Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

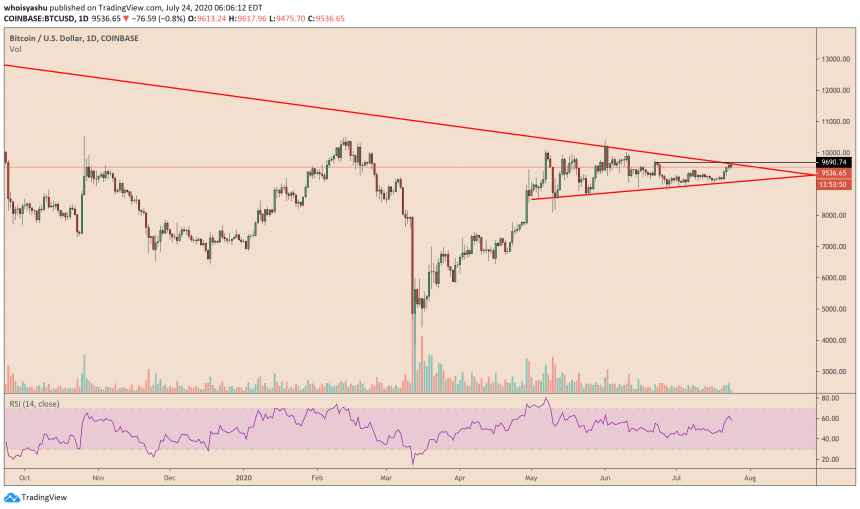

- Bitcoin declined during the Friday trading session after establishing its weekly top at $9,686.

- The downside correction appeared on rising profit-taking sentiment near $9,700, a historically strong resistance level.

- Analysts asserted that Bitcoin’s latest move is a sign of its bullish structure breaking, with one envisioning it to fall back towards $9,200.

Bitcoin stepped back from continuing its modest bull run upon facing a higher selling sentiment at its local top.

The benchmark cryptocurrency slipped by up to 2.17 percent from a weekly high of $9,686. So it seems, it fell owing to an existing profit-taking sentiment near the $9,700-mark. Daytraders looking to score attractive, short-term gains exited their bullish positions, leading to a minor price dip.

Bitcoin sells off ahead of testing $9,700. Source: TradingView.com

The area between $9,700-$9,900 has been holding Bitcoin from attempting a full-fledged breakout towards the $10,000-10,500 range. Between June 12 until today, the cryptocurrency has made eight efforts to close above $9,700, failing every time.

Bullish Structure Breaking

The fractals have prompted Bitcoin traders to take a step back from making hyper-bullish predictions. Many of them see the cryptocurrency trending inside a sideways consolidation range, with a bias shifted towards bears.

Koroush AK, a famous trader in the cryptocurrency community, said he is refraining from building “a serious long position” until the bitcoin price breaks above $9,700. He further added that, to him, the cryptocurrency’s bullish structure is already breaking with a possibility of dipping below $9,500.

Bitcoin's bullish bias under risks as the price fails to break above $9,700. Source: TradingView.com, Koroush AK

Another analyst – a pseudonymous Twitterati – narrowed his resistance target from $9,700 to $9,600, albeit repeating what Mr. AK said in his analogy.

“BTC resistance at $9,600,” he stated. “I will have to wait until we see further rejection or consolidation before I feel comfortable opening a long/short. Would love a dip that I could re-long as momentum and the trend still looks bullish.”

Teddy Cleps, another prominent daytrader, also envisioned Bitcoin inside a $9,200-$9,600 range as long as there is low volatility in the market. The cryptocurrency’s latest upside attempt did very little in raising its volatility.

Macro Bias Bullish

Away from the technical patterns, some traders also kept their focus on macroeconomic factors that more or less concern Bitcoin.

Some particularly connected the dots between the cryptocurrency and its traditional rival, gold. This week, both of them almost rallied in tandem. At the same time, Bitcoin’s growing proximity with the precious metal saw its correlation with the S&P 500 – a risk-on market – going down.

“Gold is about to break $1,900 & have a crack at $1920 all-time high,” said Alex Saunder, the CEO-co-founder of Nugget News. “If this happens I fully expect Bitcoin to make a MONSTER move through $10k printing a $1k daily candle.”

Joseph Young, a crypto-market analyst, also noted that a rise in Gold rates would eventually help Bitcoin gain traction among bulls – albeit in the long-term.

Both Gold and Bitcoin rose as the US dollar weakened, real US yields fell into a negative area, COVID-19 cases rose, and the US-China geopolitical tensions escalated.