Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin Price steady, may rally

- Avnet now accepts Bitcoin via BitPay

- Participation low but demand picking up

By collaborating with BitPay, Avnet now joins the likes of Microsoft and Dell as corporations accepting Bitcoin as payment. Regardless, Bitcoin (BTC) prices are steady and could close above $4,000.

Bitcoin Price Analysis

Fundamentals

Based in Phoenix, Arizona and drawing $17.4 billion in revenue, Avnet—one of the largest electronic component distributors in the US and one of the most capitalized Fortune 500 Company has partnered with BitPay, a Bitcoin and Bitcoin Cash payment processor. Because of this tactical—and even profitable shift, Avnet is the third major corporation in the US to accept crypto payments after Microsoft and Dell.

“When a customer elects to purchase with Bitcoin (BTC) or Bitcoin Cash (BCH), Avnet will work with BitPay to verify the funds, process the order and complete the transaction. Avnet and BitPay will also have the ability to manage and process cryptocurrency requests outside the US on a country-by-country basis.”

In days ahead, the corporation will let their customers pay for services using cryptocurrencies in a move that reveals how the world if fast shifting from fiat and embracing a global and trusted alternative. Aside from immutability, the VP of Avnet, Sunny Trinh, pointed at several advantages tied to Bitcoin including cost saving and elimination of barriers common when rolling out products to the market.

Besides, settling with Bitcoin is usually faster and safer than using traditional set-ups charging exorbitant fees. If anything, this has been on the writing for a while. Avnet has been working with Bitcoin.com as they create a secure crypto wallet as the tech-centric company prepares for a transition to cryptocurrency.

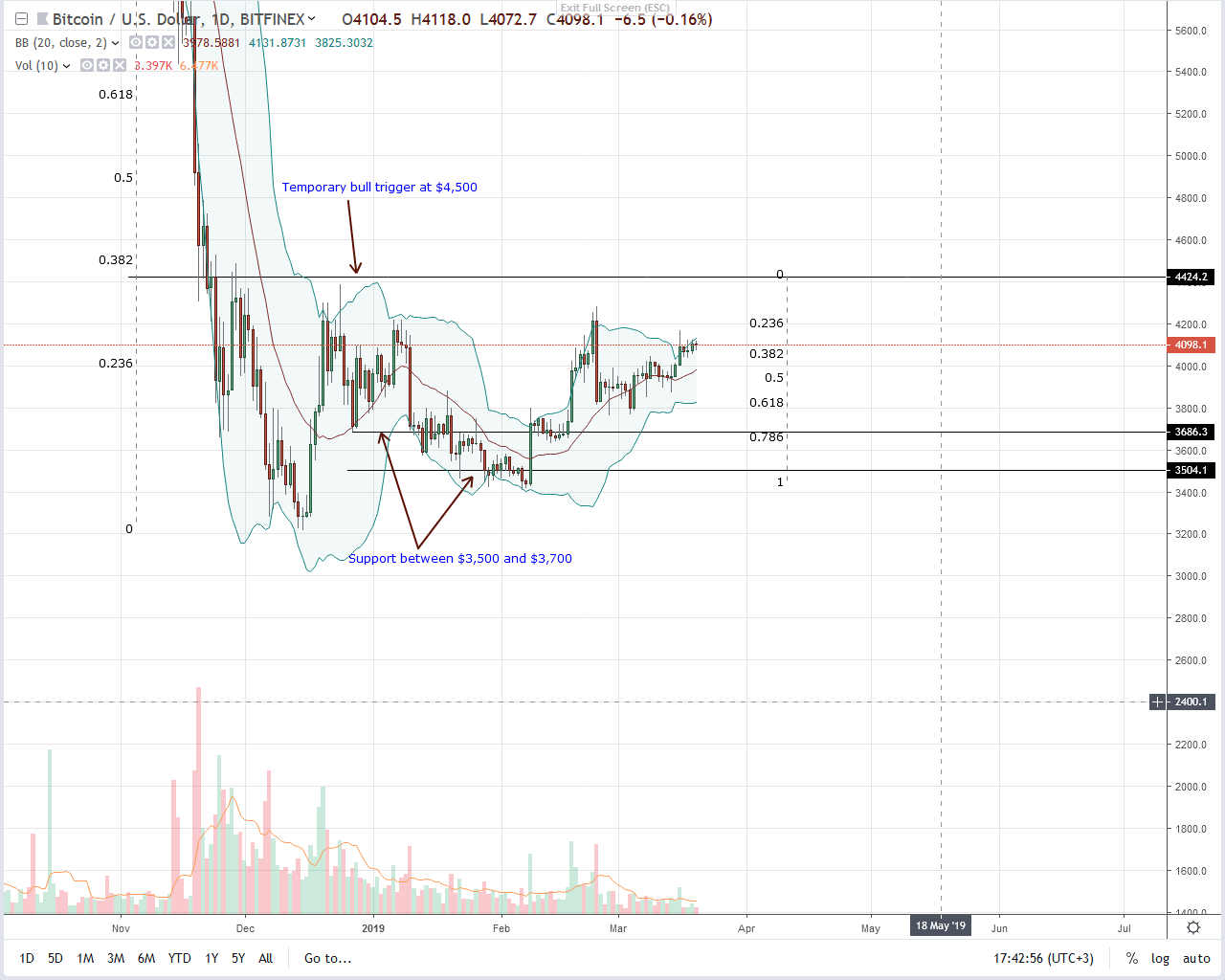

Candlestick Arrangement

Even though Bitcoin (BTC) prices are trending inside Mar 16 high low, bulls appear to be in control. It is easy to see why.

Despite demand tapering in the last few days, prices are edging higher. At this pace, we expect a recovery of Feb 24 losses. That is mostly thanks to increasing demand and Bitcoin (BTC) prices rejecting lower lows as they align along the upper BB.

Like in our previous BTC/USD trade plans, every dip should be a buying opportunity with reasonable targets at $4,500. Such is only possible if BTC is steady above $3,800—our breakout level now minor support.

Technical Indicators

Participation is low, and in the next few days, Mar 16 candlestick anchors our trade plan. It has been successful in holding price action in the last few days and has decent volumes—13k versus 7k. Dictated by candlestick arrangements, buyers will be in control if prices race above $4,200. As always, accompanying this move must be high volumes exceeding 13k thereby confirming bull pressure of Mar 5.