Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

All across the crypto market, altcoins like XRP and XLM have been going on massive surges, and Bitcoin has once again reclaimed $8,500.

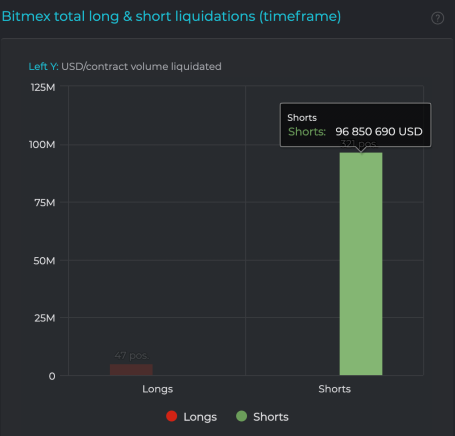

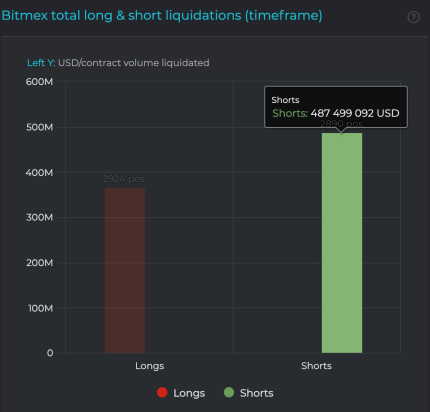

However, the latest crypto rally isn’t positive for every market participant, as the pump has liquidated over $95 million in shorts on BitMEX today alone, and over the last month has amounted to nearly $490 million worth throughout the course of April 2020.

Over $95 Million Worth of Bitcoin Positions Liquidated Today Alone, $490 Million For the Month

The crypto market is on fire, now that Bitcoin has broken through nearly every overhead resistance it had between it and $10,000.

The leading crypto asset by market cap found itself retesting bear market lows surprisingly, as it was caught up in the Black Thursday selloff fueled by the coronavirus.

Related Reading | Sell Bitcoin in May and Go Away? Ominous June Event Could Cause Crash

It fell to under $4,000, then rapidly found its way back at over $8,500, where the asset is currently trading at.

On its way up to current levels, overleveraged traders using margin on the crypto trading platform BitMEX, have been liquidated left and right. Both shorts and longs suffered, but as of today, shorts took an exceptional beating, with over $95 million in short liquidations today alone.

The number pushed the grand total for the month to nearly $490 million. And with a day to go, the number could continue to balloon to $500 million if Bitcoin continues to pump.

Why Crypto Traders Shouldn’t Try to Short The Top of the Current Rally

As if the numbers alone didn’t prove that shorting the top of a crypto rally was dangerous enough, there are additional factors that make doing so an especially risky move.

Shorting the top in crypto is the opposite of “knife-catching” the bottom, just in inverse. There are enormous profits to be made by doing this, but it can also lead to substantial losses as these traders have learned the hard way.

When Bitcoin is especially bullish, short positions are used as fuel to “short squeeze” and cause Bitcoin price to trend higher and higher. This carries the entire crypto market higher.

Related Reading | Altcoins Could Get Crushed By BTC Halving Volatility, Here’s Why

This is exactly what caused the epic rise in mid-2019 that took Bitcoin to over $13,000.

Adding fuel to the fire is the market is currently overly bearish due to the continued coronavirus fears. This could be causing more shorts to stack up, further setting up the perfect storm for a short squeeze.

Past recessions have shown that the market rebounds and stays positive for longer than most would expect. This time is likely no different.

Bitcoin’s halving also provides more bullish momentum that could keep the short liquidations coming until crypto traders finally give up and start to hold on for dear life instead.

Featured image from Pixabay