Uniswap’s newly released governance token – called UNI – has taken a serious beating throughout the past few days, with its price bearing witness to unrelenting selling pressure that has slowed its ascent and caused it to shatter multiple key technical levels.

Analysts are now growing concerned with the cryptocurrency’s near-term outlook, as its latest bout of selling pressure has struck a serious blow to its market structure.

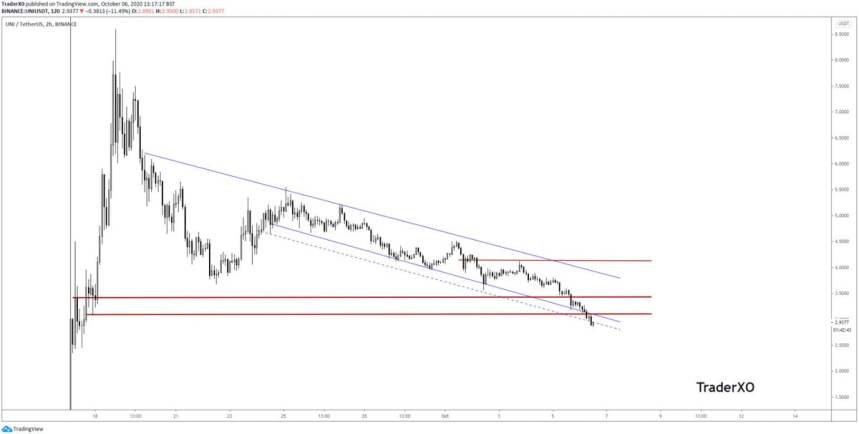

One analyst is now noting that the last ditch support level he was closely watching has been shattered, and that significantly further downside could be imminent in the coming days.

As for just how low it may go in the near-term, one popular trader who has been closely tracking UNI’s price action is now noting that a decline towards $2.50 could be imminent.

This is where it does have some notable support that could slow its descent, and possibly spark a trend reversal.

That being said, because there are no immediate catalysts that may cause UNI’s price to rise, it is unclear as to how sustainable any short-term trend reversals may be.

Uniswap’s Token Continues Plunging as Investors Flee En Masse

At the time of writing, Uniswap’s UNI token is trading down over 10% at its current price of $2.98. This marks a notable decline from daily highs of nearly $3.40, and only a slight rebound from lows of $2.80.

The cryptocurrency is now trading at the lowest levels it has been at since its price peaked at highs of $8.50 in the days following its launch last month.

Until there are catalysts for upside, like the release of Uniswap V3 or a fee distribution proposal, it remains unclear as to whether or not UNI will be able to see any sustainable upwards momentum.

UNI Could Plunge Towards $2.50 as Technical Weakness Mounts

While speaking about Uniswap’s market structure, one analyst observed that the cryptocurrency shattered multiple key support levels throughout the course of its latest downtrend.

“UNI: Houston we have a problem. I’m still under the impression BTC will drop lower and as for alts, well you know…” he said while pointing to the below chart.

Image Courtesy of TraderXO. Chart via TradingView.

Another trader similarly stated that his gut is telling him to “short UNI till $2.5,” adding that the chart says the same thing.

Unless the entire crypto market rebounds in the near-term, it is likely that Uniswap’s UNI will continue facing inflows of selling pressure.

Featured image from Unsplash. Charts from TradingView.