Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

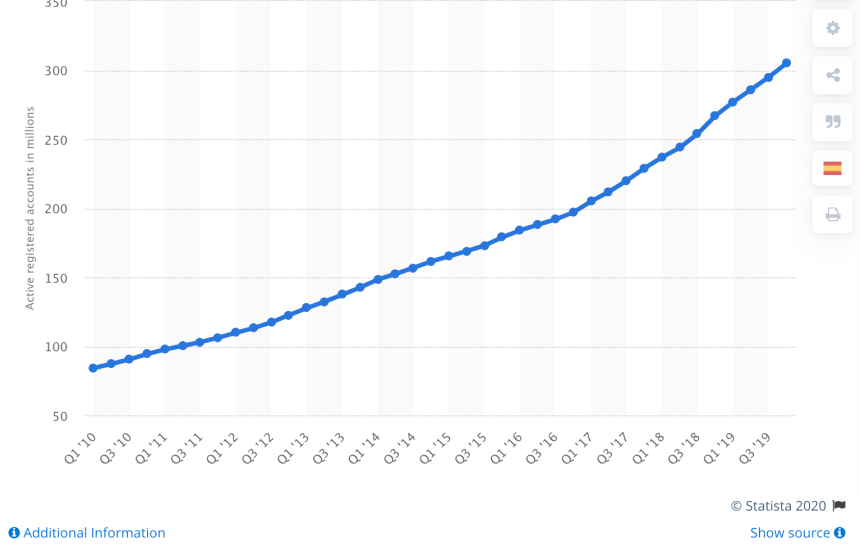

An over 300 million active register accounts on PayPal highlights just how important digital scarcity is to Bitcoin’s value.

The enormous installed userbase suddenly having access to cryptocurrencies could be a major boost to adoption. We’ve done the math to see how the numbers add up and the type of impact that is possible.

PayPal Rumored To Be Exposing 305 Active Users To Cryptocurrencies

Yesterday, rumors began circulating about a potential move by PayPal and Venmo to support Bitcoin and other cryptocurrencies.

Discussion over the potential impact of the payments processing giant may have on cryptocurrency adoption has spread like wildfire.

According to data, there are over 305 million registered and active user accounts on PayPal today. This number is only bound to grow and has steadily since the company was first founded in 1998.

PayPal became synonymous with the online auction website eBay in the late ’90s and early ’00s. Later, the two businesses separated.

Related Reading | Rumored PayPal and Venmo Crypto Support To Provide Big Boost To Adoption

PayPal also recently acquired popular payments app Venmo, further growing its install base of users. The company’s CEO recently told the media that it plans to aggressively grow user accounts of the app to 52 million this year.

The significance of exposing a substantial userbase to Bitcoin and other cryptocurrencies cannot be understated.

But for those that don’t quite understand the impact, comparing these figures to Bitcoin’s maximum supply can be eye-opening.

Simple Mathematics Highlights The Potential Impact on Bitcoin Supply and Demand

Bitcoin was designed to be digitally scarce, making the asset a hedge against inflation. Although a mechanism exists that unlocks new BTC to incentivize miners to keep the network churning, the max number of Bitcoin will never increase.

Only 21 million BTC will ever exist. There aren’t enough for the number of millionaires in the world to one 1 BTC each. And if the entire global population of 7.8 billion people all wanted Bitcoin, there’s only enough of the cryptocurrency for 0.0026 BTC to be equally distributed.

21 million BTC distributed equally across just PayPal’s 305 million users alone, would only amount to 0.068 BTC per user.

Even Venmo’s goal of 52 million users by the end of 2020, spread out evenly wouldn’t even make for half a Bitcoin per user.

Related Reading | Bitcoin Stock-To-Flow Model Updated To Account for Satoshi’s 1 Million BTC

But as we’ve learned from the dollar, wealth is rarely distributed evenly. Wealthy individuals are bound to buy up the lion’s share of the asset, making it even more scarce through demand.

With even more BTC lost forever due to forgotten private keys or deceased users, the supply may even smaller than thought.

As much as 1 million BTC is said to be held by wallets related to the asset’s creator. Satoshi Nakamoto is suspected to be deceased, and those 1 million BTC may never be accessed again.

The entire max supply of Bitcoin also won’t be fully mined until the year 2140, making the current circulating supply that much more limited.

While the PayPal news may indeed be significant for hastening adoption, Bitcoin’s digital scarcity itself is where the asset’s true value is found.