Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has soared higher over the past few days. After bottoming at $11,200 late last week after the OKEx news, the cryptocurrency has mounted a comeback.

As of this article’s writing, the coin trades for $11,750, around $400 higher than it was trading just 36 hours ago. The coin briefly surpassed $11,800 earlier today but was rejected as the U.S. dollar underwent a slight bounce amid stimulus uncertainty. Bitcoin has begun to decouple from traditional markets to some extent, with BTC actually rallying while most other risk-on assets like the S&P 500 have sunk. The cryptocurrency is also outperforming gold.

Related Reading: Here’s Why Ethereum’s DeFi Market May Be Near A Bottom

Bitcoin Soars Higher

Bitcoin has soared higher over the past 24 hours as buyers have returned to the market.

The leading cryptocurrency has gained around $300-400 in the past two days, rallying higher as the U.S. dollar continues its descent lower.

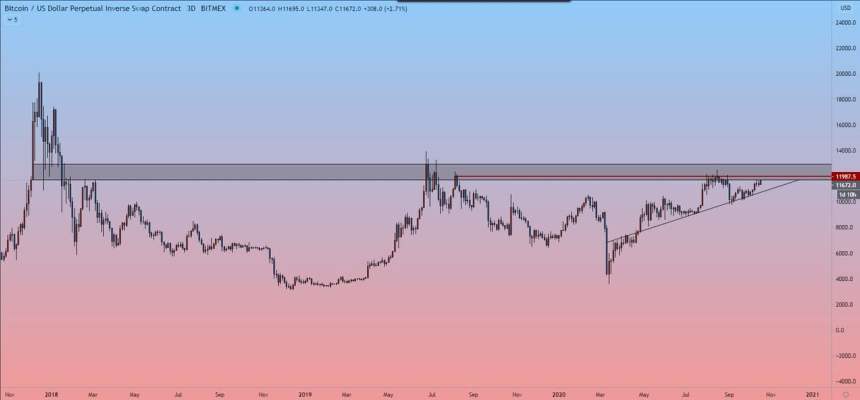

Analysts think that this price action is a precursor to a greater move higher. One crypto-asset trader noted that the cryptocurrency is now rubbing up against the crucial resistance of $12,000, which could trigger a move above $13,000. That region has been pivotal for Bitcoin since the 2018 highs and since the 2019 blow-off top.

“Bitcoin is now up against major resistance. High time frame close above $12,000 and $13,000 is on the table IMO. If we want the FULL BULL, BTC will need to fully breach and close above 13K. Retest and flip the gray box to support and up it will go. (stimulus permitting),” he said.

Image Courtesy of Chase_NL. Source: BTCUSD on TradingView.

Related Reading: Tyler Winklevoss: A “Tsunami” of Capital Is Coming For Bitcoin

DeFi Coins Underperform BTC

What’s weird is that this has been a Bitcoin-focused rally. Altcoins are actually down massively on the day, with even Ethereum posting a red day despite the price surge in Bitcoin.

CoinGecko data indicates that leading DeFi coins have dropped 5-10% in the past 24 hours.

Take the example of AAVE, which has dropped 10% in the past 24 hours. Yearn.finance (YFI), too, has dropped 8.5% in the past 24 hours.

It seems that Bitcoin is starting to take the lead once again as macro factors favor growth in a decentralized, scarce, and digital currency.

For one, Fed Chair Jerome Powell commented on Monday morning that the U.S. is still looking into a digital currency. Many see Bitcoin as a valuable alternative to a central bank digital currency.

Related Reading: 3 Bitcoin On-Chain Trends Show a Macro Bull Market Is Brewing

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Top DeFi Coins Crater 5-10% Despite $400 Bitcoin Price Jump