The beginning of the month was quite chaotic for Bitcoin and those trading it.

On June 1, the flagship cryptocurrency was able to slice through the $10,000 resistance level for the first time since mid-February. But a few hours later, BTC plummeted by more than $1,000 in less than five minutes.

The wild price action resulted in more than $240 million worth of long and short positions liquidated on BitMEX alone.

Since then, the price of Bitcoin was able to stabilize, and it is currently consolidating within a narrow trading range defined by the $9,450 support and $9,900 resistance level. However, data shows that large investors are once again accumulating BTC.

If history repeats itself, this could be a sign that the pioneer cryptocurrency is poised for a bullish impulse.

Bitcoin Whales Fill Up Their Bags

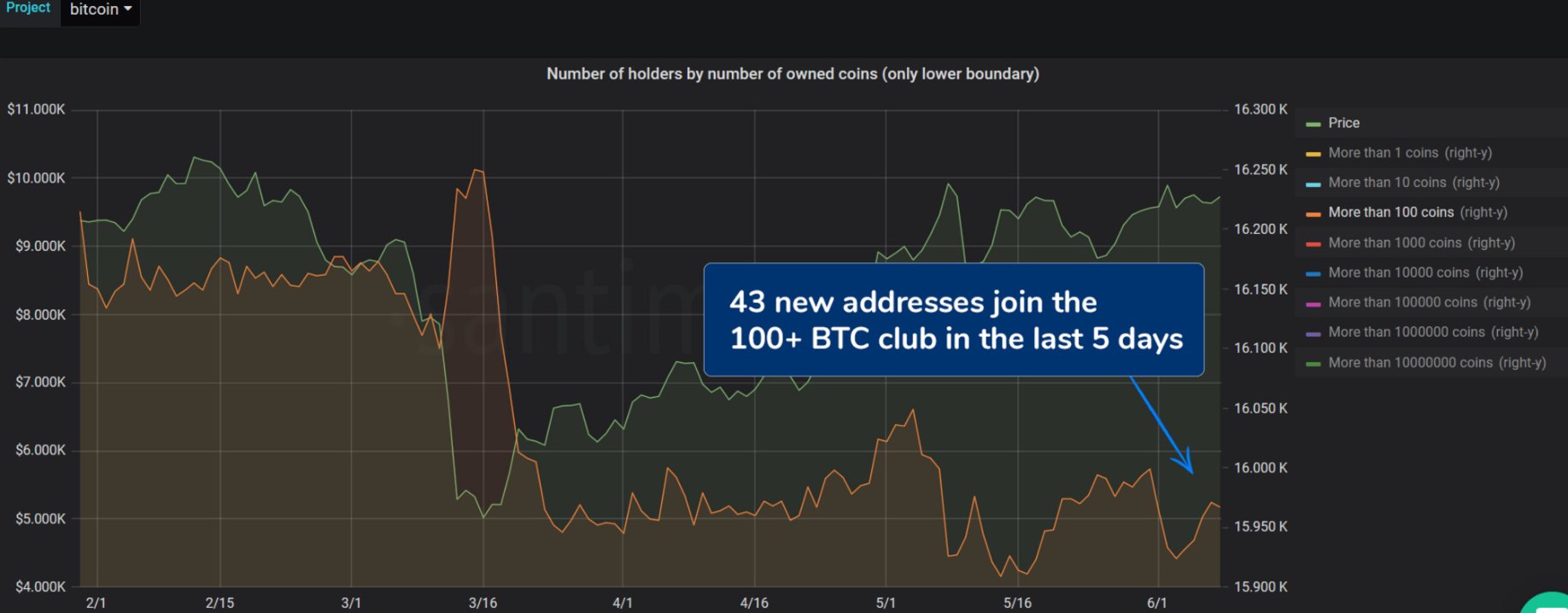

Santiment, a behavior analytics platform, recently pointed out that the number of addresses with millions of dollars in Bitcoin, colloquially known as “whales,” is trending up.

The on-chain data provider affirmed that the number of wallets holding more than 100 BTC has been rising for the past week despite a considerable correction it suffered at the beginning of June.

