Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin risks plunging back towards $6,000 purely based on a historical technical setup.

- The analogy appears after switching a BTC/USD chart from normal to a more precise logarithmic scale.

- It shows that the cryptocurrency has not precisely broken above its long-term descending trendline resistance.

There is an extreme possibility that Bitcoin plunges towards $6,000 in the coming sessions, according to a historically accurate technical setup.

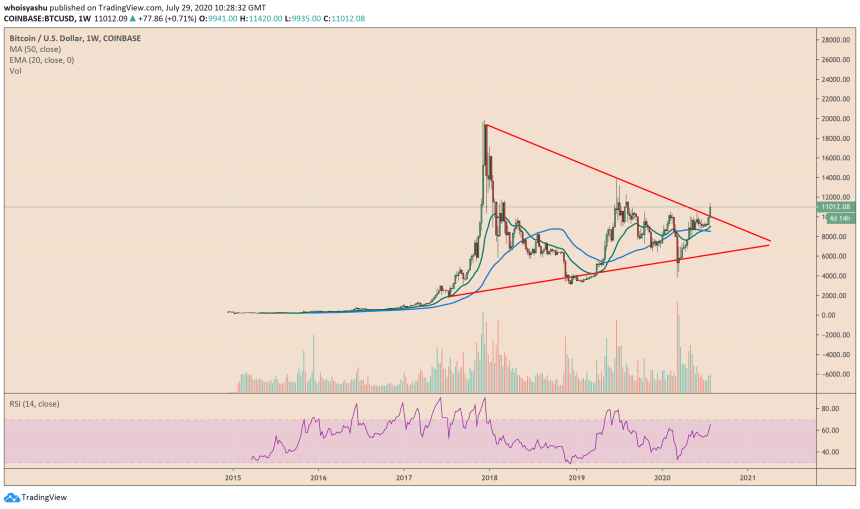

On a BTC/USD weekly chart, the pair continues to trend inside a large triangle pattern. It has been fluctuating between its two converging trendlines, unable to establish a clear breakout on each retest since 2017.

Bitcoin tests the upper trendline of the Triangle. Source: TradingView.com

As of this week, Bitcoin tested the upper trendline as it rallied above $11,000. Nevertheless, the upside sentiment failed to garner enough buying sentiment to paint a breakout move. It is similar to how Bitcoin’s previous breakout attempts flunked in July 2019, June 2019, and December 2017.

A Log Chart

A majority of traders, on the other hand, are bullish under the impression of a breakout move on a linear BTC/USD weekly chart.

In retrospect, logarithmic charts are more accurate in narrowing big price data. They also come handy when one needs to realize an asset’s percent change or multiplicative factors. The Balance explains:

“On the linear chart, all one dollar moves take up the same amount of visual space. Linear graphs have a fixed distance between price levels, while log charts have set intervals between percentage moves.”

The same Bitcoin pattern but on a normal chart. Source: TradingView.com

On a linear chart, the BTC/USD exchange rate has broken above the Triangle resistance, accompanied by a rise in trade volumes. That indicates a breakout move but without assuming the noise created by price volatility: that risks fakeout – a bull trap.

Meanwhile, the downside target on the BTC/USD weekly logarithmic chart stands near $6,000 – the lower trendline support. Therefore, failing to establish a convincing bullish move could prompt the pair to fall in the coming weekly sessions.

Macro Factors

While the technical indicators paint a bearish picture, Bitcoin may still be able to break above its logarithmic resistance owing to supportive macroeconomic factors.

At first, the cryptocurrency’s latest price rally towards $11,500 has taken cues from a falling US dollar. Second, bids for safe-haven assets– including gold–have also increased after US real yields fell below zero, leaving investors with no choice but to hunt for profits in riskier markets.

With the Federal Reserve looking to maintain its interest rate near zero and deciding to continue its bond-purchasing program until December 31, it appears people would keep buying gold and bitcoin to safeguard their portfolios from inflation.