Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin is eyeing a breakout towards $12,000, according to crypto-chart analyst Josh Rager.

- The analogy appears out of Ethereum’s latest upside move from a consolidation range.

- Mr. Rager sees Bitcoin repeating the same bullish action as it trades inside a similar sideways pattern.

Bitcoin is at the cusp of hitting $12,000 in the coming sessions, according to an inter-coin fractal shared by Josh Rager.

The market analyst noted that Bitcoin is almost mirroring the recent price moves of Ethereum, the second-largest cryptocurrency by market cap. Earlier yesterday, the ETH/USD exchange rate broke out of its consolidation range.

Ethereum breaks upward of its sideways consolidation pattern. Source: TradingView.com

The pair rose by more than 6 percent from the point of the breakout.

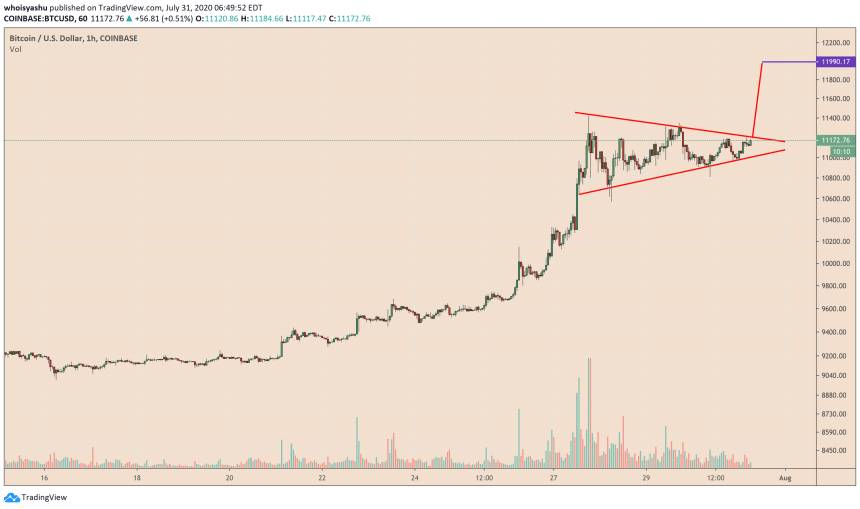

Mr. Rager spotted BTCUSD in a similar Triangle-like range. He said in a Friday tweet that the cryptocurrency could break above the pattern–just like Ethereum did– and attempt a close above $12,000.

BTCUSD price in the Ethereum-like consolidation channel. Source: TradingView.com

A Bull Triangle

The reason for Mr. Rager’s bullish Bitcoin prediction also resorted to the shape of its current consolidation pattern. It technically resembles a symmetrical triangle, confirmed by its two converging trendlines. It is a continuation pattern that typically sends the price in the direction of its previous bias.

In the current case, BTCUSD was rising before it formed the Symmetrical Triangle pattern. As a result, the cryptocurrency should ideally continue trending upwards upon breaking it. Meanwhile, the length of the breakout should be as much as the maximum height of the Triangle.

BTCUSD symmetrical triangle's upside target is near $12,000. Source: TradingView.com

That is $780, which puts Bitcoin’s next upside target close to or above $12,000.

Pullback Theories

As Mr. Rager and others eye a BTCUSD upside continuation, specific bearish setups are also waiting to pull the rugs under bulls.

For starters, the cryptocurrency continues to feel the selling pressure while trading under a long-term descending trendline. As shown in the chart below, BTCUSD’s latest rally has paused right near the same price ceiling that has been holding it from logging a full-fledged breakout since December 2017.

BTCUSD bulls remain capped under the red trendline. Source: TradingView.com

On a macro front, the latest signals show that Bitcoin may continue its upward moves in the coming sessions ahead.

The Federal Reserve’s decision to keep its interest rate near zero, as well as to continue its bond-purchasing program until December 31 may send investors looking for safety in Bitcoin, a perceived anti-inflation asset.