Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Just months ago, in March, many thought Bitcoin was on its way out. The cryptocurrency registered a 50% drop in a single 24-hour period in March, falling as global markets imploded.

BTC miners followed suit, shutting down their machines en-masse because they weren’t profitable.

But just three and a half months later, network data shows that Bitcoin is fundamentally stronger than ever.

Related Reading: 43% of Crypto Twitter: BTC Will See 1,000% Yearly Returns Again

Bitcoin Mining Difficulty Is About to Rocket to a New High

As NewsBTC has covered over recent days, the hash rate of the Bitcoin network is surging in spite of the stalling market.

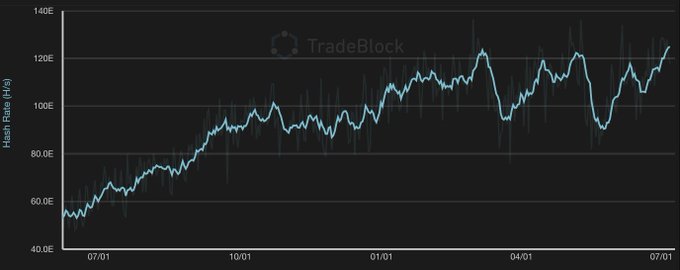

Crypto data firm TradeBlock reported on July 7th that the seven-day moving average of the measure hit an all-time high above 124 exahashes per second. For context, that’s double what the hash rate was at one year ago and 1,000% higher than the hash rate at Bitcoin’s $20,000 high.

Chart of Bitcoin's hash rate over time from TradeBlock (@Tradeblock on Twitter)

Bitcoin’s network difficulty, which regulates how fast blocks are mined, is expected to follow suit. Pseudonymous quantitative analyst “PlanB” said on the matter:

“Despite death spiral FUD, miner capitulation FUD, future manipulation FUD, corona, PlusToken FUD, Tether FUD, whales selling FUD etc… BTC just had its third-best quarterly close ever ($9.1K) and is heading for difficulty ATH Monday (17E12).”

This comes on the back of an influx of investments by cryptocurrency miners across the world.

The Vancouver-based HIVE Blockchain Technologies announced on July 6th that it has purchased 200 of Bitmain’s newest mining machines. The company intends on activating those machines sometime in the upcoming three weeks.

Core Scientific, an American-based blockchain and artificial intelligence hosting provider, made an even bigger investment. Per Forbes, the company obtained 17,595 new Bitmain Antminer S19s, which purportedly represents the largest-ever shipment of such machines to the U.S.

Bitcoin’s mining ecosystem is also being benefited from it being the summer rainy season in China. Because crypto mining is centralized in China, specifically in river regions where hydroelectricity is prevalent, increased rainfall leads to cheaper power.

How Will It Affect Price?

Analysis by a digital asset manager suggests that the health of Bitcoin miners is somewhat correlated with BTC’s price action.

In December, the investor, Charles Edwards revealed a model indicating that BTC’s price has long been influenced by the power consumption of the underlying network.

His latest analysis of the data suggests that Bitcoin is trading around 25% under its energy value, now at $12,800.

With miners continuing to activate new machines and farms, Edwards’ analysis suggests Bitcoin will rally to and potentially past $12,800.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Following BTC's Hash Rate, Network Difficulty Is About to Set a New High