Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Ethereum (ETH) up 5.4 percent

- In two years, ETH issuance may be reduced 10-fold.

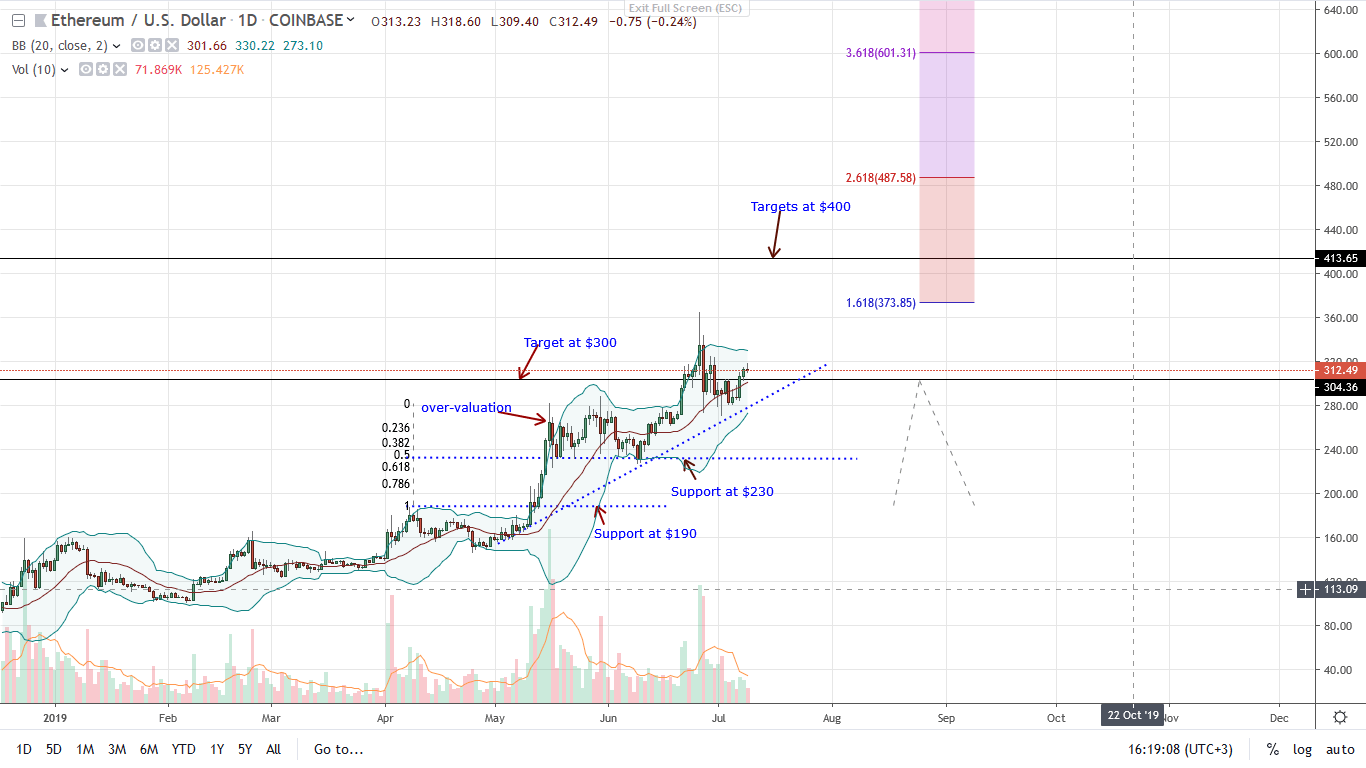

From Constantinople to the activation of EIP 1234, Ethereum fundamentals are overly bullish. Add that to possible plans of reducing ETH issuance by 2021 and bulls are at a prime position to rally. At the moment, ETH is up 5.4 percent.

Ethereum Price Analysis

Fundamentals

The Ethereum developer community are a determined lot. The Constantinople update set the ball rolling. Plus, with another update in two months, all indicators point to a bullish ETH. However, in the midst of it all, the main discussion is around the consequences of upgrading and shifting from a proof-of-work system to a proof-of-stake consensus algorithm.

Although building the bare bones for a scalable and efficient network, there are wrinkles that must be ironed out. A visible one is talk around ETH issuance and whether there should be a hard cap.

Earlier, Vitalik Buterin said the total ETH in circulation would be capped at 120 million or at least twice the amount of ETH sold during the 2015 crowdfunding. In a Github post he said:

“Because issuing new coins to proof of work miners is no longer an effective way of promoting an egalitarian coin distribution or any other significant policy goal, I propose that we agree on a hard cap for the total quantity of ETH.”

Stemming from above, a vocal Ethereum developer, Justin Drake says upon Beacon Chain activation the total ETH in circulation may be slashed 10-fold:

“Here’s a possible timeline (dates likely totally wrong!) highlighting the key milestones: January 2020: Beacon chain launch. June 2020: ETH2 light clients production-ready. November 2020: ETH1 fork #1 to have its fork choice rule honor ETH2 finality (conservatively, no issuance reduced). March 2021: ETH1 fork #2 to reduce issuance by 10X.”

Candlestick Arrangement

Ideally, in case this happens then ETH would be scarcer that BTC and LTC. From supply-demand dynamics, that is massive for ETH holders as a repricing will drive prices higher. Currently, ETH is in a clear uptrend.

Nonetheless, like BTC, there are hurdles. June 27 bear candlestick defines the immediate price action since prices are still oscillating within its trade range. Therefore, while aggressive traders can buy the dips, it will fit for the conservative type of traders to wait for clear breakouts above June high.

Not only will that reaffirm bulls but it will set the pace for a possible rally to $400 as bulls begin the long journey of rewinding last year’s losses.

Technical Indicators

As a result, June 26 and 27 candlesticks are significant. Aforementioned, any breakout bar driving prices above June high ought to be with high trading volumes exceeding 554k of June 26. That will confirm bulls of May through June while acting as springboards for $400 and $500 in coming weeks.

Chart courtesy of Trading View. Image Courtesy of Shutterstock