Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Days of consolidation under $7,800 culminated an explosive move on Wednesday, which resulted in Bitcoin rallying from $7,700 to $8,400 within 12 hours’ time — an uptrend of nearly 10%.

Bitcoin has seen an initial rejection at $8,400, a level of technical importance stretching back months, but it has held up well thus far at $8,300 just 60 minutes after hitting $8,400.

This resilience the cryptocurrency has seen thus far suggests bears were pushed out of their positions, and are staying out of their positions.

Bitcoin Is Becoming a Buyers’ Market

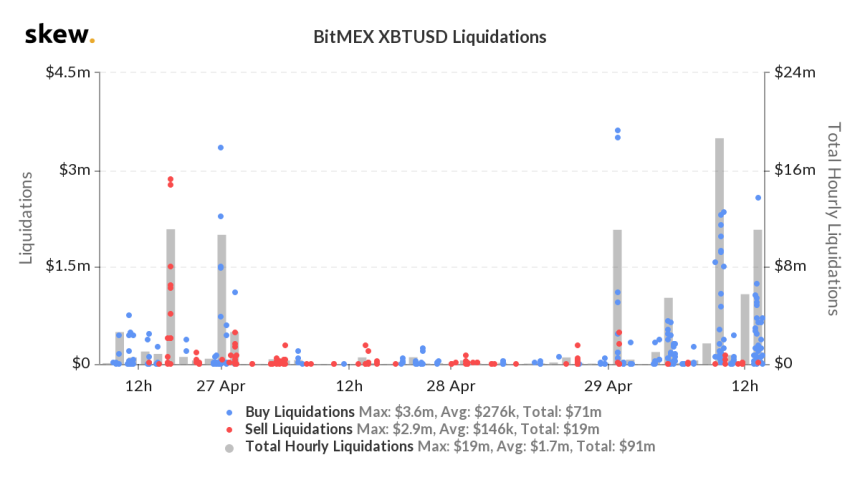

Per data from Skew.com, which tracks crypto derivatives markets, just over $40 million worth of BitMEX short positions were liquidated in this controlled rally higher. Although a large sum of money, explosive moves in the BTC price liquidated many millions more over the past few weeks.

With BitMEX’s data also registering a decrease in BTC-denominated open interest since the drop began and a series of positive funding rate prints, it would suggest that Bitcoin is becoming a buyers’ market, boding well for its trajectory.

A crypto trader explained this concept quite well when he wrote the following in the wake of BTC tapping $8,400:

“I think that OI not rising here much with BTC is actually more bullish when taken in context with how it has regained these levels. […] There can still be a big herd rush of momentum when sidelined players catch up.”

Related Reading: The Odds Bitcoin Sees an Exponential Spike Are “Rapidly Increasing”: Here’s Why

Trend Flip Bullish as Technical Resistances Fail to Hold

Bitcoin’s ability to retake the levels it has in rapid succession have brought the cryptocurrency past key historical resistance levels, adding to the growing bull case.

As one crypto trader shared, the $7,800-8,100 zone was “bears’ last stand” due to the confluence of the following resistance levels in that region:

- The 200-day simple and exponential moving averages

- The yearly volume-weighted average price

- The 61.8% Fibonacci Retracement of the $10,500 2020 top to $3,700 bottom.

- The 21-week simple moving average

- A so-called “orderblock” (or block of sell orders)

- And the origin of the March 12th and 13th crash that brought BTC as low as $3,700

Now above these levels, Bitcoin has much less overhead resistance to worry about.

It’s important to point out that the cryptocurrency will need to register a daily close above $8,100 to begin the process of invalidating these resistance levels.

This positive technical occurrence comes as Bitcoin’s block reward reduction has just become two weeks away. Although the bullish narrative around the halving has recently been questioned by analysts, the arrival of the event could catalyze an influx of BTC buying pressure.

As reported by NewsBTC on an earlier date, there’s data from Google Trends and from on-chain analytics companies to suggest that the Bitcoin halving is causing new investors to enter the industry and old investors to accumulate more coins.

Photo by Gabriel Gurrola on Unsplash