Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) has been able to post a notable rebound today that has allowed it to recoup some of its recent losses, with bulls stepping up and propelling the cryptocurrency back into the $8,000 region following its recent dip to lows of $7,700.

This has led the aggregated cryptocurrency market to post some decent gains, with many major altcoins climbing 5% or more as analysts eye further short-term upside.

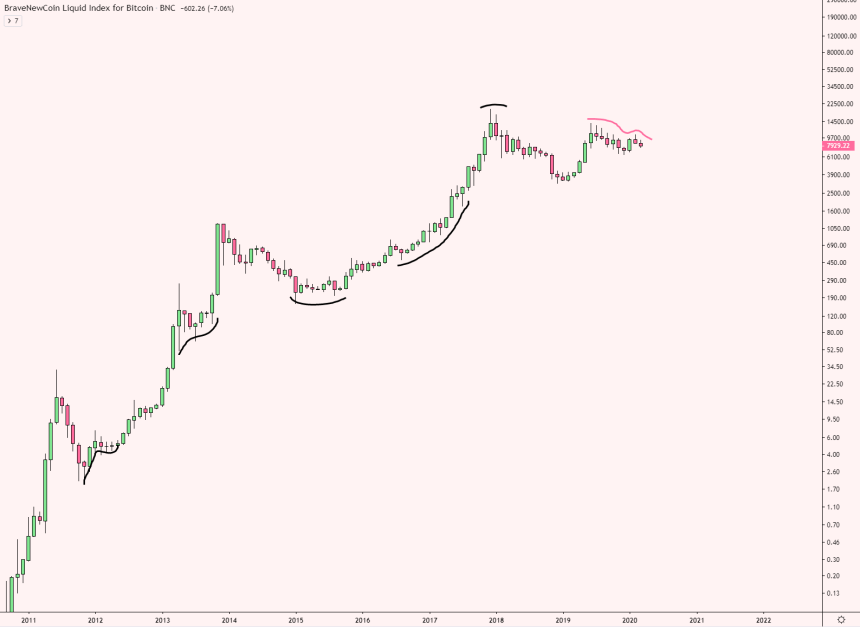

In spite of some near-term bullishness, one top trader is noting that Bitcoin appears to have entered a “new era” – as its price action from a macro perspective is showing signs of unprecedented bearishness that hasn’t been seen before in its history.

Bitcoin Sees Short Term Upside as Bulls Recapture Key Technical Level

At the time of writing, Bitcoin is trading up roughly 4% at its current price of $8,100, which marks a notable climb from daily lows of $7,600 that were set at the bottom of yesterday’s intense selloff.

It appears that the strong support that the cryptocurrency has established at $7,700 is enough to stop it from seeing further downside, as its recent rally past $8,000 came about shortly after bulls posted a strong defense of this key level.

One other important factor to consider is that Bitcoin has been able to recapture its 4-hour EMA, which is a bullish sign that may allow it to climb higher in the hours ahead.

“Bitcoin 4 hour EMA re capture,” popular analyst Big Cheds explained while pointing to the chart seen below.

$BTC #Bitcoin 4 hour EMA re capture pic.twitter.com/EYTGCv11L1

— Cheds (Trading Quotes) (@BigCheds) March 10, 2020

BTC May Be Entering a New Era of Immense Bearishness

One interesting trend to keep in mind is that Bitcoin’s price action seen in the time following its 2017 bull rally has been some of the most bearish seen in the cryptocurrency’s relatively brief history.

MoonOverlord – a well-respected analyst and trader on Twitter – pointed out the striking change in BTC’s macro market structure in a recent tweet, pointing to a chart elucidating the differences between its recent price action and that seen following parabolic cycles in years past.

“Feels like were in a new BTC era, price action above $9-$10k being stifled and sold heavy, all wicks to the upside. Historically dips, and a majority of wicks were to the downside, feels like that has flipped, especially in this newest structure,” he explained.

The size of Bitcoin’s market is likely one factor that has changed its macro price action, but it is important to keep in mind that a continuance of this bearish price action could lead it to see a notable selloff in the months ahead.

Featured image from Shutterstock.