Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

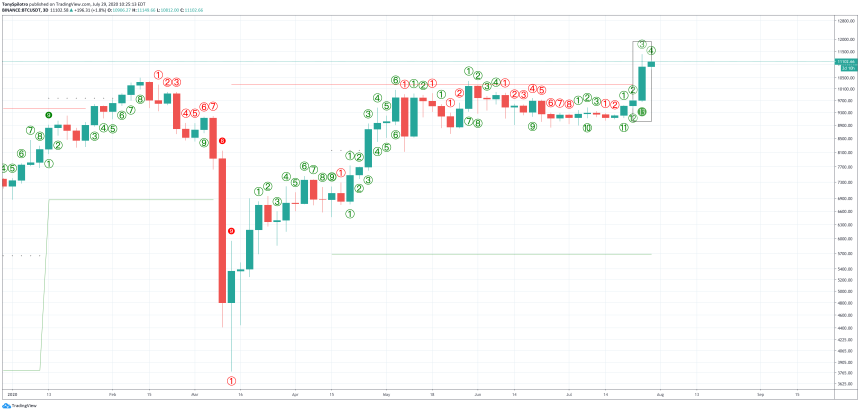

Bitcoin price this week broke up from consolidation and surged over 15% to $11,400 at the high. On one specific timeframe, the recent push through resistance has triggered a signal that the uptrend may be exhausted and therefore coming to an end.

However, in the past, the cryptocurrency kept on climbing by as much as 220% before the bullish momentum came to a halt. With this supposedly bearish signal triggering yet again, will it lead to a pullback or continued pump?

Bear Signal Triggered On Bitcoin 3D Charts, Uptrend Nears Point of Exhaustion

Technical analysis involves reviewing the price charts of various assets. Charting cryptocurrencies like Bitcoin is no different and relies on various indicators or patterns to provide signals or insight that influences strategy.

Not only do crypto analysts check current price action for such signals, but they review past instances certain signals were triggered and compare them to active market conditions. Historic recurrence is a very real phenomenon, and markets are said to be cyclical by nearly every top analyst ever.

Assets like gold, currencies, or even some major stock indices have been trading for more than a century for analysts to compare against. Bitcoin and other crypto assets, however, have roughly ten years or less.

Due to their scarcity and underlying fundamental differences, such as the relationship between miners and an asset’s decentralization, they are even more difficult to make sense of.

Related Reading | Was the Massive Bitcoin Rally Engineered by a Single Whale? Possibly

Still, several techniques have been used with much success. In the cryptocurrency market, few indicators are considered as accurate as the TD Sequential indicator.

The tool was developed by market timing expert Thomas Demark, who utilized it to spot when reversals may occur or when trends reach a point of exhaustion.

A 9 count on the indicator, results in a buy or sell setup, depending on the sequence. A countdown to 13 points to a trend becoming exhausted, or yet another point of a potential reversal.

BTCUSDT 3D TD Sequential 13 Countdown | Source: TradingView

On 3-Day BTCUSD price charts, the TD Sequential indicator reached a 13-candle countdown. And while this normally suggests that the trend is nearing a point of exhaustion, in the past, there have been some interesting results.

Looks Can Be Deceiving: Lucky Number 13 Flashing Resulted In As Much As a 220% Pump

A 13 countdown on 3-Day BTCUSD price charts can be seen in only two instances in the last four years of crypto market price action.

In the first, a 13 count appeared just over one year ago in June 2019. The cryptocurrency smashed through $9,000 and breached above $10,000 for the first time since the bear market began. The total rally was over 60% following the trend exhaustion signal.

BTCUSDT 3D TD Sequential 13 Countdown 2017 Top Fractal | Source: TradingView

Another downtrend took place, dropping Bitcoin back down to $3,800 on Black Thursday, bringing the market back to where we are today.

As strong as the 2019 example was, it is the 2017 rally that is particularly noteworthy.

Related Reading | Here’s What Surging Crypto Market “Greed” Could Say About Bitcoin’s Pump

In this instance, the same 13 countdown triggered on BTCUSD as it passed through $6,000 – a level that acted as support for most of the bear market.

After passing through that key level, Bitcoin rocketed by another 220% through $10,000 and to its all-time high of $20,000.

BTCUSDT 3D TD Sequential 13 Countdown 2017 Top Fractal | Source: TradingView

Bitcoin price is once again showing a 13 countdown on the TD Sequential across 3-Day timeframes. If historic recurrence really does exist, and the crypto market cycle is ready to start all over again, this trend exhaustion signal will result in another explosion like before.