Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

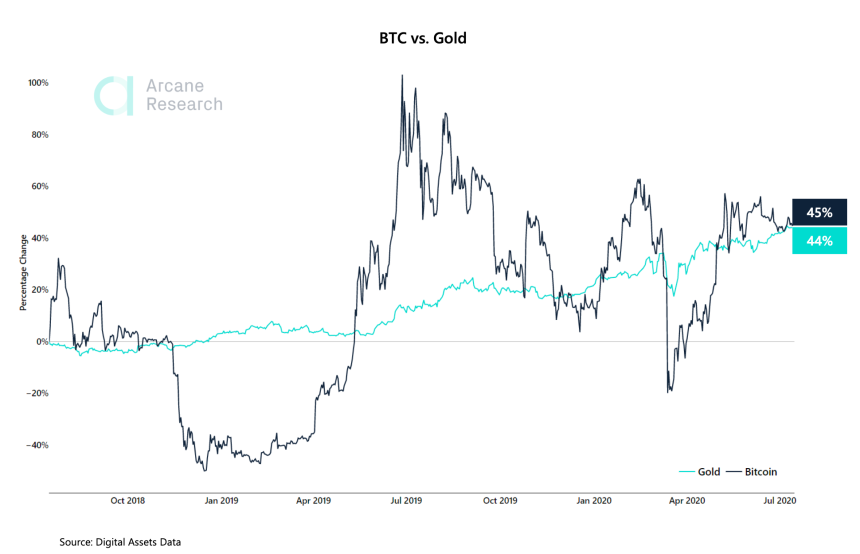

After two full years of price action, Bitcoin and gold are neck and neck in terms of return on investment. However, during the same time period, the leading cryptocurrency by market cap experienced wild price swings while gold stayed stable and steady.

Has the wild ride along the way tarnished the cryptocurrency’s safe haven narrative?

Can Bitcoin Live Up to The Digital Gold Standard?

The global economy is struggling. The dollar’s reign is being challenged for the first time since it took power nearly 100 years ago.

The Federal Reserve printing money at a whim to attempt to prevent further economic collapse has thus far proven effective. The stock market has had a V-shaped recovery, and several stocks have set new record highs since Black Thursday.

But the economy is still on thin ice, and the flood of newly printed fiat currencies has created an environment where hyperinflation will take over.

Related Reading | Are Altcoins Silver To Bitcoin As Gold? Unusual Correlation Discovered

Gold is among the few assets that have continued to shine through the recent darkness. When the economy is struggling, investors move capital into gold to protect from losses. It has long been used as a safe haven asset for this very reason.

The precious metal is also used as a hedge against monetary inflation due to its scarce supply. Bitcoin is said to share such qualities due to its fixed, 21 million BTC supply.

But when comparing price action between the two assets over the last two years, it is difficult to call Bitcoin a safe haven asset next to gold.

BTCUSD Vs XAUUSD: Two Year Performance of Safe Haven Asset Compared

BTCUSD is currently trading at $9,000, roughly $4,000 lower than the high set in 2019, and approximately $6,000 above the low. Throughout the last two years of price action, Bitcoin has had several wild price swings, over 50% collapses, and record-breaking rallies.

XAUUSD, however, has taken a slow and steady approach, generating consistent and sustainable gains over the last two years. It is now testing highs not seen since the Great Recession, and a break could lead to a new all-time high.

Yet at the end of the two years, both assets are trading at roughly 45% up from the start of the timeframe. Bitcoin gets the slight 1% edge, but for that meager boost, investors would have had to ride a rollercoaster of price action.

Related Reading | Gold Aims For Decade Highs, Safe Haven Surge May Also Boost Bitcoin

Gold investors, however, were able to feel safe in their haven, keeping their capital protected and growing steadily.

Bitcoin, on the other hand, experienced wild volatitly that made the asset ideal for traders, but a hard pill to swallow at times for investors.

With the two assets neck and neck, Bitcoin will need to prove itself here and rise in the face of economic turmoil. If it doesn’t, and gold continues its rise, the idea of digital gold acting as a safe haven like its physical counterpart, may be tarnished forever.