Reason to trust

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Key Highlights

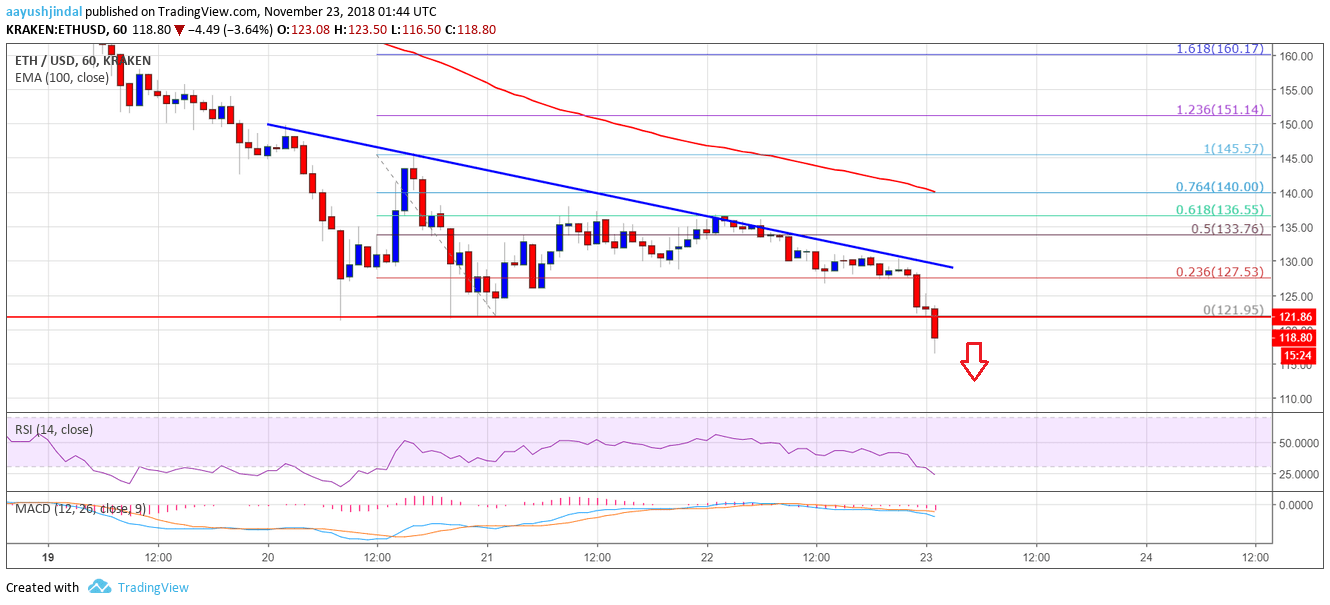

- ETH price failed to move above the $135 and $136 levels against the US Dollar.

- There is a new key bearish trend line formed with resistance at $127 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair is currently under pressure and it could accelerate declines below the $120 level.

Ethereum price is faced a fresh round of selling against the US Dollar and bitcoin. ETH/USD broke the $120 low and it could accelerate further losses.

Ethereum Price Analysis

Yesterday, we saw a minor upside correction in ETH price from the $122 support against the US Dollar. The ETH/USD pair corrected above the $130 and $132 levels. The price also moved above the 50% Fib retracement level of the last slide from the $145 high to $121 swing low. However, the upside, move was capped by the $135 an $136 resistance levels.

Buyers also failed to break the 61.8% Fib retracement level of the last slide from the $145 high to $121 swing low. Moreover, there is a new key bearish trend line formed with resistance at $127 on the hourly chart of ETH/USD. Clearly, the pair failed to gain momentum above the $136 level and declined. The recent downside move was such that the price broke the $124 and $122 support levels. More importantly, the price traded to fresh yearly low below $120. It seems like sellers are back and they could push the price further lower towards the $115 or $110 levels in the near term.

Looking at the chart, ETH price likely completed a short term correction from the $122 support. It failed to gain pace above key resistances near $136 and $140, resulting in a fresh decline. Buyers need to be careful considering the current market sentiment and break below $120.

Hourly MACD – The MACD is now back in the bearish zone.

Hourly RSI – The RSI is currently moving lower towards the 20 level.

Major Support Level – $110

Major Resistance Level – $130