Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

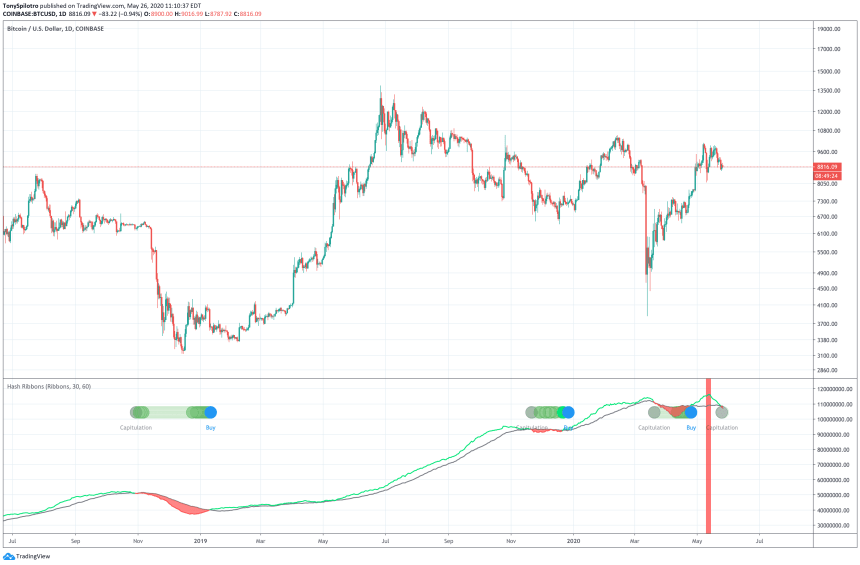

Bitcoin‘s hash rate, a measure of the amount of processing power fueling the cryptocurrency’s underlying blockchain protocol, has fallen to a low beyond the levels seen following the Black Thursday market collapse aftermath.

Does this mean yet another, more severe selloff is possible in the day and weeks ahead?

Bitcoin Hash Rate Falls To Levels Below Post-Black Thursday Devastation

Black Thursday is a day investors and traders won’t soon forget. The jaw-dropping crash in Bitcoin and other cryptocurrencies wiped out more than half of their valuations.

The stock market, commodities, and more suffered just as bad, and even safe-haven precious metals took a major hit.

Markets, including Bitcoin have since recovered nearly to former highs set in early February before the outbreak reached pandemic levels.

Related Reading | Spot-Driven Retail Selling Sparked Sunday’s Bloody Bitcoin Selloff

Following the collapse, Bitcoin’s hash rate reached a 2020 low due to miners turning off their expensive, energy-consuming mining machines until the cost per BTC became more profitable. The price of the first-ever cryptocurrency fell so low, miners were better off buying the asset instead of running their math-crunching machinery.

Miners capitulating due to low prices made perfect sense at the time, with Bitcoin price trading below $4,000 temporarily. But why then, has Bitcoin’s hash rate plummed to a new 2020 low – one that’s even lower than the post-Black Thursday rate drop?

BTC Miners Shutting Down Expensive Machinery Could Fuel a Severe Selloff

According to data from Blockchain.com, Bitcoin’s hash rate has fallen to a new 2020 low, beyond the drop seen following Black Thursday this past March.

Bitcoin’s hash rate has been on a steady incline for much of the asset’s existence. Since the crypto hype bubble, it has grown exponentially.

The only major collapses since the bubble back in 2017, was just ahead of Bitcoin’s historic collapse from $6,000 to its current bear market bottom at $3,200 per BTC. This happened beginning in October, but price later responded mid-way through November 2018.

A smaller decline occurred in late 2019, but Bitcoin’s hash rate set an all-time high after that. Black Thursday created the next largest drop on record, until now.

The impact of Bitcoin’s halving may be starting to unfold. High prices and retail FOMO following a retest of lows pushed Bitcoin price high enough to delay what seems to be the inevitable capitulation of miners.

Coinciding with the largest yet drop in hash rate, the hash ribbons indicator is also signaling capitulation. This happens when the cost of producing each BTC falls below the expense in energy costs that miners must pay to run their machines.

What hasn’t yet occurred is Bitcoin price responding to the reduction in hash rate. Miners shutting down their machines are either waiting for prices to fall to turn them back on, or worse, are closing down for good.

Related Reading | Bitcoin Hash Ribbons Indicate Post-Halving Miner Capitulation Has Begun

While weaker miners leaving the network to more efficient miners is the healthiest for the network and the most ideal conditions for the next uptrend, it could cause a short-term selloff of extreme severity.

Given how sharply the hash rate has dropped to a level even deeper than Black Thursday, it is possible that Bitcoin price will also see a deeper drop and set a new 2020 low.