Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

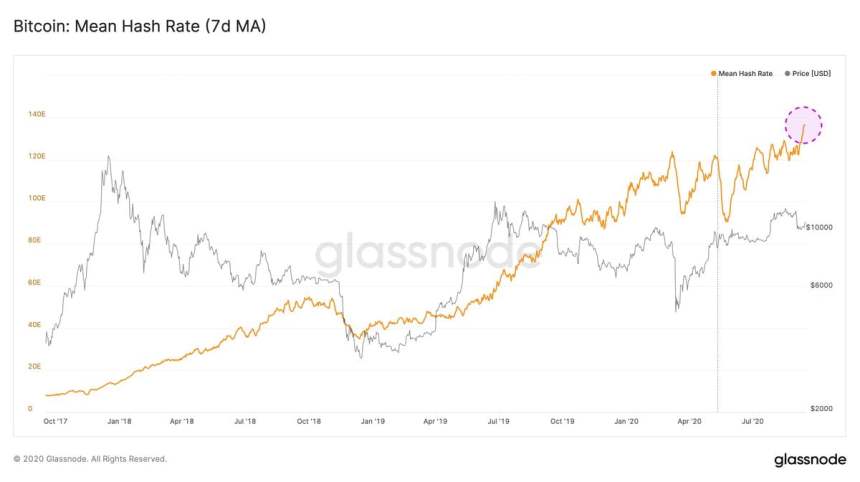

Bitcoin’s recent price turbulence has not been emblematic of its underlying strength, as the cryptocurrency’s hash rate has been plowing higher throughout the past several weeks and months, just setting another fresh all-time high.

This metric’s growth signals that demand for the Bitcoin network is incredibly high at the moment, despite many of the cryptocurrency’s detractors stating that it is being overshadowed by Ethereum.

It is true that Ethereum has seen a spike in blockspace demand like never before, but this has come about due to the inflows of users that need to use ETH to transact on decentralized exchanges.

Bitcoin, on the other hand, appears to be seeing more organic usage, which also comes as more transaction begin taking place outside of exchanges. This may come from peer-to-peer transactions, or even over-the-counter deals taking place between large buyers.

The rising demand for the Bitcoin network is what has caused its hash rate to surge. This, in turn, is leading to an imminent +11% difficulty adjustment that is slated to take place this coming weekend.

Bitcoin Transactions are Rapidly Moving Off of Exchanges

As NewsBTC reported last week, transaction data shows that users are beginning to transact with BTC at a rapid rate off of exchanges.

This means that the network is being used more widely by users, with its utility stretching beyond just being used by speculative investors who buy BTC on an exchange and let it sit there until they sell it.

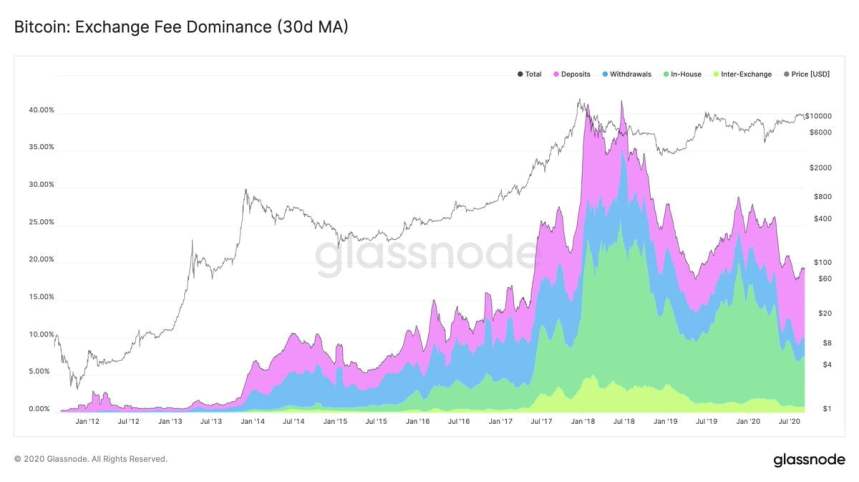

As cited within the report, Glassnode spoke about this trend in a recent tweet, explaining that exchange fee dominance shows the declining role they are playing within the ecosystem.

“On-chain Exchange Fee Dominance shows the major role that centralized exchanges play in the Bitcoin ecosystem. 20% of all miner fees are currently used for BTC txs involving exchange activity. In 2018 after BTC peaked, this number was as high as 41%.”

Image Courtesy of Glassnode.

BTC to Undergo Imminent Difficulty Adjustment

As Bitcoin’s hash rate reaches new highs, the blockchain is now about to undergo the second largest positive difficulty adjustment seen in 2020.

Glassnode also spoke about this in a recent tweet, referencing a chart showing the parabolic growth that BTC’s hash rate has seen.

“Regardless of short-term $BTC price movements, Bitcoin’s hash rate continues to climb – and to hit new ATHs. At the current rate, miner difficulty is estimated to increase by 11% this Sunday – the second largest positive adjustment in 2020.”

Image Courtesy of Glassnode.

This metric may not have any direct impact on the cryptocurrency’s price action in the near-term, but it does bode well for the asset’s fundamental outlook.

Featured image from Unsplash.