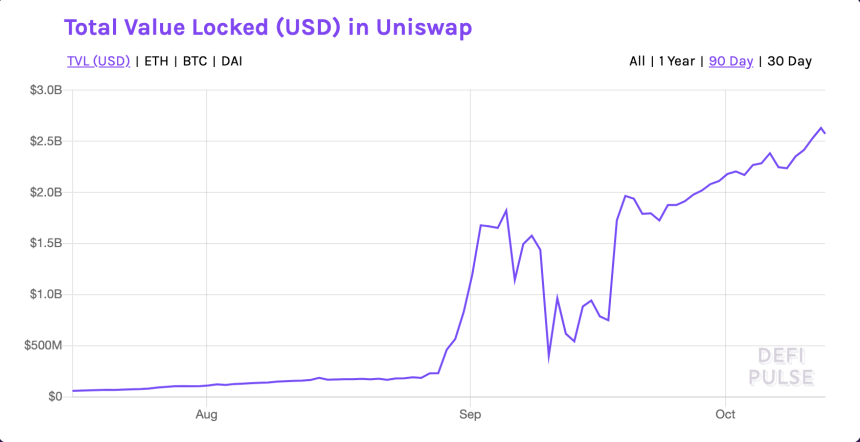

UniSwap has paid out more than $60 million to its 400,000 liquidity provider. It is the same reason why, despite UNI’s latest plunge, the total-value-locked (TVL) inside its pool barely moved lower. In contrast, other pools lost almost half of their reserves.

The TVL of the UniSwap pool. Source: DeFi Pulse

With UNI now becoming an economic incentive, the token expects to grow higher in value.