Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin has barely flinched in the face of the dollar’s best attempt at a rebound in over a year. The greenback is trying to stage a comeback against the top cryptocurrency, which has left the global reserve currency battered and beaten.

Although Bitcoin has fended off the advance in USD, if history repeats and the dollar surges, a short term bear phase could be coming to the crypto market soon.

The Badly Beaten Dollar Begins Breakout And Bounce

2021 thus far has been Bitcoin’s best year on record. 2020 was among the dollar’s worst as sentiment turned negative and inflation fears pushed investors toward hard assets like gold and crypto.

However, according to the DXY Dollar Currency Index, which weighs the dollar against a bucket of other national forex currencies, a comeback is in the making.

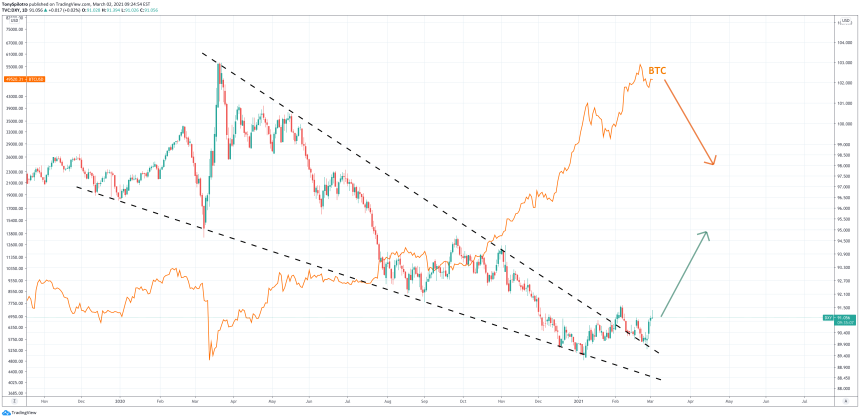

The dollar is breaking out from a falling wedge. Will crypto respond? | Source: DXY on TradingView.com

The chart above shows the DXY breaking out from a falling wedge pattern, and coming back down to retest the former resistance line as support. With the retest complete, a stronger push higher should result.

Related Reading | Dollar, Divergences, & More: Here’s Why Bitcoin Could Soon Bounce

Thus far Bitcoin has remained largely unaffected by the dollar’s advance, despite one half of the cryptocurrency’s main trading pair featuring the fiat currency.

A bullish MACD crossover will confirm the breakout as it has in the past | Source: DXY on TradingView.com

Coinciding with the breakout of the falling wedge, on higher timeframes, the MACD – a momentum indicator – is starting to turn upward. Past instances of the same pattern breaking upward combined with a bullish crossover on the MACD has led to sustained upside in the DXY.

How A Reversal In The Greenback Could Send Bitcoin Into A Bear Market

Although the leading cryptocurrency by market cap has shaken off the greenback’s rebound thus far, a bear phase could soon be coming that sets back the current uptrend for some time.

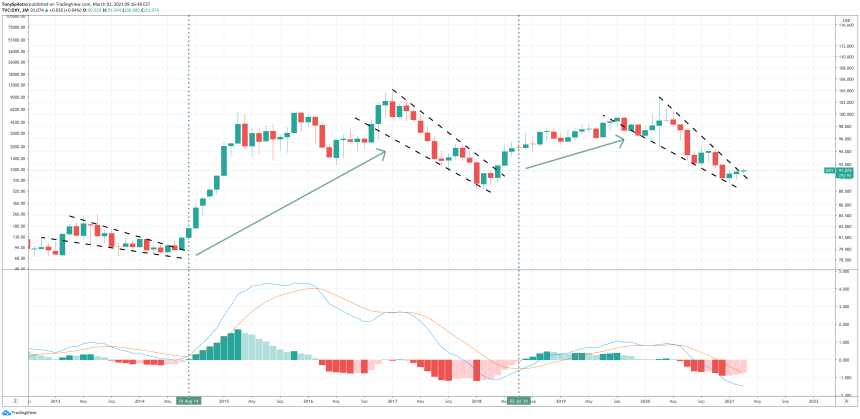

Each time the MACD crossed bullish on the DXY, it led to an extended bear market in Bitcoin, as pictured below.

Each bullish crossover in the dollar led to a crypto bear market | Source: DXY on TradingView.com

Bitcoin has been an uptrend for nearly a full year – since Black Thursday in 2020 – but time could be running out. The MACD hasn’t fully crossed over just yet, but has begun to turn upward.

Related Reading | This Unique Take On Bitcoin Suggests A Bear Phase Is Near

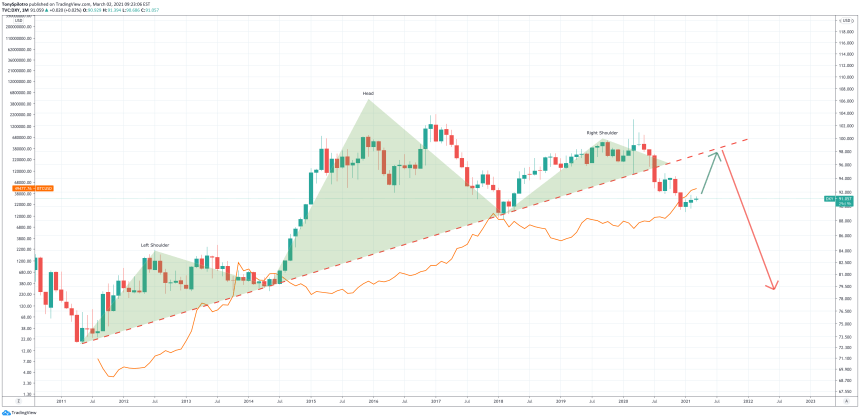

However, not all is lost for Bitcoin and the rest of the crypto market. An inverse head and shoulders on high timeframes might have completed on the DXY, which after a throwback to the trendline to confirm it as resistance, could result in the largest collapse in the dollar’s history, and its eventual undoing.

Upside in the dollar could ultimately be limited, benefiting Bitcoin | Source: DXY on TradingView.com

Such a scenario would suggest a bear phase in Bitcoin will arrive sooner than later, but that it will be much shorter-lived than previous bear markets, and once it ends, the leading cryptocurrency by market cap could completely take over as the global reserve currency.

Of course, there’s no telling what the dollar could do from here, or if this time is actually different.

Featured image from Deposit Photos, Charts from TradingView.com