Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Binance Coin (BNB) has led the top ten cryptocurrencies in terms of quarter performance.

The Binance crypto exchange’s native asset surged 185 percent in the first quarter of 2019, jumping from $6.069 to $17.335, according to data provided by Messari. On the whole, BNB was the sixth largest gainer in the said period, beaten only by PCHAIN’s PI (+787%), Ravencoin’s RVN (+337%), Everex’s EVX (+313%), Enjin Coin’s ENJ (+287%), and Numeraire’s NMR (234%). None of these cryptocurrencies were in the top ten list.

The three-month long bullish performance followed a considerable debacle last year, which saw BNB’s market capitalization dropping by over 75-percent from its historic high. Part of the collapse was due to crypto market’s overvaluation, which saw some major bearish corrections throughout the top and tail coins. However, almost all the significant cryptocurrencies seemed to have established their bottom levels, which somewhat explains why BNB had an impressive fiscal quarter.

Fundamentally Strong

Binance Coin (BNB) remained one of the few coins that traders included in their crypto portfolio. What backed it through the rough waters, and eventually to a decent recovery, is reputation. Binance’s success as a cryptocurrency spot exchange helped BNB attaining more legitimacy as a well-backed token. Binance ventured into other business territories that hinted more demand for BNB tokens in real-time, which included a decentralized exchange and token launchpad for blockchain projects.

https://twitter.com/TheCryptoDog/status/1112205801161220099

While on one hand, Binance promised more demand for BNB, on the other it kept reducing the token’s supply rate.

In retrospect, Binance spends 20-percent of its profits every quarter to buyback BNB tokens for destruction. That systematically reduces the supply rate of BNB tokens, leading investors to remain bullish based on the classic more-demand-less-supply scenario.

What’s Next for BNB?

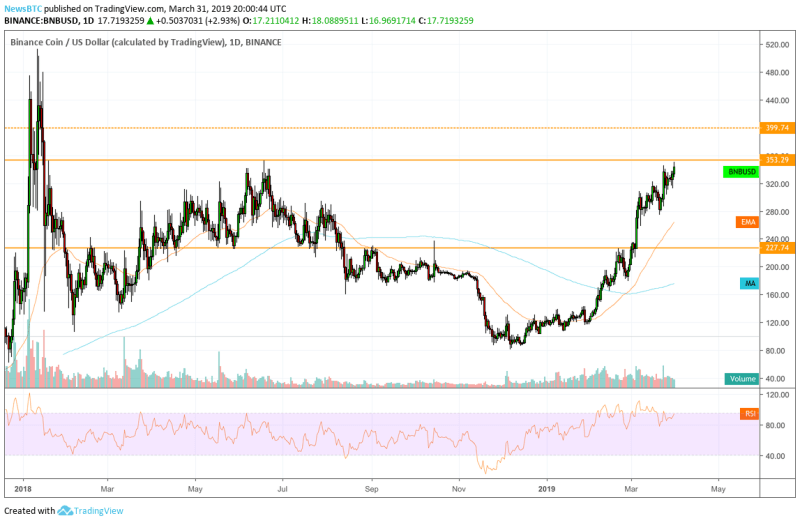

Technically, the BNB price is now close to testing a crucial resistance area. Have a look:

The area near $353 has historically capped the BNB upside action from maturing any further. The price is once again testing the same level, supported by a moderate trading volume on the daily chart. If the BNB/USD rate manages to break through $353, then it could allow the pair to extend its bullish momentum further towards $400, a psychological resistance level.

If BNB/USD fails to spark a breakout action, then the pair could see a sharp pullback towards the 50-day exponential moving average. This MA has lately provided support to the ongoing BNB uptrend.

The Relative Strength Index, which indicates the asset’s momentum, is close to entering the overbought area, which means the ongoing uptrend might exhaust for a short time. There is momentum support at 96.82 that could allow BNB to bounce back and continue its uptrend as before.