Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

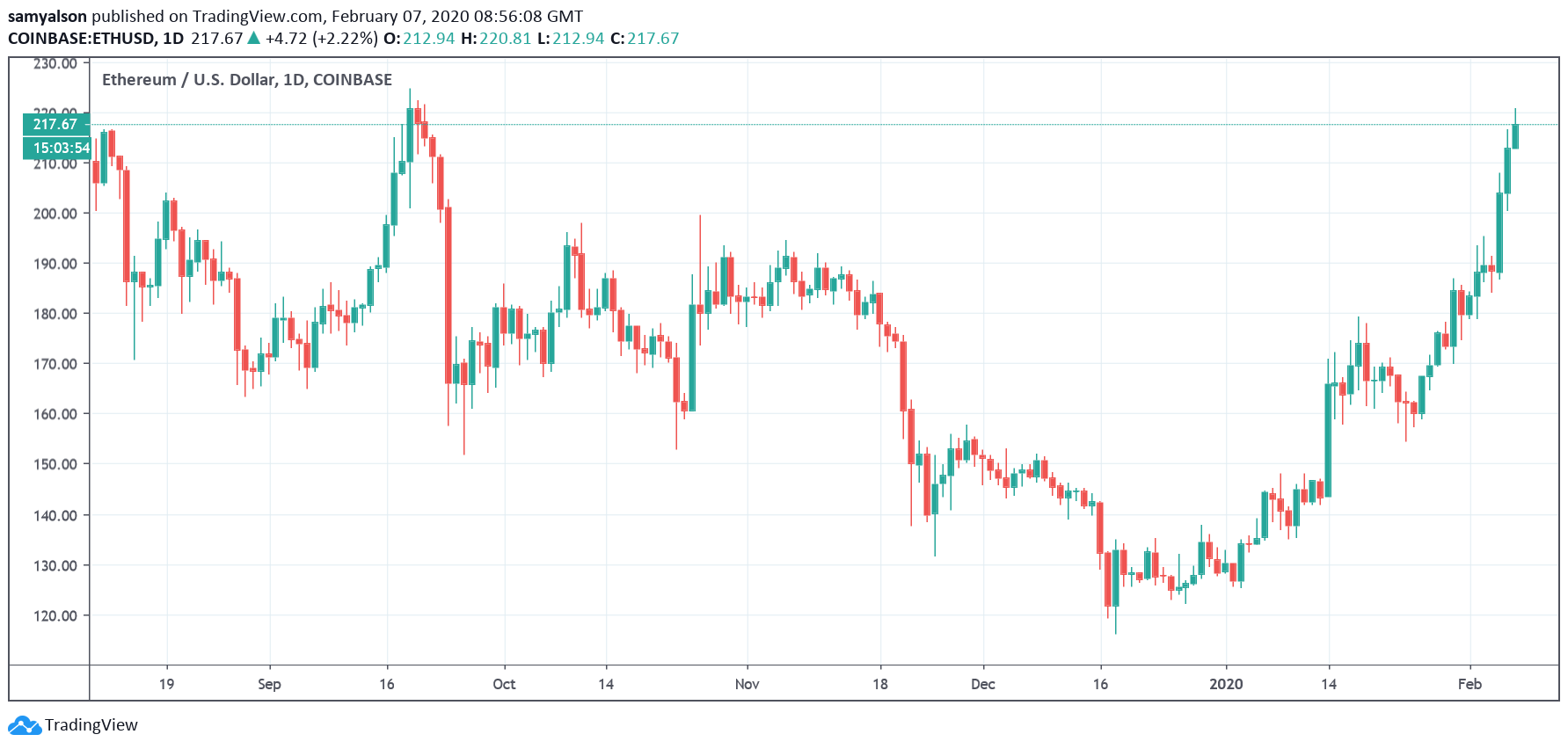

Since the start of the year, Ethereum has been moving steadily upwards, sometimes violently, to form a steep vertical channel. And yesterday’s sharp gains saw a breach of the key $200 level.

As such, analysts expect this to be a massive turning point for the number two cryptocurrency, which up until the start of the year, was in a 6-month slump of descending price.

But having flipped the trend, expectations for further gains are intensifying. And certainly, goings-on within the Ethereum ecosystem lends support to that idea.

Ethereum Cracks Key $200 Level

Currently, Ethereum is up 4% trading at $218. A somewhat moderate gain following the spectacular achievements of the past two days.

Nonetheless, this is mirroring the present market sentiment, which has cooled off following a crazy period of explosive gains for many. Today, from the top 20, only Tron and Chainlink are posting double-digit gains.

All the same, price action from this week has left ETH bulls ecstatic. And having crossing above the psychological $200 level, the expectations of significant long term gains are high.

At the start of Ethereum’s parabolic spike on Wednesday, analyst Josh Rager posted his opinion on ETH, suggesting that it could be a great long term buy.

“We’ll look back in two years and talk about how sub-$200 $ETH was a gift.”

https://twitter.com/Josh_Rager/status/1225125466660622336

JohnLiv echoes this view, with a price prediction of $400 by the end of 2020. However, in the short term, he sees Ethereum next big test, at $240, sparking a break down of upward momentum.

All the same, much like Josh Rager, JohnLiv remain long term bullish on Ethereum.

“The crypto currency in my analysis is now looking very much like its heading north after half a year of south bound travel.”

The Fundamentals Indicate Long Term Strength

Happenings within the Ethereum ecosystem indicate the project will be hard to top going forward. And the major talking point on everyone’s lips is DeFi, which continues to exceed expectations.

Yesterday, as Ethereum was surging, the amount locked up in DeFi crossed $1 billion. Which is an astonishing achievement considering the relatively short time needed to get there.

$1 billion is now locked into decentralized finance applications & protocols after 2.5 years.

It took Lending Club 5 years to get to that same amount.

Finance has always been a high value, low engagement product. It’s exciting to see #DeFi take off—it didn’t need scalability. pic.twitter.com/RRzemqRJVG

— ian (@ianDAOs) February 7, 2020

A year ago, the amount locked up in DeFi was just $276 million, a far cry from where it stands today.

And what’s particularly impressive is the exponential growth that has come about since the start of 2020. In 5 short weeks, the amount locked up in DeFi grew 50% from $668 million on January 1st.

Indeed, DeFi’s rising popularity is sparking huge demand for Ethereum. On top of which staking in Ethereum 2.0 is also doing the same. All of which is adding to the demand for Ethereum.

Whether a break down occurs at $240 remains to be seen, but for now, ETH holders can revel in the satisfaction of major progress being made.