The recent bullish breakout in Bitcoin has caused a massive wave of FOMO as late to the game buyers attempt to get in before the cryptocurrency takes off to a new all-time high.

But one sharp-eyed crypto analyst has spotted a fractal in Amazon’s post-dot-com bubble crash recovery that closely matches the cryptocurrency’s recent price action. If the fractal plays out, and there could be merit behind the expectation thanks to a rare harmonic pattern, a sizable Bitcoin crash could be on the horizon.

Amazon Fractal Should Act As “Anti-FOMO” For Bitcoin Buyers, Analysts Warns

Cryptocurrencies have drawn regular comparisons to the early dot-com days, back when projects appeared by the dozen, all boasting about being the next big thing but instead failing to deliver on promises.

The air and capital eventually came rushing out of both bubbles, bringing valuations back to reality. From the ashes of the dot-com bubble rose today’s giants like Facebook, Microsoft, Google, and Amazon.

Related Reading | Technical Expert Shows How Bitcoin Path Could Reach Gold’s $10 Trillion Cap

The same could be happening again in crypto, and after a bear market, future winners like Bitcoin and Ethereum are emerging strong.

But just like those days, when the winners did begin to stand out from the crowd, the leftover overly bullish sentiment was used to torment bull who thought a full-on recovery was in effect.

Amazon stock shares' post-dot-com recovery had one last rug pull | Source: AMZN on TradingView.com

When Amazon set its first higher high following a higher low, investor enthusiasm picked up too fast, too soon, and a final correction made guessing if a bull market was back even more difficult.

In the chart above, AMZN shares plummed by more than 66% following a parabolic rise that brought the stock price to its first higher high after the dot-com bubble burst.

One crypto analyst sees several similarities between AMZN stock shares back then, and Bitcoin now, according to the chart they shared below.

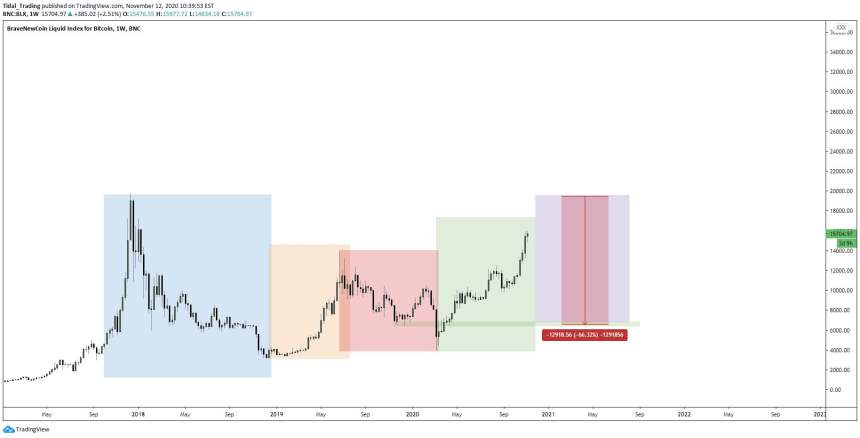

A pseudonymous crypto analyst sees similarities in crypto charts | Source: BTCUSD on TradingView.com

Could A Bearish Gartley Harmonic Pattern Bring The Crypto Market One Last Crash?

A 66% collapse would take Bitcoin price back to $5,550, and would certainly put a real scare in crypto bulls convinced the asset will soon rise beyond $20,000.

There’s also no denying how bullish Bitcoin’s high timeframe chart currently looks, and there is next to no BTC available on exchanges that can even be sold into the market. So what then could cause the sudden change?

Related Reading | Bitcoin Experts Claim Post-Halving Performance Is More Bullish Than Pre-2017

The stock market toppling from secular bull market highs could be a trigger. But it also could be purely market dynamics at work, depicted by a massive bearish Gartley formation that has formed on high timeframe BTC charts.

A bearish Gartley harmonic pattern could be the culprit that causes a crash | Source: BTCUSD on TradingView.com

A bearish Gartley is a rare harmonic pattern, that must follow certain measurements in price and time to become valid. While it’s not a perfectly formed Gartley, the latest high, if Bitcoin stops here, could be the pattern that sends the cryptocurrency back to test much lower.

Gartley targets typically follow Fibonacci retracement levels, much like the measurements in the pattern do. Typical targets for such a pattern often reside at the 0.618 retracement level, or what would equal a roughly 40% crash.

Bitcoin bull market corrections often reach a severity of between 30-40% according to previous cycles, which would take Bitcoin around the mid-$8,000 range.

Featured image from Deposit Photos, Charts from TradingView.com via HornHairs on Twitter