Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Last week, Bitcoin plummeted from $7,500 to $3,800 at the extreme point of the low, as a result of a coronavirus panic-induced selloff combined with a liquidity crisis and potential DDoS attack on BitMEX that created a cascade of liquidations driving the price of Bitcoin down at a rapid rate.

But rather than clean up their act, strange price action continues to take place on the Bitcoin-based margin trading platform. In the latest shenanigans, the price of Bitcoin futures wicked all the way to $8,700 before falling back down to normal prices. When will the issues on BitMEX end?

Bitcoin Futures Wick Hits $8,700 on BitMEX, While Normal Prices Trade Below $7,000

BitMEX has long been the king of the cryptocurrency space, in terms of overall trading volume and impact on the overall market.

The platform’s open interest and funding rates often can have an effect on the price action taking place in the crypto market, and some of the market’s top traders reside there. Or at least they did.

Related Reading | Brutal 25% Bitcoin Crash Liquidates $0.5 Billion In BitMEX Longs

Following a cascade of liquidations last week, which BitMEX blames on orchestrated DDoS attacks, the platform nearly drove the price of Bitcoin down to zero, until the plug was pulled. Almost immediately, the price per BTC began to bounce on spot exchanges like Coinbase.

After the event, large-size traders are too fearful to trade there, resulting in empty order books compared to the days leading up to the event.

Don't mind me, just going to wick to 8.7k$BTC pic.twitter.com/JdyC0XJ2Vb

— Hsaka (@HsakaTrades) March 20, 2020

These empty order books may have caused a massive wick to $8,700 on the platform’s Bitcoin September futures contracts this morning. Meanwhile, Bitcoin price was actually trading at around $6,800 at the time, with a high of $7,100 where the wick occurred.

Wicks like these hit the stops of traders causing a cascading effect much like what happened when non-stop liquidations caused Bitcoin price to collapse last week. Price action like this has become synonymous with BitMEX.

Has a Liquidity Crisis Dethroned the King of Crypto Trading?

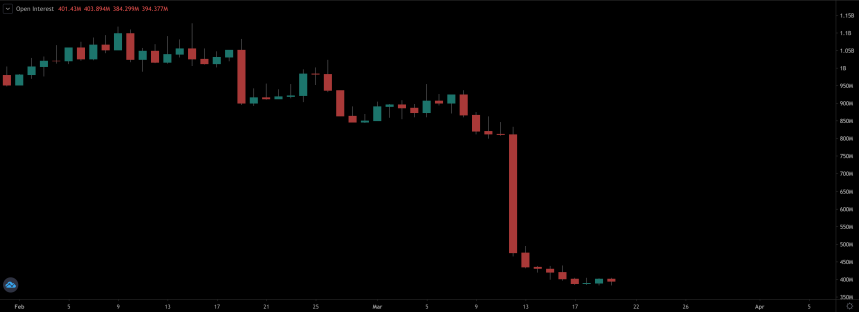

According to data, the lack of confidence in BitMEX corresponds with an extreme drop in the platform’s open interest (pictured above), suggesting that either traders have left the cryptocurrency market, of have found homes elsewhere outside of BitMEX.

The platform has long dominated the Bitcoin trading volume across the cryptocurrency industry, by offering long and short positions and up to 100x leverage on crypto trading. But with continued issues plaguing the platform and an investigation from the CFTC, traders may have finally had enough.

Related Reading | Cryptocurrency Exchange Order Books Are a Ghost Town, Data Shows

And with the likes of Binance and even Coinbase recently adding margin, and the rapid growth and proliferation of high-leverage competitor margin trading platforms, BitMEX must clean up its act for risk losing its leadership position. Although, it may already be too late for that, given the drop in open interest.

Featured image from Shutterstock