Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto staking on the Matic mainnet went live just over two weeks ago. On launch, Matic co-founder and CEO, Sandeep Nailwa took to Twitter to boast of the incredible 150% annual yield available for early adopters.

In few hours @maticnetwork community has staked around 6.68% of circulating supply of Matic. The current annual yield stands at around ~150%

Happy staking guys !! pic.twitter.com/X9yErope3E— Sandeep AggLayer. polygon 💜 (@sandeepnailwal) June 29, 2020

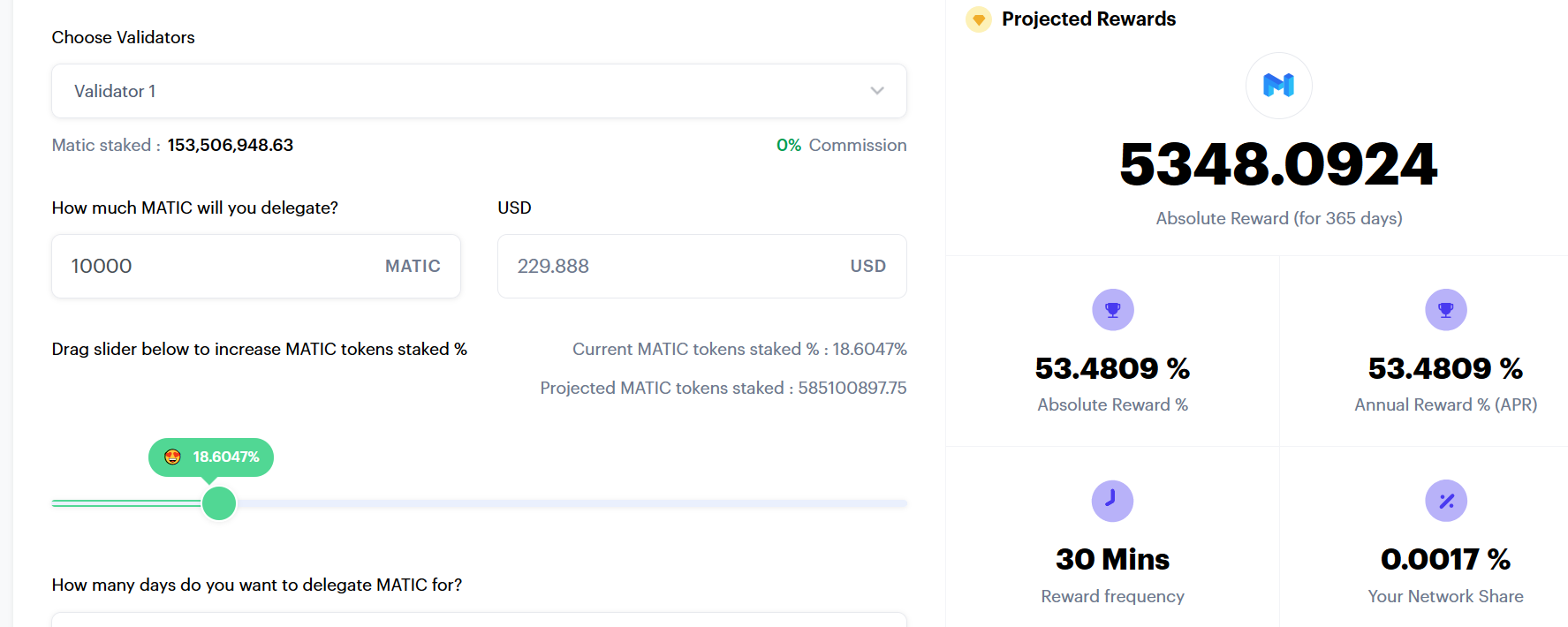

Since then, as more token holders have come on board, the annual yield has dropped to 53%. This will drop further as the current percentage of tokens staked grows from its present level of 18%.

