Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

- Bitcoin Price ranging inside Jan 22 high low

- A mark of adoption, Samsung S10 supports cryptocurrencies

- Transactional volumes low and dropping—now stands at 12k on average

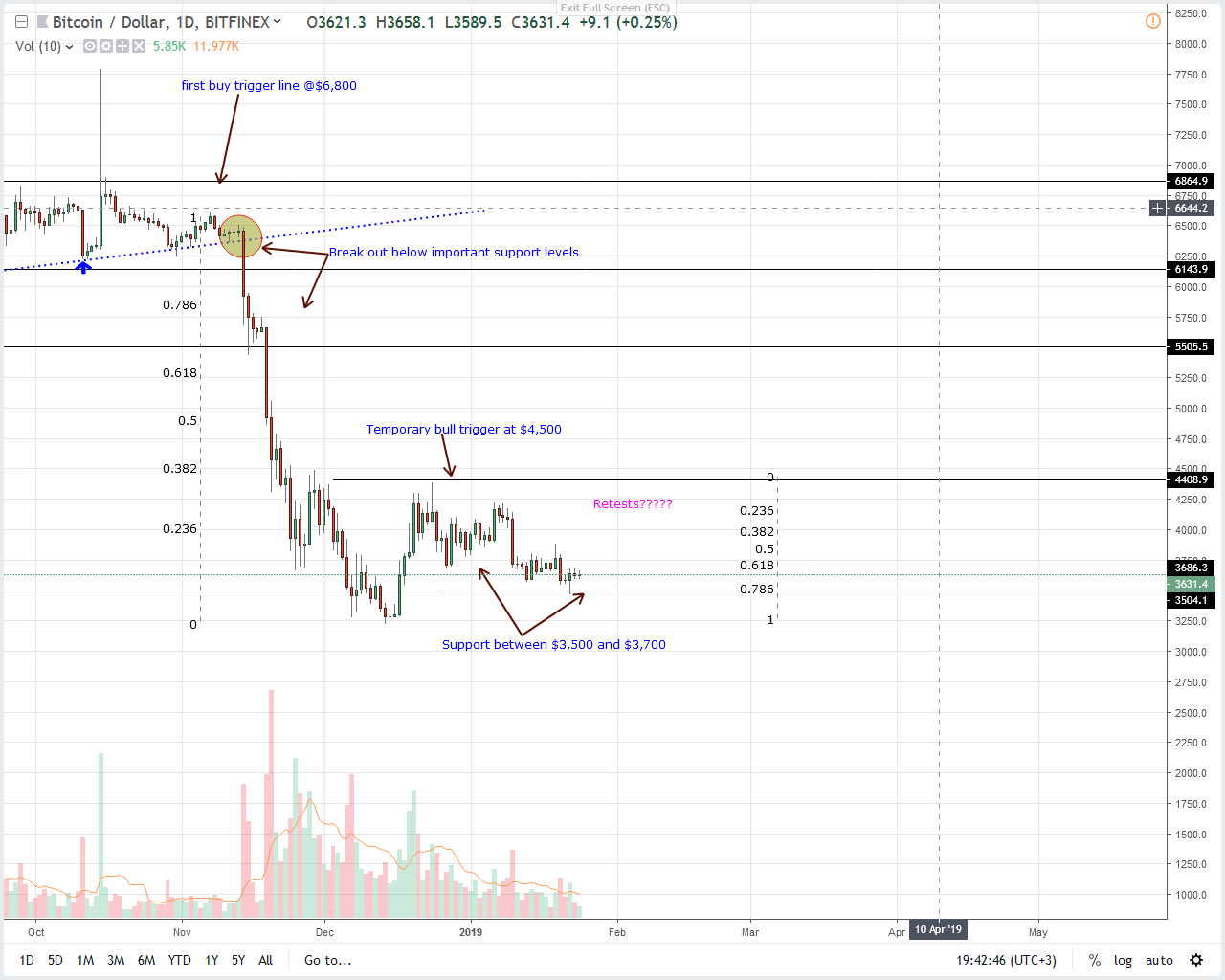

Investors, as well as traders, are confident. With supportive fundamentals, BTC demand should increase, lifting prices from spot rates to above $3,800. That will be in line with our previous BTC/USD trade plan. If not and prices drop below $3,500, BTC could sink to $3,200.

Bitcoin Price Analysis

Fundamentals

Following the HTC route, Samsung “leaked” to the world the next generation Galaxy S10 phone. The phone expected to launch on Feb 20 and hit the market in early March will offer support for cryptocurrencies and blockchain. The Samsung Blockchain KeyStore feature allows users to store their coins private keys safely.

New #GalaxyS10 live images leak with ‘Samsung Blockchain KeyStore’

(images via @GregiPfister89) pic.twitter.com/g0FipTooe6

— Ben Geskin (@BenGeskin) January 23, 2019

Samsung’s splash page describes the wallet saying it is “a secure and convenient place for your cryptocurrency.” Review is pending although biometric verification will be part of safety measures in place. Overly we are confident as this will be massive for crypto. However, we’ll have the real picture once users begin running tests on the application’s security—which as we understand is crucial in cryptocurrencies. While nothing is official, we expect the wallet to support Bitcoin—as the dominant coin.

Candlestick Arrangements

Increasing adoption is positive for Bitcoin as well as other blockchain based projects. With growing demand, we expect to see transactional volumes increase. In return, that spike in demand might end up propelling prices from current lows.

Currently, BTC prices are in consolidation, ranging within Jan 22 high low. Even though we are net bullish and anticipating price expansions in line with our trade plan, conservative traders ought to buy BTC once prices rally above $4,500.

On the reverse side, Bitcoin prices would expand if and only if there is confirmation of Jan 22 bull bar. In that case, we shall have a three-bar bull reversal pattern. These are the building blocks that would lift prices above $3,800—triggering our first wave of buys. After that, it is likely that BTC will rally above Dec 2018 highs as risk-averse traders pump prices towards $6,000.

Technical Indicators

As BTC prices range inside Jan 22 high low, accompanying volumes are low. Perhaps fundamental reasons as Bitcoin ETF failure is deflating. Regardless, break above $3,700 or Jan 22 highs should be at the back of abnormal volumes exceeding 18k hinting of underlying demand.