Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

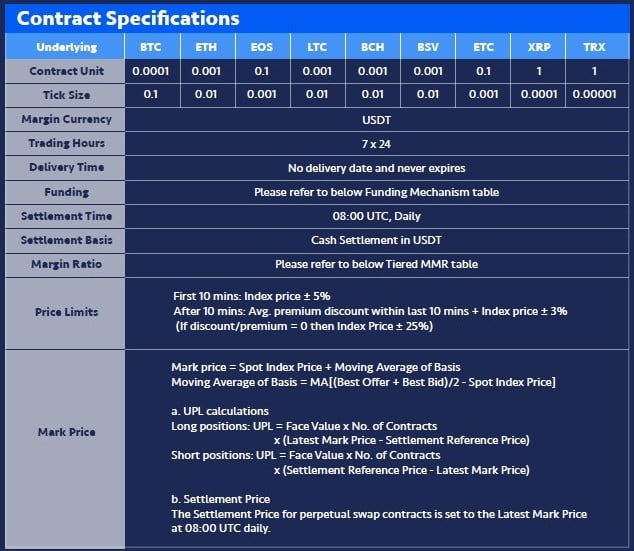

OKEx, the leading global cryptocurrency futures exchange platform has announced that it is going to soon launch its USDT Margined Perpetual Swap Trading feature. According to the announcement, the latest USDT denominated linear contract offering is set to go live on December 16, 2019, following the simulation phase which went live on December 4. The simulation phase will go on until the 14th of this month.

The USDT-Margined Perpetual Swap Trading feature is an add-on to the recently launched USDT Futures Trading offering. With Perpetual Swap Trading, users can long or short a position or hedge against USDT’s price movement without having to consider the expiry of the contract or the need for roll-over. The USDT-Margined Perpetual Swap will initially support 9 different trading pairs including BTC, EOS, ETC, ETH, LTC, XRP, TRX, BCH and BSV, with a distinct possibility of more additions in the future. Traders will also be able to avail 0.01-100x leverage to get the most out of their orders. By eliminating the need to reopen new positions, the latest feature will also help traders avoid paying extra transaction fees generally incurred while opening a new contract.

The Perpetual Swap feature for other cryptocurrencies has been around for a while on OKEx. It is received well by the community, as an ideal instrument for long-term investment and risk hedging. With the USDT-Margined Perpetual Swap, the instrument is quoted and settled in USDT tokens, with each contract having a face value of a fixed amount of digital tokens and no expiry.

Features of OKEx USDT-Margined Perpetual Swap Trading

Some of the key features of the new USDT-Margined Perpetual Swap Trading offering includes:

- Availability of 9 USDT pairs

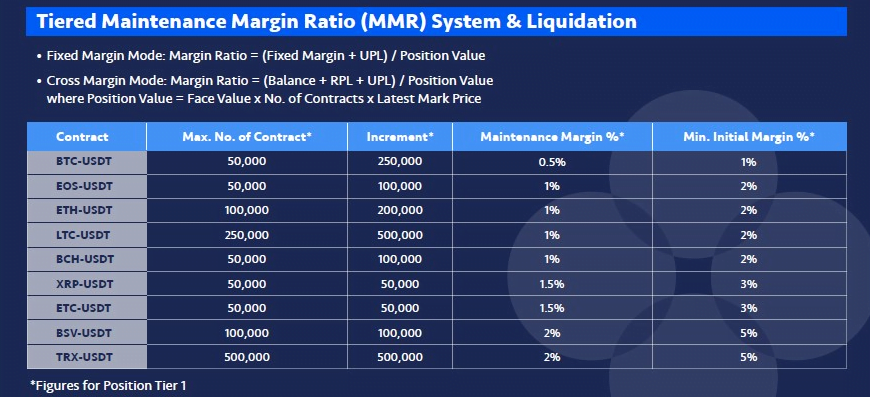

- Tiered Maintenance Margin Ratio System & Partial Liquidation

- Leverage ranging from 0.01X to 100X

- Algo trading supported

- API supported

- 24/7 trading

Risk Management on OKEx

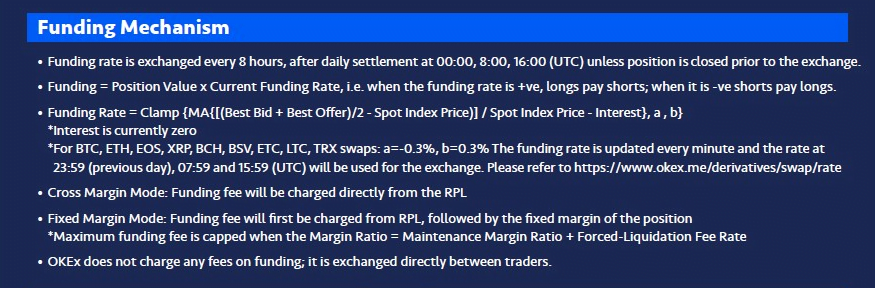

OKEx offers enhanced risk management system for derivatives trading on its platform. Some of the components includes:

- Mark Price system to minimize huge fluctuations in price and unusual liquidation.

- Tiered Maintenance Margin Ratio (TMMR) System to prevent liquidation of large positions and its after effect on market liquidity

- Forced Partial Liquidation Mode that eliminates market impact caused by many liquidated orders.

A break down of TMMR in the context of USDT-Margined Perpetual Swap:

The Tiered Maintenance Margin Ratio (TMMR) system will also be extended to cover spot margin trading on OKEx, starting 07:00-08:00 (UTC) on December 9, 2019. TMMR has been around as part of OKEx’ enhanced risk management system since the beginning of this year, and so far, it was offered to accounts participating in Perpetual Swap Trading on the platform. With its introduction to Spot Margin Trading, users will now experience a lower leverage risk combined with higher borrowing limits. The TMMR system efficiently manages the leverage depending on the borrowing amount. If the borrowing amount is higher, the required maintenance margin ratio will also increase which will in turn, lower the available maximum leverage for that user. By doing so, the system helps traders avoid cascade liquidation while offering a wide choice of leverage levels of up to 10x and enhanced lending limits.

Learn more about the TMMR – https://okexsupport.zendesk.com/hc/en-us/articles/360037209112