Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As fears over the coming economic recession continue to mount, demand for gold continues to surge. And as mining operations have frozen due to the coronavirus outbreak, there’s a recipe for dwindling supply that could have an astronomical impact on the asset’s value in the months ahead.

The surging demand and lack of supply, however, has resulted in the rapid growth of digital versions of the precious metal. And we’re not talking about Bitcoin – it’s Tether’s version of digital gold as well as other stablecoin competitors who are taking advantage of the gaping hole in the market that currently needs filling.

Coming Recession Sparks Demand For Gold, Coronavirus However Cripples Supply

At the start of March, coronavirus concerns reached peak panic, causing a massive selloff of all asset types, including gold, Bitcoin, and the stock market.

Records were broken for the steepest collapse in decades across most assets, while newer, speculative assets like Bitcoin and other cryptocurrencies were decimated in the collapse.

Gold, however, absorbed the impact better than most assets and has already reclaimed highs prior to the selloff.

Related Reading | No Haven Safe: Silver, Gold and Other Precious Metals Nosedive Alongside Bitcoin

Gold has been used in trade for thousands of years, has been historically used as a currency, store of wealth, and a flight to safety for capital during a time of crisis.

One of the biggest crises the world has ever witnessed is here, and now is the asset’s time to truly shine – no pun intended.

The glittering and glistening precious metal may be used in ornate jewelry and to show off success, it’s also used to protect capital from the impact of inflation during economic downturns.

Due to the asset’s limited supply, its value remains relatively stable and often increases during recessions.

That limited supply, while can have a dramatic effect on increasing the asset’s price, is also causing issues now that mining operations have ceased or slowed due to lockdowns related to the pandemic.

It’s caused many banks to struggle to deliver physical bars to investors. To fill the hole left by this supply shock and the growing demand for gold, Tether, and Paxos – two competing stablecoins – have launched digital tokens representing ownership over physical gold.

Stablecoin Tether Satisfies Need With Digital Token Representing Physical Bars

With investors are struggling to gain access to physical gold, Tether or Paxos version of digital gold isn’t just the next best thing, it’s all-around better than physical gold.

The biggest benefit Bitcoin has as the digital gold counterpart over the precious metal itself, is the fact that it only exists digitally and therefore can be easily transferred from owner to owner, or wallet to wallet.

Related Reading | Crypto Analyst: Digital Gold Narrative Out The Window Amidst Crisis

However, these actual versions of digital gold represent physical gold bar allocations that can later be redeemed for physical gold bars so long as the investors hold at least 1 gold bar’s worth of the tokens.

Digital versions of the precious metal can more easily be broken down into smaller demonizations as well, encouraging more small-time investors to dip their toes into the asset.

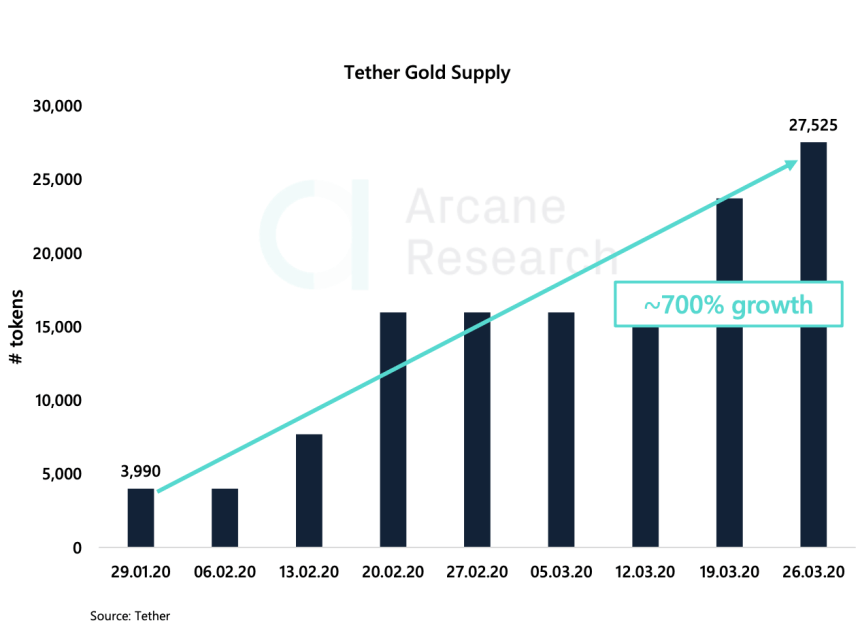

The demand for this type of asset has exploded during the coronavirus outbreak.

Tether launched its XAUt token in January 2020 and has already grown its supply to over 30,000 tokens or over $48 million in market cap.

And with the recession not even really getting started yet, and the supply of gold likely not set to increase until after quarantines end, demand for the digital gold Tether tokens will only continue to increase from here.

Featured image from Shutterstock