Ethereum saw one of the most intense drops it has seen since mid-March yesterday, with the cryptocurrency’s price reeling from highs of $415 to lows of $300 in a matter of minutes.

This decline caught bulls off guard, as the crypto was previously flashing signs of overt strength as it pushed higher each day.

ETH’s sharp decline also came about in tandem with that seen by Bitcoin, which faced a grim rejection at $12,000 that caused its price to decline down towards $11,000.

Both assets have since recovered from their lows, with ETH’s recovery being a bit more pronounced than BTC’s.

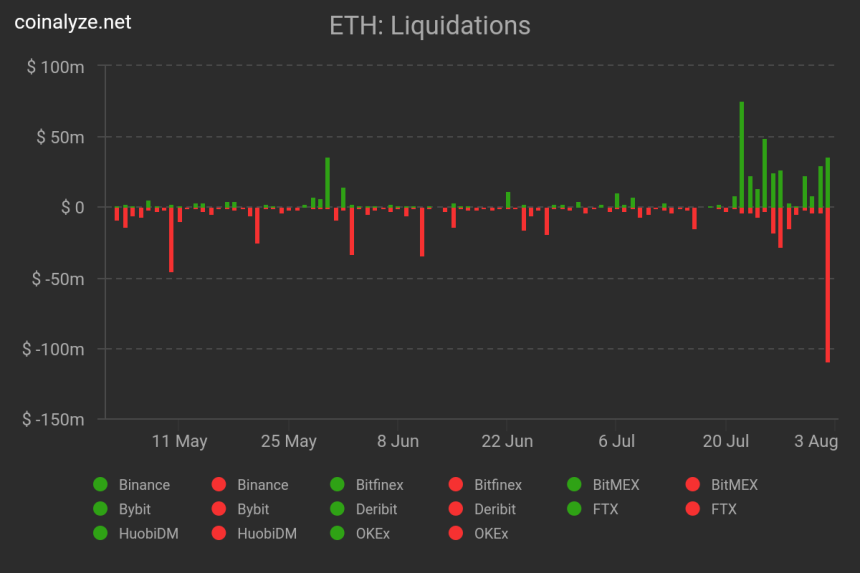

One result of this volatility has been widespread liquidation of long positions – with Ethereum bulls facing losses totaling at well over $100 million as a result of this movement.

Analysts are now noting that the cryptocurrency still appears to be strong from a macro perspective despite this latest decline.

For this strength to translate into further upside, however, it needs to surmount the resistance that has been established around $390.

Ethereum Incurs Intense Volatility as Bulls Face Widespread Liquidations

At the time of writing, Ethereum is trading down just over 4% at its current price of $370. This marks a notable decline from daily highs of $415 that were set yesterday evening.

It is important to note that despite ETH trading well below these highs, it has posted a massive recovery from its daily lows of $300 that were set across multiple major trading platforms.

The dip to these lows was fleeting but still caused bulls to face widespread liquidations.

According to data from the crypto analytics platform Coinalyze, a total of well over $100 million worth of Ethereum long positions were liquidated as a result of this selloff.

Image Courtesy of Coinalyze.

The intensity of this decline was not enough to spark a cascade of liquidations, however, which is likely due to the vast majority of ETH long positions still being profitable despite the intensity of this move.

Analyst: ETH “Still Looks Strong” as It Hovers Below Key Level

Ethereum is now trading below its recent resistance that was established at roughly $393. This could be a crucial near-term level that bulls need to capture to spark further upside.

It is important to note that one analyst believes that further upside could still be imminent despite this movement.

“Taking my chances with spot ETH. Still looks strong – and worth taking the risk of holding, IMO. The last thing I want to do is open a chart and see ETH price at over $400 knowing that I sold a $375,” he explained.

Image Courtesy of Josh Rager. Chart via TradingView.

Whether or not Bitcoin can stabilize above $11,000 could be another crucial factor that plays into ETH’s near-term trend.

Featured image from Unsplash. Charts from TradingView.