- KNC, the native token of Kyber Network – an Ethereum-based decentralized exchange, surged by circa 16.5 percent in just two days.

- The cryptocurrency’s latest jump appeared as Bitcoin rally paused below $12,000.

- Meanwhile, the KNC/USD exchange rate is trending inside a technical pattern that points to a 60 percent breakout move.

DeFi token KNC showed signs of a healthy recovery after plunging by almost 40 percent from its all-time high at $2.05.

A 60% KNC Rally Expected

The Kyber Network’s asset surged by about 16.25 percent from its session low at $1.05, a rebound that appeared as Bitcoin’s rally paused below its year-to-date high around $12,000. At its weekly high, the KNC/USD was trading at 1.608.

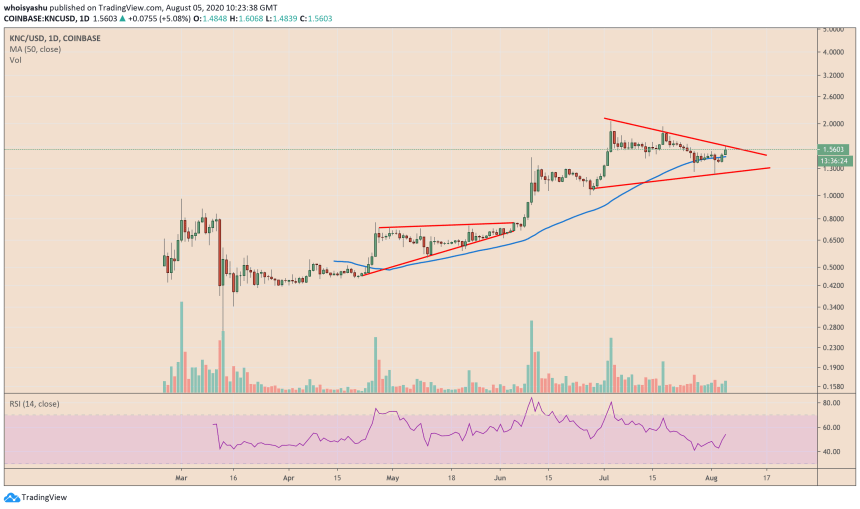

KNC/USD rebounds by 16.5 percent from its Sunday low at $1.05. Source: TradingView.com

Zooming out on the KNC’s intraday moves showed it trading inside a broader Symmetrical Triangle pattern. The range, as shown in the chart above, gets validated when an asset forms at least two lower highs and higher highs. That results in two converging trendlines meeting at an apex.

Technically, a Symmetrical Triangle is a continuation pattern. It sends the price in the direction of its previous trend. In KNC’s case, the Triangle has formed following an explosive 178 percent price rally. That means the DeFi token should continue trading higher following a breakout above the Triangle range.

Ideally, the length of the breakout action comes to be as much as the maximum height of the Triangle. In KNC’s case, it is about $1.04, which puts the cryptocurrency’s upside target $1.04 higher from the point of the breakout.

A Parallel Technical Setup: Bull Flag

Away from the Symmetrical Triangle pattern, KNC/USD is also painting a parallel technical setup: Bull Flag.

KNC/USD bull flag formation. Source: TradingView.com

The long-term upside targets for a Bull Flag setup is the same as the Symmetrical Triangle one. Here, a successful breakout should lead the KNC price higher, albeit by as much as the height of the flagpole that led to the formation of the Flag. The height of the flagpole is $1.04.

Meanwhile, the short-term price targets that could confirm an extended upside are measured per the height of the flag itself. That is roughly $0.33.

Therefore, if KNC/USD breaks above the Flag resistance, then it should log a run towards $1.95. Similarly, a breakdown below the Flag support could cash the pair anywhere between $1 and $0.735.

Fundamentals

The overall rally in the KNC market follows its protocol upgrade called “Katalyst.” It now enables the Kyber Network users to stake their KNC tokens in the KyberDAO to make changes to its network.

“Token holders who participate in this governance process will be paid in ETH generated from exchange fees which will also be redirected towards reserve rebates for Fed Price Reserve and a KNC burn (65%, 30%, 5%, respectively),” read an analysis by Messari on the Kyber Network’s new economic model.

It is possible that traders are accounting for the major upgrade in their long-term investment perspective concerning KNC. Meanwhile, it is also possible that traders merely want to speculate on booming altcoins as long as Bitcoin trades below $12,000.