Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s and Ethereum’s strong surge to kick off 2020 has caught many traders aback. Case in point: each leg higher in the price of BTC during January and February was marked by dozens of millions of dollars worth of short liquidations on margin trading platforms like BitMEX.

While the majority seem to have been caught off guard, one trader called the crypto market’s then-emerging uptrend: Tyler “Sawcruhteez” Coates. Just a day after New Year’s Day, the prominent trader claimed that Bitcoin was starting to show signs it was forming a textbook Wyckoff Accumulation and Spring pattern. The pattern, Sawcruhteez suggested, implied BTC was going to hit $9,200 in the middle of January.

Now, he thinks ETH is preparing to explode higher.

Top Analyst: Ethereum Could Soon Surmount $300

Sawcruhteez recently noted that the second-largest cryptocurrency, ETH, is showing clear signs that it has recently bottomed and is preparing to reverse higher to new local highs from here: the price recently bounced off a two-month-long uptrend that has supported the steep rally, while crossing above key exponential moving averages.

This, he claims, gives the cryptocurrency the potential to rally 50% to 2019’s high of $360 in the coming months.

$ETH at $232…don't mind if I do 🙂 pic.twitter.com/Xyck92SjCQ

— Tyler Coates (@Sawcruhteez) March 5, 2020

Not Entirely Unfounded

Sawcruhteez’s optimism about Ethereum isn’t entirely unfounded; there are others that are suggesting that per their analysis, the top cryptocurrency is preparing to surge higher, or at least will soon put in a strong bottom.

Su Zhu, the CEO at forex- and crypto-focused hedge fund Three Arrows Capital, recently noted that the trading pair of the DAI stablecoin and Coinbase’s USDC may be a sign that Ethereum (and likely the rest of the market, Bitcoin included) has bottomed:

“DAI/USDC at the highs of the year now, a good barometer of risk aversion. May signal now is a decent re-entry level on the $ETH/DAI and ETH/USD pairs,” he explained.

“DAI trades above peg whenever there’s large liquidations on ETH/DAI, demand for DAI. It will result in the SF going lower on MKR and represents a flushout of leveraged longs,” he noted.

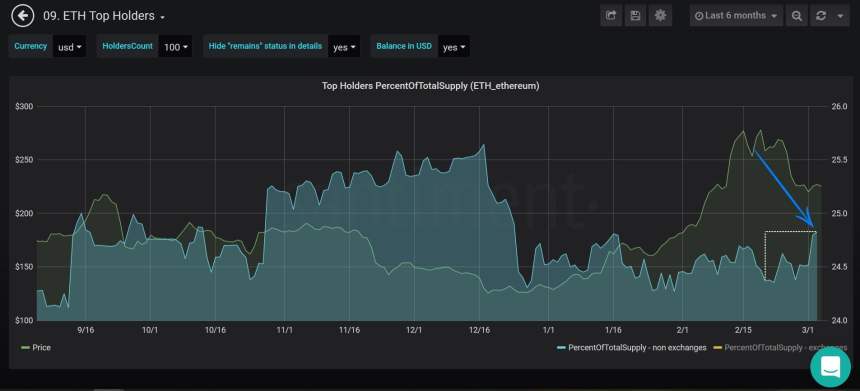

Also, more recently, data from industry firms have shown that large Ethereum holders have started to stash up on the cryptocurrency once again, a sign of long-term confidence.

Featured Image from Shutterstoc