Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin holds above a key support level of $9,000 amidst growing demand for safe-haven assets.

- The cryptocurrency is eyeing a break above $9,500 to confirm a medium-term bullish bias.

- Rising cases of Coronavirus in the US has led investors to withdraw from equities this week. Gold and bonds have inched higher, meanwhile.

The last couple of weeks saw an intense selling action in both equities and safe-haven markets, including bitcoin.

When the US stock indices plunged to their record lows, the market also saw gold and bitcoin heading to lower prices. Experts noted that traders liquidated their positions to safeguard themselves from the rising Coronavirus epidemic in the US. They dumped both risk-on and risk-off assets to go into either cash or bonds.

However, some analysts also believed that investors will come back to the safety of traditional hedging assets like Gold if the equity market keeps underperforming. While the Federal Reserve tried to rescue stocks by introducing an emergency rate cut of 50 point basis, the strategy didn’t do enough to investors’ risk-on sentiment.

The reason is simple: rate cuts can offer liquidity to an ailing financial market, but they cannot promise to cure the real problem: the Coronavirus pandemic that has so far taken 12 lives and infected 200 others in the US – and the numbers keep rising.

Bitcoin Jumps At Last

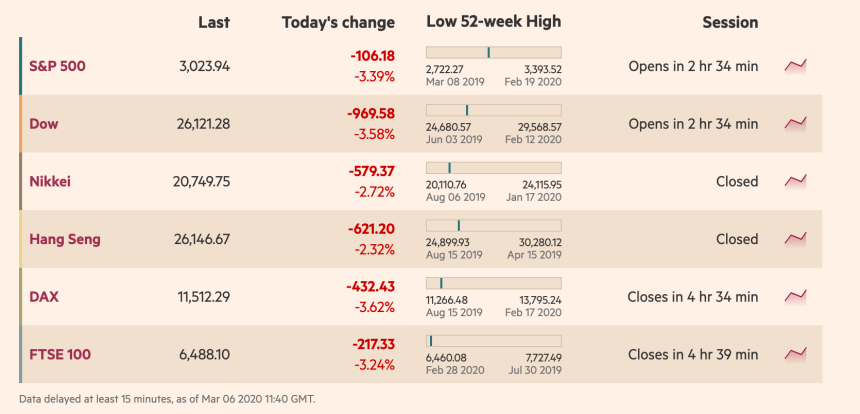

On Thursday, all three US indexes – the Dow Jones, the Nasdaq, and the S&P 500 – plunged by 3 percent at the closing bell. Futures linked to these markets also hinted fresh declines into the Friday’s market open. The vast sell-off in equities has prompted investors to seek back safety in hedging assets.

At the same time, the bitcoin price is rising. The benchmark cryptocurrency on Thursday surged by 3.53 percent to close above $9,000, level traders perceived as a crucial technical resistance. Heading into Friday’s global session, it maintained its gains, allowing analysts to predict an extended rally towards or above $9,500.

Mihir, an India-based crypto trader, said $9,500 is a key breakout level for bitcoin. He added that the cryptocurrency’s into the current week was, so far, good, noting that the trend may continue to borrow sentiments from the global markets.

“I see the impact [of] the US equity market in the last 4 days. It’s reflecting S&P 500 moves,” Mihir stated on Friday.

Traditional Safe-Havens Inch Higher

Dumping sentiment in stock markets has also pushed gold towards setting up its best week in a decade. The bitcoin’s traditional rival surged two days in a row to bring its week-to-date gains up by 6.28 percent. Its wild move upside further validated what a menace Coronavirus has become for financial markets.

That is further visible in the yield on long-term US government bonds. On Friday, the benchmark 10-year Treasury dipped by 0.8 percent for the first time ever, proving that investors are moving into low-risk assets – and that any effort of the Fed to contain the Coronavirus panic is not working.

Meanwhile, analysts are hopeful on bitcoin to protect investors’ capital until the virus continues to pressure the financial market. According to Ran Neu-ner, the founder and CEO of Onchain Capital, a crypto investment and advisory business, the offbeat asset has the best fundamentals around it that could attract investors in the short-term.

I’m doing maths on the price of Bitcoin, but I haven’t done maths since school – help me..

BTC price = China printing money + Fed lowering rates + South Korea legalization + global equity sell off + Corona virus + negative interest rates + long overdue correction + India

— Ran Neuner (@cryptomanran) March 6, 2020

Bitcoin was trading at circa $9,141 at the time of this publication, up 0.74 percent into Friday.