“After declining to start the month, the number of addresses holding more than 100 Bitcoin has been on the rise over the past 5 days, with 43 new addresses joining the 100+ BTC club,” said Santiment.

Data from the past few months reveals that a growing number of BTC whales has led to short-term price rallies. The enormous holdings of these large investors allow them to have a disproportionate impact on prices. They can coordinate buying and selling activity and manipulate the market at their will.

If history repeats itself, Bitcoin may be on the cusp of an upswing.

Strong Support and Weak Resistance

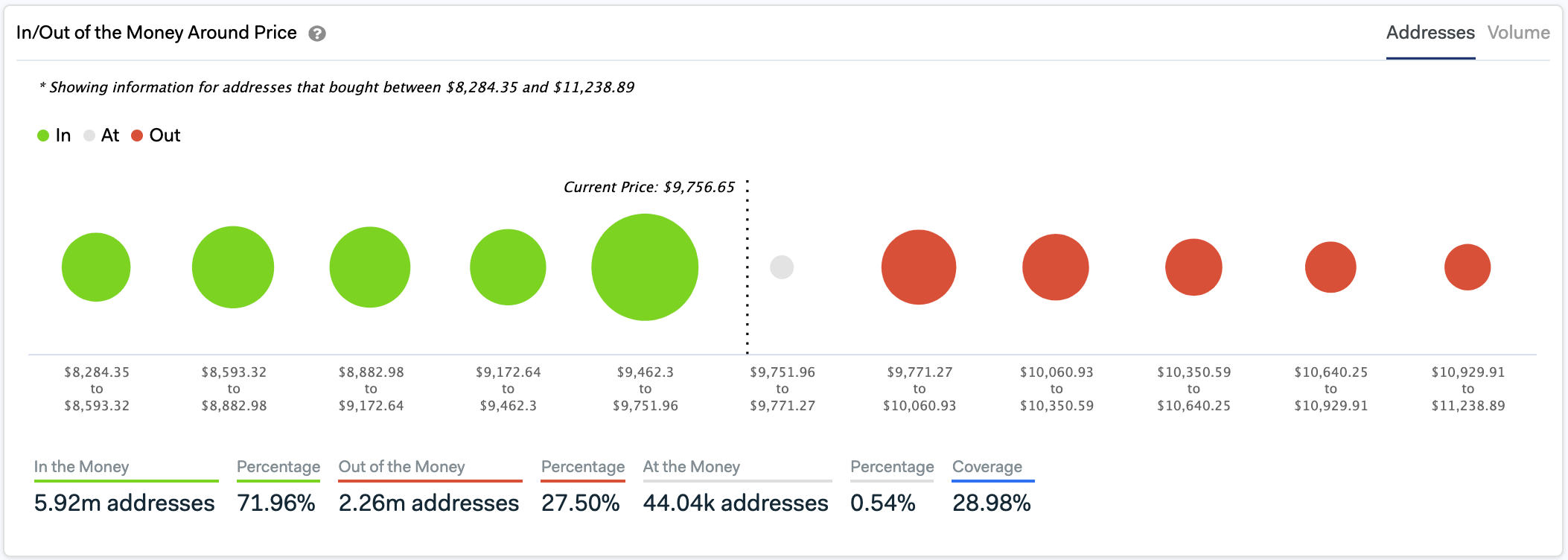

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model adds credence to the bullish outlook. Indeed, the bellwether cryptocurrency currently sits on top of a massive supply barrier that may absorb any downward pressure.

The IOMAP cohorts reveal that 2.23 million addresses bought nearly 1.5 million BTC at an average price of $9,640. As such, the $9,460-$9,750 price level could contain Bitcoin from a steeper decline in the event of a correction.

On the flip side, the most significant resistance wall to pay attention to sits between $9,770 and $10,060. Here, roughly 833,000 addresses purchased 570,000 BTC.

An increase in demand that allows Bitcoin to break above this supply barrier may have the strength to send it towards $12,000 since there aren’t any significant hurdles between these price points.

It remains to be seen whether support or resistance will break first to determine where the flagship cryptocurrency is headed next.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt