Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Across crypto Twitter, analysts claim that Bitcoin price just had an extremely bullish close, but a crucial momentum measuring indicator says otherwise.

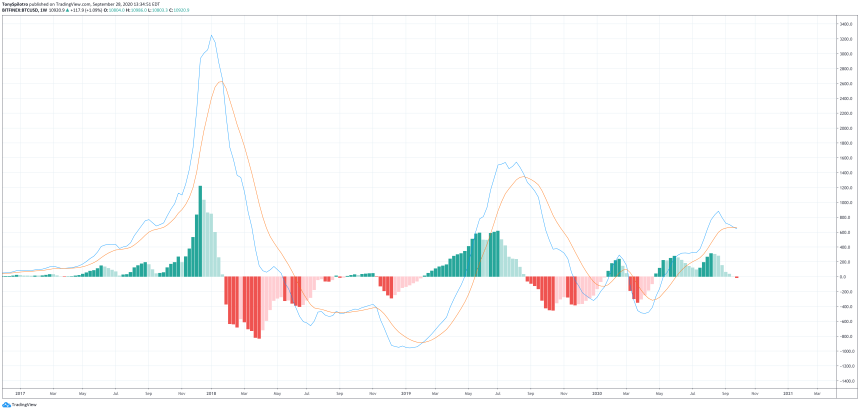

In fact, the tool just flipped bearish for the first time on weekly timeframes since April 2020, right after the Black Thursday rebound and pre-halving rally.

Bitcoin Weekly MACD Opens Bearish For First Time Since Black Thursday

The leading cryptocurrency by market cap closed above $10,750 last night, ending an otherwise bearish week on a high note.

Bulls have held on after successfully defending below $10,000 seven consecutive days before trying for higher, but have failed to set a higher high.

While things aren’t as bullish as they once were, they haven’t yet flipped bearish – until now.

BTCUSD Weekly MACD Bearish Flip First Time Since April 2020 | Source: TradingView

The weekly MACD turning bearish on Bitcoin and top crypto assets like Chainlink were uncrossed ahead of the Sunday night weekly close, but it couldn’t stop the new weekly from opening in the red for the first time since April.

Related Reading | Break of “Market Structure” Puts Bitcoin Uptrend On Thin Ice

Although bulls were able to close the week out green, a red open could be starting a bearish trend.

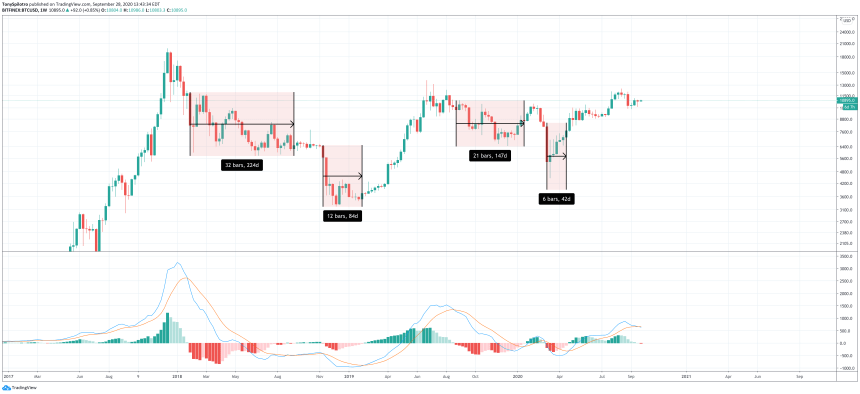

Past instances of a weekly MACD flipping red on the histogram have resulted in on average 124 days out of four different occurrences. However, things are likely not as bullish as this data would suggest.

BTCUSD Weekly MACD Bearish Crossover Past Bear Market Results | Source: TradingView

Why Flipping Bearish This Time Around May Yield Unexpectedly Bullish Results

Flipping bearish on the MACD often results in extended downside, and it is impossible to rule that out currently with the first weekly red open since April 2020. After such a long uptrend with limited pullbacks, a deeper correction is very possible.

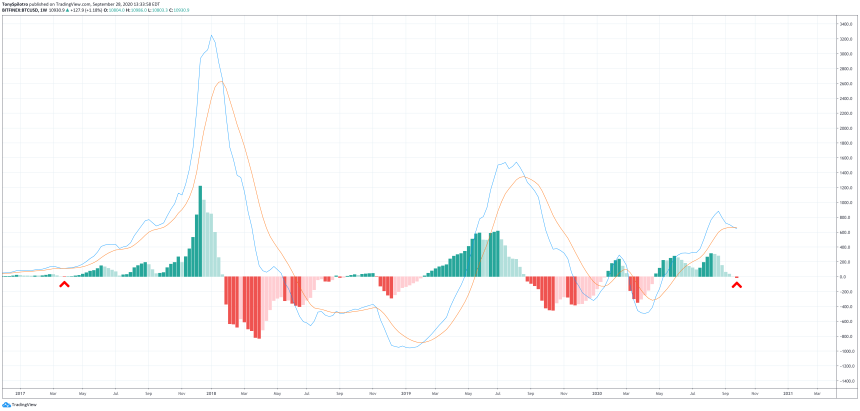

But flipping bearish on the weekly MACD doesn’t always yield bearish results. In the example below, just before the 2017 bull run kicked into high gear, the leading cryptocurrency by market cap flipped bearish for just one tick on the histogram.

BTCUSD Weekly MACD Bearish Flip First Time Since April 2020 | Source: TradingView

The MACD is a momentum measuring tool, and flipping back bullish signaled just how strong bulls had become, and that was it for the bear market. And while that’s very possible this time around, another scenario is possible.

While the above chart does show a short-lived bearish blip followed by a long run of green upside on the MACD, that might not be where Bitcoin price is at currently in its market cycle.

Related Reading | Bitcoin Descending Triangle Hints At Third Downtrend Before Bear Market Finish

Comparing the last market cycle – the most significant sample to go off of – suggests that instead of being at point B, where Bitcoin broke up into a full bull market, the crypto asset could be at point A.

BTCUSD Weekly MACD Bearish Flip First Time Since April 2020 | Source: TradingView

Point A was also a bearish MACD flip on weely timeframes but resulted in every little downside. Instead, Bitcoin price traded mostly sideways and upward for the next over 200 days.

Although another 200 days of sideways won’t be bearish on Bitcoin, it could be painful for any crypto investors expecting $100,000 or more price levels as proposed by the stock-to-flow model.

The final bear flip, however, ended the bear market for good and sent the cryptocurrency from under $1,000 to $20,000. With Bitcoin at $10,000 now, another similar rise would take the asset to $200,000 per BTC.

Featured image from Deposit Photos, Charts from TradingView