Source: wallet.matic.network

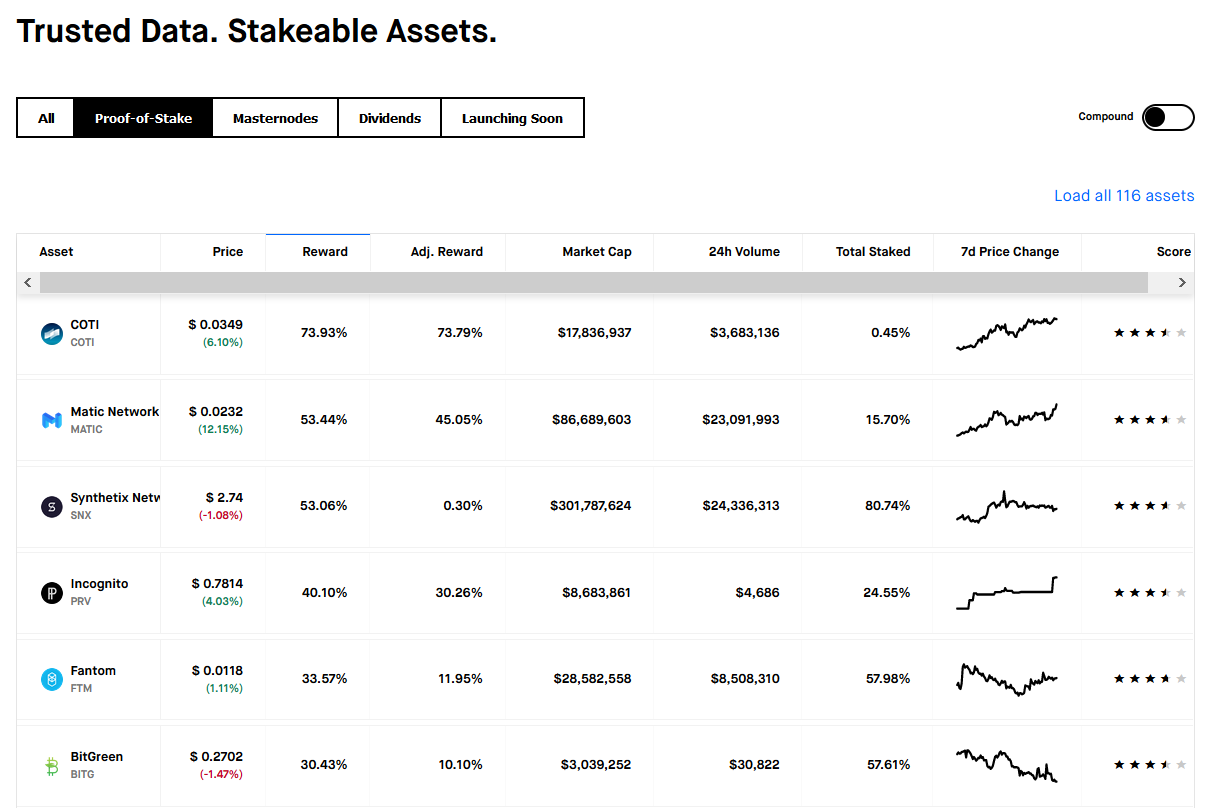

Market analysis shows Matic currently generates the second-highest reward yield in the industry, behind COTI.

However, the fundamentals of Matic, including market cap and volume, are all superior to that of the market leader.

Source: stakingrewards.com

Notable staking protocols readying for launch include Cardano, which will be available from August 18th. Also, Binance backed mid-cap offering Elrond roll out their mainnet with staking on July 30th.

With that, the buzz surrounding staking, as well as DeFi in general, is generating huge excitement over the potential of cryptocurrency as a means to financial independence.

Matic Staking is Live

In a recent blog post, Matic demonstrated just how easy staking on their network is. The process starts with an ERC20 compatible wallet such as MetaMask or WalletConnect. Token holders use the wallet to log into the Matic Staking Dashboard.

From there, it’s a matter of navigating to the staking tab and choosing a validator. Following confirmation in the wallet, staking will be live after 12 block confirmations (approx 5 minutes.)

At present, there are seven validator nodes, all of which are run by the Matic Foundation.

However, as previously mentioned, the next stage of development will incorporate external third-party validators.

https://youtu.be/ZWBAb7Xx-Kw

The protocol distributes rewards every 30 minutes, and users have the option to redelegate rewards earned for the compounding of staking rewards.

Community Feedback

So far, community feedback has been generally positive. One user drew attention to the gains being much better than that of his bank.

My bank pays 5% for the "year"…well…..why would I not stake all my $matic 💥💥💥

— Anarchy! (@life_cool) June 29, 2020

But being a pioneer has its drawbacks. For one, staking on the Matic network requires users to lock up their tokens. Once staked, the Matic tokens are under the full control of delegators, and not the original token holder.

Recent changes meant the “unbonding” period (from a delegator) was cut from 19 days to 9 days. But when compared to Cardano, whose protocol will allow users full control of their staked ADA, the Matic protocol seems somewhat dated.

As well as that, Matic staking requires users to hold ETH to pay for gas fees. Not only is a gas fee incurred to pay to stake tokens, but redelegating rewards earned also draws additional gas fees.

The charges are relatively negligible, plus users can opt for slower confirmation times to reduce costs. But as gas fees fluctuate, this system highlights the protocol’s susceptibility to third party instances outside of their control.

Nonetheless, as demonstrated by Matic, as well as other projects, staking can and does work in the real world.

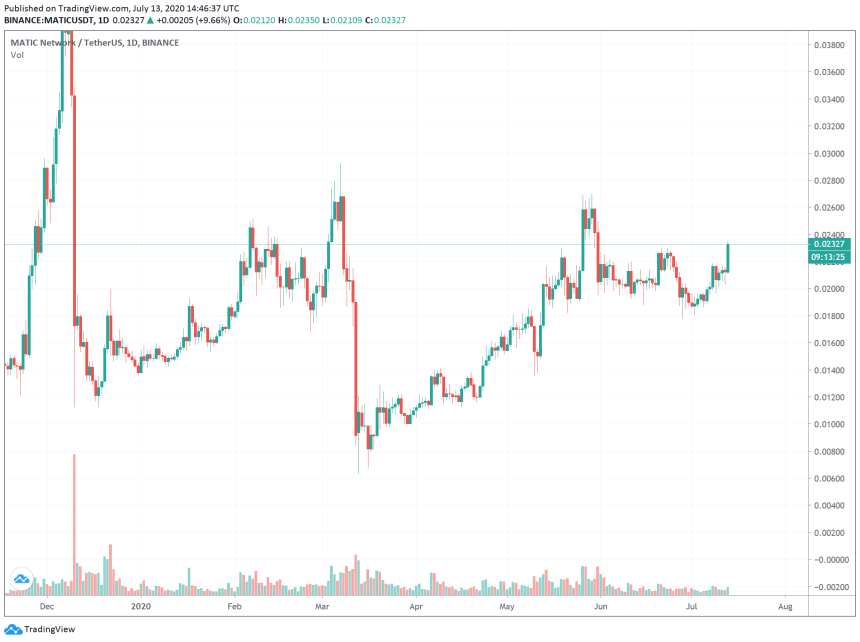

The price of Matic Network against USDT. Source: TradingView.com

And with the trend towards proof-of-stake protocols, this movement will only get bigger.