Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

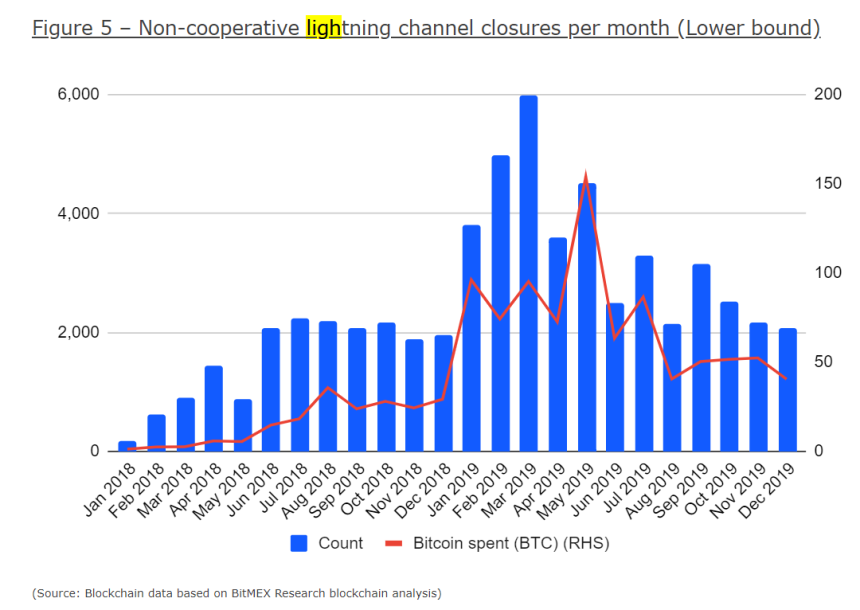

According of a research report from BitMEX, the largest cryptocurrency margin trading platform in the global market, the usage of the lightning network on bitcoin has surpassed expectations.

More than 60,000 lightning network non-cooperative channel closures were recorded, and around 6,000 BTC were spent for closure transactions.

The lightning network is a second-layer scaling solution that allows users to transact using bitcoin with extremely low fees.

Why lightning’s growth is crucial for bitcoin’s long-term trend

A channel on the lightning network is like a opening a tab at a bar.

Similar to how customers can buy drinks and food throughout the night and pay all of it with a single bill, users on the lightning network can initiate many transactions and merely the close the channel after all transactions are complete.

The channel closure occurs on-chain on the Bitcoin blockchain network which is immutable and unalterable. As such, it allows for secure settlement of many bitcoin transactions at once.

“Our database illustrates that non-cooperative channel closures are relatively common and that lightning network usage is higher than expected,” said BitMEX.

The report of BitMEX’s research arm shows that the usage of lightning has exceeded expectations in the past year, and the growing usage of a second-layer scaling solution like lightning is crucial for BTC’s long-term growth trend.

For most blockchain networks, especially those using the proof-of-work consensus algorithm, the capacity of on-chain transactions is limited.

The majority of major blockchain networks in the likes of Bitcoin and Ethereum can handle about 6 to 50 transactions per second on average, and pushing beyond it often result in higher fees.

Hence, successful implementation and rising usage of second-layer solutions are crucial for any large-scale blockchain network.

“The findings may indicate that experimentation with mobile lightning wallets (which often produce private channels) may be more common than many expected. The data may also indicate that non-cooperative closure types are more common relative to the cooperative closure type, than the community thought,” read the BitMEX report.

More fundamentals investors have to consider

The increasing usage of second-layer solutions is one of many important fundamental factors for bitcoin’s long-term trend.

Other factors include a consistent rise in hashrate, an active developer community, high developer activity, and rise in unique addresses on the Bitcoin network.

Looking ahead, the scarcity of BTC as a store of value is set to decline following the scheduled block reward halving of bitcoin in May 2020.

In recent months, after the price of BTC fell by around 40 percent from its 2019 high, BTC has dropped close to its “intrinsic” value based on a report from JPMorgan.

If the fundamentals like usage of lightning, hash rate, and others continue to improve in the months to come, it is expected to have a positive effect on the bitcoin price.