Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

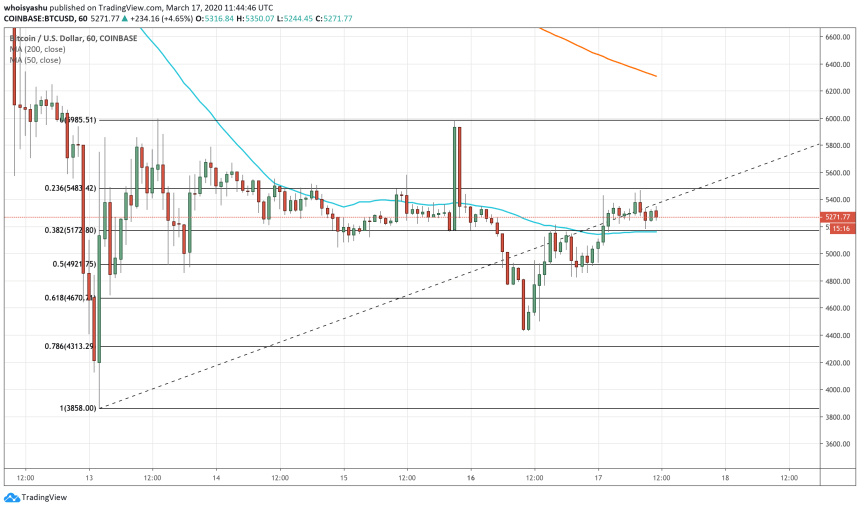

Bitcoin traded higher on Tuesday following a severe sell-off that saw its prices plunge by circa $900 at the start of this week.

The benchmark cryptocurrency jumped to intraday high of $5,466 from its weekly low, up 23.34 percent as traders hunted for short-term profits. The move upside quickly followed a weak pullback into the European morning session, bringing price about $200 lower.

Bitcoin’s upside moves followed a similar recovery in the US stock futures. According to CNBC pre-market data, the Dow Jones Industrial Average could open Tuesday about 400 points higher.

Nevertheless, the Wall Street Journal reports that the US stock futures are jittery as their volatility has now reached a two-year high, per the Cboe Volatility Index. Bitcoin, which has formed a short-term positive correlation with US stocks, could, therefore, follow stocks heading into the US session.

$BTC exhibiting bullish price action due to anticipation that the markets will give some relief today and be in the green. Pre-market futures are higher over night.

— Satoshi Flipper (@SatoshiFlipper) March 17, 2020

Coronavirus Remains the Leading Indicator

The paring of bitcoin’s gains showed how traders remain unconvinced with its short-term price rallies amidst the escalating Coronavirus pandemic. The cryptocurrency earlier this month fell to its 12-month low as big investors liquidated it to keep their money in cash. While a 40 percent recovery ensued, bitcoin’s medium-term bias turned bearish.

Coronavirus has plagued more than 182,000 people and killed about 7,000 more across the world. The pandemic has led the government to lock down cities, causing an economic blunder on the international supply chains, local businesses, consumer spending, as well the corporate earnings that contribute to the global economy’s health.

Analysts warned that the Coronavirus pandemic is pushing markets into a recession. As a result, investors are selling part of every asset they held, relating to stocks, commodities, and even bitcoin. Much of the capital is now going into cash, which is clear in the upside performance of the US Dollar Index over the last two months.

The US dollar index reached a three-year high as investors worried about the global coronavirus outbreak are moving their money into the safe-haven greenback https://t.co/ZZVK5xBD3X

— CNN (@CNN) February 22, 2020

That has prompted all the major assets to move in the same direction. Even gold, which serves as a hedge against stock market crashes, is down 4.16 percent on a week-to-date basis.

Bitcoin Analysis

George, a popular market analyst, remained cautious of a spillover anytime even as bitcoin rebounded impressively in the last 24 hours.

The Twitterati posted a graph showing two scenarios for the cryptocurrency. In the first, bitcoin was shown heading towards and above the $6,000-resistance level. In the other, it posed risks of an extended downside action towards $4,700, as shown below.

“Broke above the weekly open,” said George. “I’m out of my short hedge. Seems like we’ll see some upside. Not going to long this. Not my setup. Watching the highs for a potential short play.”

The analyst added that he would enter new short positions if the price breaks below $5,200.

At the same time, analysts with long-term views said it does not matter when one buys the cryptocurrency, stating that it is poised to head higher once the Coronavirus pandemic settles.

“Despite a ~50% drop, most Bitcoin addresses remain untouched,” noted Bloqport. “This implies that those who bought simply to trade or for short-term profit have been squeezed out. Those remaining are long-term believers with high time preferences. This is incredibly bullish.”