Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

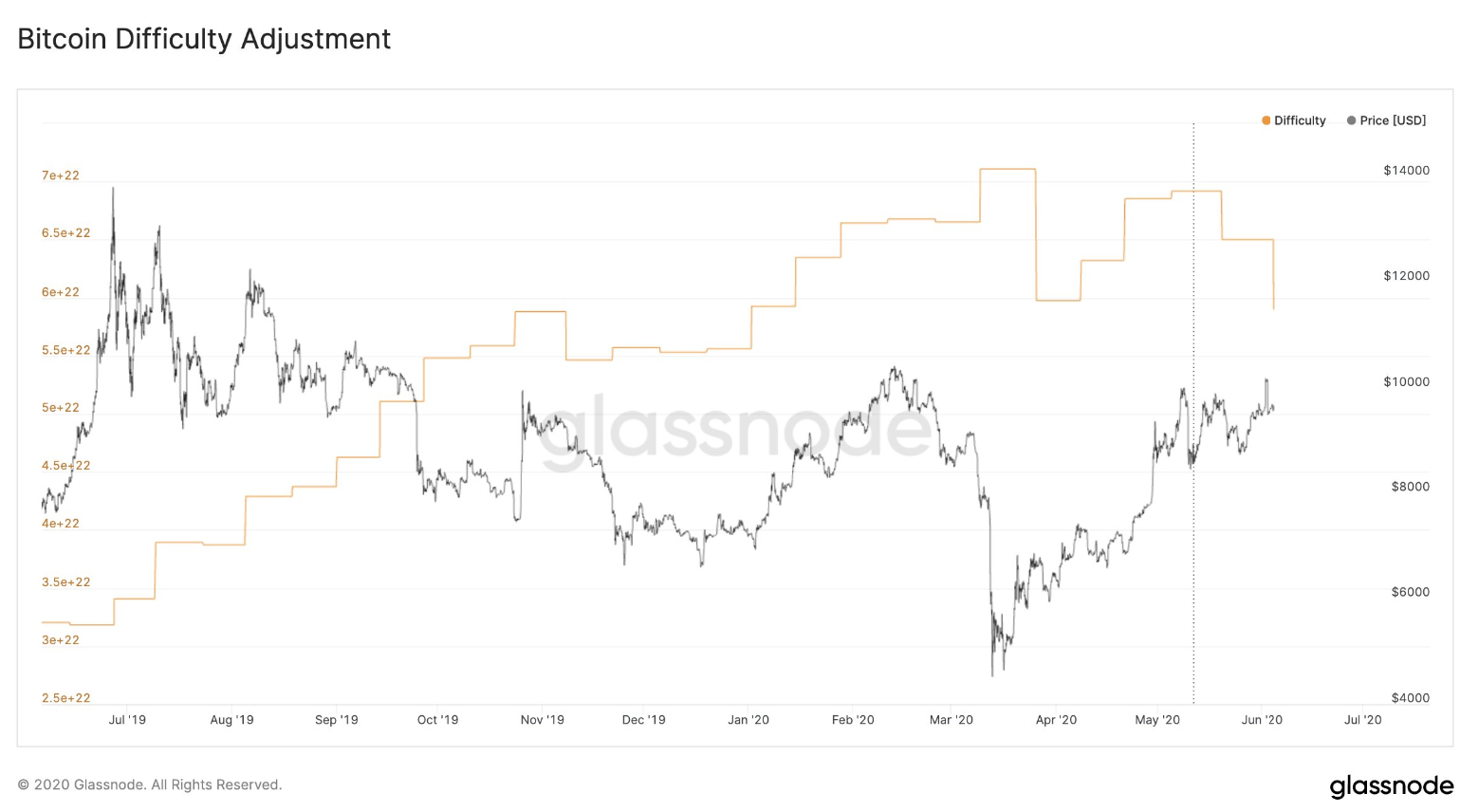

The Bitcoin blockchain saw its mining dificulty adjust downwards on June 5. It has now become easier to mine BTC. Historical data shows that price and mining difficulty has elements of positive correlation.

That being so, a drop in mining difficulty could signal an incoming drop in price. And given Tuesday’s brutal rejection at $10.4k, which saw BTC fall 11% in a matter of minutes, all eyes are on what Bitcoin will do next.

Bitcoin mining difficulty drops -9.29%

data: @glassnode pic.twitter.com/ONEy2PaQU9

— unfolded. (@cryptounfolded) June 4, 2020

Inefficient Bitcoin Miners Are Being Squeezed

2020’s most talked-about event to date was the Bitcoin halving. Now the dust has settled, and we’ve undergone a month or so of reduced supply, what has changed?

To begin with, many inefficient miners were forced to turn off their machines, which led to an immediate fall in hashing power on the Bitcoin network.

But according to Blockware Solutions, operators of the older Antminer S9s, who have access to cheap electricity, can still afford to stay afloat. They estimate that S9s are still a sizable force, making up as much as 30% of the network.

On that note, Blockware Solutions CEO, Matt D’Souza made the point that there’s a delicate balance between BTC price and the running of older mining equipment. He said the post halving price will determine whether the remaining S9 operators will be eventually forced out altogether:

“If Bitcoin is below $9,000, then margins will be poor for miners. If Bitcoin remains at $7,200, then many miners will need to shut off. It will likely be about 27%–35% of the network if Bitcoin remains below 9,000 for several weeks post-halving.”

The Difficulty Adjustment Happened Yesterday

However, one saving grace for S9 operators was the downward difficulty adjustment that occurred yesterday on the BTC network.

Mining difficulty gets adjusted every 2,016 blocks, or every two weeks, in what is a self-sustaining process.

By assessing the time it took to create the previous 2,016 blocks, an overly efficient block production increases difficulty. Whereas taking longer than two weeks, to produce the 2,016 blocks, triggers a difficulty adjustment downwards.

Analysis of data from Glassnode shows some correlation between price and difficulty. For example, in November 19, the start of a downtrend was followed by a drop in difficulty. This was also the case more recently in late February 20.

Yesterday saw a 9% drop in difficulty, the second largest fall in 2020. But what’s unusual is that the previous two examples, in November 19 and February 20, had the price starting to downtrend before the difficulty adjusted downwards.

This time around, we are still in an uptrend, as evidenced by previous higher lows on the price chart.

The only conclusion to draw at the present time is that the correlation between price and difficulty is not a strong one. This is especially evident from June 19 to November 19, when falling price coincided with rising difficulty, the opposite of expectation.

However, given Bitcoin’s unpredictability, as well as the uncertain macro outlook, we should all brace for the unexpected.