Among those who follow cryptocurrencies, altcoins are creating a lot of buzz since speculations of a possible Bitcoin break-through abound. Following weeks of slow trade, a recent capital infusion has rejuvenated the king of coins. This begs a serious issue: are cryptocurrencies destined to be left behind or will they ride the wave?

Whispers Of A Bitcoin Bonanza

According to data from Farside Investors, investor mood has changed significantly. On June 4th, around $890 million went into Bitcoin exchange-traded funds (ETFs), unmistakably indicating fresh interest. This increase in purchasing could be a trigger for a wave of speculating and upward movement in Bitcoin prices.

Still unresolved, though, is how this increased concentration on Bitcoin might affect the larger bitcoin market. Strong Bitcoin rallies have historically sometimes been accompanied by altcoin seasons, times when other cryptocurrencies show tremendous expansion. But is this different from past times?

Altcoin Season: Just Over The Horizon?

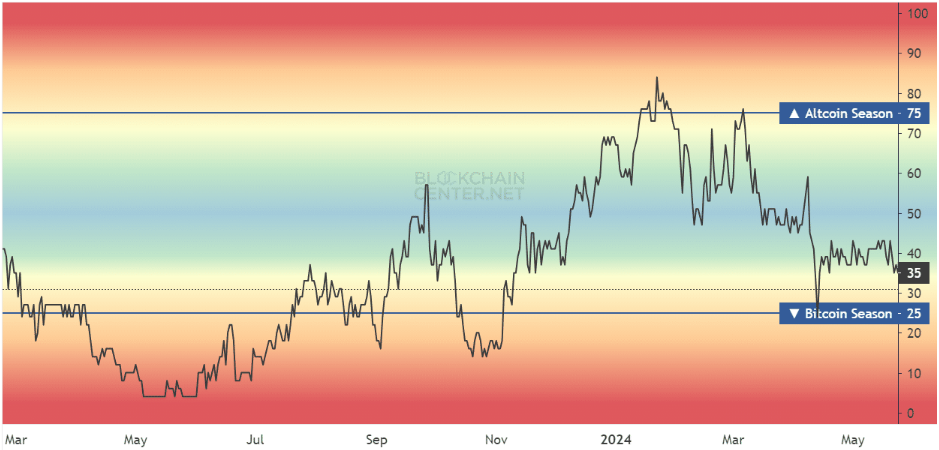

Right now, the Altcoin Season Index—a gauge of market attitude towards altcoins—is just 35. This is far different from the values of 80 recorded just six months earlier. This implies that altcoins are not yet gleaming in the reflected glory of Bitcoin’s possible ascent.

Only a few altcoins, according to experts, are likely to beat the market leader even with a Bitcoin boom. The Altcoin Season Index must rise over 75, a mark of general optimism across the whole altcoin community, if we are to really unleash an altcoin season.

Why Altcoins Might Struggle To Shine

The sheer volume of altcoins relative to past cycles also throws off the altcoin season calculation. The altcoin market was a far smaller lake in 2017 and 2021, for example. Bitcoin’s explosive rise caused investor money to migrate more easily into a limited pool of altcoins, therefore driving notable price gains all around.

The scene today is very different. Thousands of altcoins fight for investor attention, hence any gains during an altcoin season could be focused in a small number of highly successful projects, leaving the great majority behind.

Bitcoin Dominance: A Key Indicator To Watch

One other important consideration is Bitcoin Dominance (BTC.D). This statistic shows the market capitalisation of Bitcoin as a fraction of the whole crypto market cap. Altcoin seasons historically have corresponded with a notable drop in BTC.D. Early 2021, for instance, the coin’s dominance level dropped from 70% to 40%, opening the path for a time of exponential altcoin expansion.

BTC.D is currently rising, nevertheless, implying that altcoins are not yet the focus of interest. Investors seeking alternative coin prospects should monitor this indicator closely since a continuous decline in the dominance of the crypto can indicate the arrival of an altcoin season.

Featured image from Indiana Daily Student, chart from TradingView